Per IBES, 461 of the S&P 500 have reported their Q3 ’19 results.

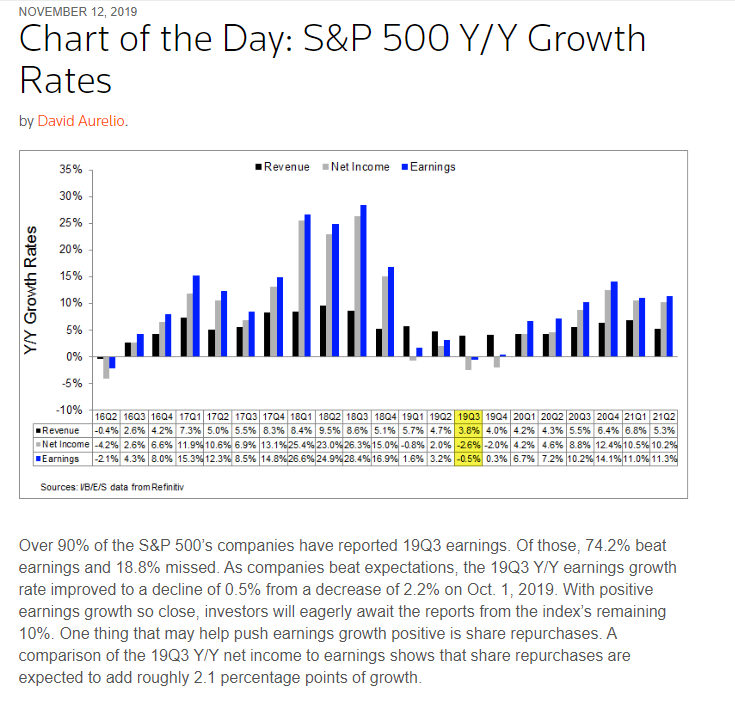

We continue to lap toughest quarter of 2018 in terms of quarterly earnings, as Q3 ’18 saw S&P 500 EPS grow 28% and S&P 500 revenue grow 8.6%. Q4 ’19 compare’s do get a little easier.

Note how strong Q3 and Q4 ’18 S&P 500 earnings and revenue growth were at the end of last year, and yet that was the peak in the S&P 500 (late September ’18 anyway) as the S&P 500 lost 13% in Q4 ’18 and 4.5% in calendar ’18, after the strongest earnings growth in years.

So much for S&P 500 earnings analysis being a good market timing tool.

The point in writing this is that readers may not realize the tough “comps” (i.e. compare) the S&P 500 has faced all year and will still do so in Q4 ’19 just to a lesser degree.

Also note the sharp deceleration in S&P 500 earnings growth in Q4 ’18 versus Q3 ’18.

This coming week Home Depot (NYSE:HD) and Lowe’s Companies (NYSE:LOW) and general merchandise retailers report. Housing stocks have been robust for most of ’19 and since the FOMC started cutting rates in late July ’19. Let’s see if Home Depot and Lowe’s reflect that resurgence.

One last chart:

Note the “expected” revenue growth rates for 2020, which are lower than 2019’s actual rates for all but the 4th quarter of 2020.

Expected S&P 500 EPS growth rates for the first half of 2020 are still below the long-run average of 7%, but the 2nd half of 2020 is expected to be more robust, however, all these estimates will change over the next few months.

Summary / Conclusion: In December ’19 we will start to hear from companies like FedEx Corporation (NYSE:FDX), Oracle (NYSE:ORCL) and numerous others with a November quarter end, which will give us our first tangible glimpse into Q4 ’19 earnings outside of recent guidance.

For the next two – three weeks, earnings reports will likely have little influence on the market with 461 of the S&P 500 having already reported Q3 ’19.

There is more earnings-related importance at the company level rather than the macro-level at this point, hence, the struggle to find something both interesting and relevant to write about.

Remember, companies like FedEx) and Oracle) and others that report their quarter in December will be lapping some of their worst compares in years. Some of December ’18’s earnings reports were ugly.