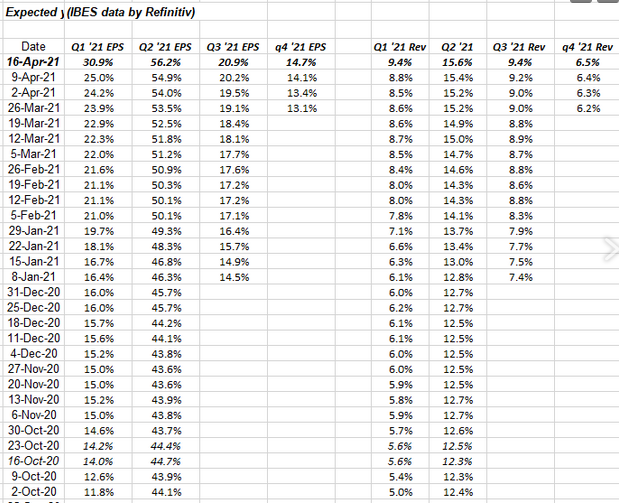

This has become the “go to” table every week to portray in one clip, the upward pressure on “expected” S&P 500 revenue and EPS growth for readers.

This is a good thing for those long or bullish the S&P 500 this year (So far anyway, but don’t get carried away.)

Expected Q1 ’21 S&P 500 EPS jumped 500 bps this past week, from 25% to 30%, probably thanks to financials given the powerful “upside surprises” we saw.

Note too expected revenue growth is smaller, but all 4 quarters are still moving higher.

Final point: note how the EPS revisions in later ’21 quarters are more “restrained.” Sell-side analysts are still squeamish about lifting numbers too aggressively.

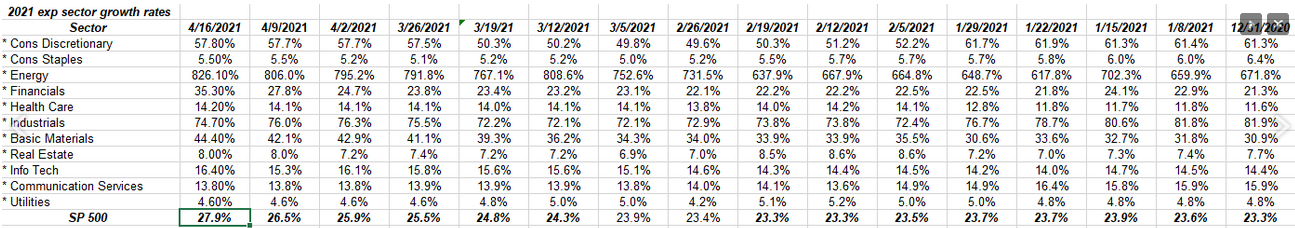

Change in full-year 2021 expected S&P 500 sector EPS growth rates

Readers should note the 700 bps increase in expected ’21 Financial sector growth. The other 2 sectors that showed upward pressure more notably were Energy and Basic Materials. It’s a commodity world and we’re all just living in it. Did I read that line somewhere this week?

Seriously, Technology, Communication Services and Consumer Discretionary will likely see more significant upward revisions after the major companies in those sectors report, which would be Apple (NASDAQ:AAPL) and Microsoft (NASDAQ:MSFT), within Tech, Alphabet (NASDAQ:GOOGL) and Facebook (NASDAQ:FB) within Communication Services and Amazon (NASDAQ:AMZN) and Tesla (NASDAQ:TSLA) within Consumer Discretionary. (Long all those names in various quantities and weights.)

Various data points for the S&P 500 earnings review done weekly

- The forward 4-quarter estimate rose to $184.05 this week from $183.34 last week. This has been the pattern since last May – June ’20. The normal pattern is that the forward 4-quarter estimate starts the quarters close to its peak, and then slowly gets eroded until the next quarter arrives. But since the pandemic, the estimate keeps rising almost every week. Remarkable.

- The PE ratio is 22.7x. An interesting stat is that on 12/31/20, the PE ratio was 23,6x, so even though the S&P 500 is up 11% YTD, the PE is a touch lower (just sayin’).

- The S&P 500 earnings yield is 4.40% this week versus 4.44% last week. Still low, relatively speaking.

- The S&P 500’s expected 2021 EPS growth rate has risen to an expected 27% versus the 23% as of 12/31/20.

- The “average” 2020 and 2021 expected S&P 500 EPS growth rate is still 6%. That average has been consistent like that for a 6 – 8 weeks.

Summary/conclusion

With the S&P 500 +11% YTD after just 10 -11 weeks into the new year has a number of folks nervous—including me—but I put some (not all) significance on the fact that Street analysts have dramatically underestimated S&P 500 earnings, and the trend is still higher. To give you some idea of the extreme end of the upside surprised and revisions, Goldman Sachs' (NYSE:GS) EPS estimate for 2021 was $30.99 on Mar. 31, 2021 and now, after earnings were reported this week, that same EPs estimate is $41.29. That’s a big increase. JPM’s were not as strong, but were upwardly revised as readers might expect.

Coke (NYSE:KO), IBM (NYSE:IBM), Intel (NASDAQ:INTC) and AT&T (NYSE:T) all report next week, Mostly laggards and “old tech.” That’s ok. You’ve got to watch the long-time underperformers for secular shifts in markets and strategy.

Look at Microsoft. It was left for dead until Steve Ballmer was jettisoned, and Satya Nadella went full-in on the cloud, in April ’13. Apple had 3% of the PC market in 1999 and traded down to $3 per share during the LongTerm Capital Crisis. It was left for dead too. Think of the reception you’d have received in March, 2000, if you went on CNBC and said you were selling all your large-cap tech and buying Apple and gold.

Disclaimer: Be skeptical about all financial commentary and advice. Many times the stock market corrects before it starts to show up in S&P 500 EPS data. I've found this data to be more coincident than leading in the past. Still there is some benefit to grinding the numbers.