The weekly S&P 500 earnings update:

- Fwd 4-qtr estimate: $168.79 vs last week’s $169.13

- PE ratio: 16x

- PEG ratio: 4x

- S&P 500 earnings yield: +6.23% vs last week’s +6.25%

- Year-over-year growth of fwd est: +3.8% vs last week’s +4.2%

Source: I/B/E/S by Refinitiv

Versus the 4-quarter trailing actual EPS, the forward S&P 500 EPS estimate continues to indicate slowing earnings growth for the S&P 500, however the S&P 500 “earnings yield” continues to indicate that the overall S&P 500 valuation relative to S&P 500 earnings growth remains reasonable. Here is the S&P 500 “earnings yield” average over the 1,3, 6, 12, 24 and 36 month periods:

- 4-weeks: 6.32%

- 12-weeks: 6.53%

- 26 weeks: 6.27%

- 52 weeks: 6.12%

- 104 weeks: 5.84%

- 156 weeks: 5.86%

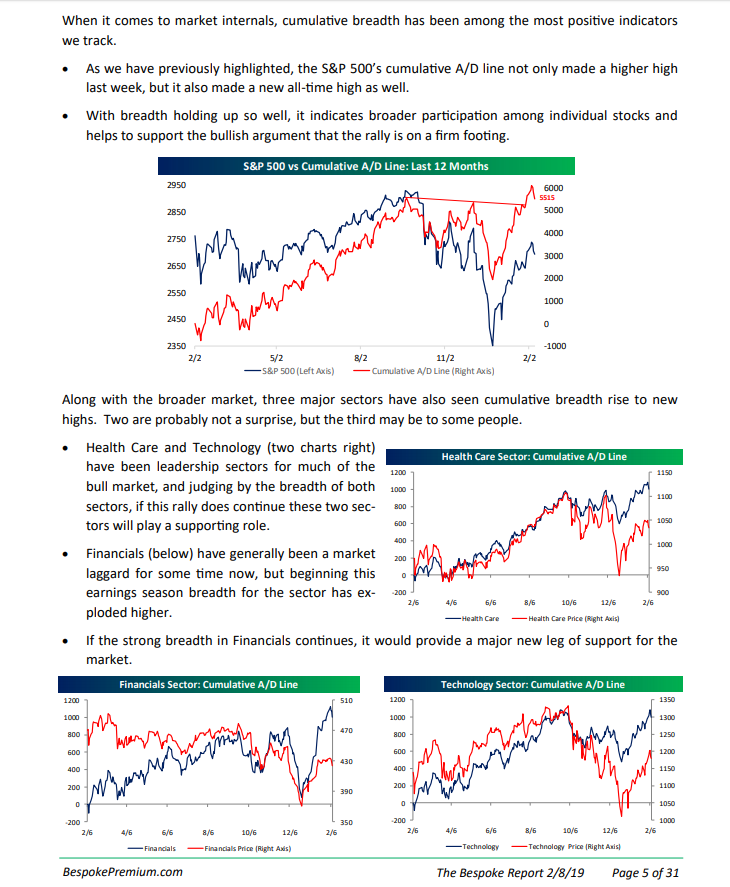

What about market Breadth?

The attached commentary on breadth was from the Bespoke Report, dated February 8th, 2019.

As regular readers know, this blog is a big fan of Bespoke Research. For the cost, the site is one of the most insightful commentaries available on the Street, both from a market scope and depth perspective.

Most pundits would agree that “market breadth” has held up particularly well during this correction, far better than prior to the 2000 and 2007 bear markets.

Summary

Readers should never focus on just one indicator or metric: S&P 500 earnings, technical analysis, volume, breadth all count in evaluating market risk, but instead, investors should look at the bigger picture including credit spreads and valuations to arrive at the best market opinion. High yield and corporate bond spreads have actually rallied more in percentage terms since the December 24th and 26th bottom for the S&P 500, and both the S&P 500 and credit spreads have stalled as the S&P 500 reached the 200-day moving average this week.

My own opinion is that this current correction is just that – a temporary correction – in a secular bull market, and that the S&P 500 makes new all-time-highs in 2019.

The first key level to be overtaken is the 200-day-moving-average and then the S&P 500 should make a run at the Sept ’18 highs near 2,940 – 2,941.

Take all opinions and predictions with a substantial amount of skepticism.