Investing.com’s stocks of the week

The volatility of the S&P 500 has an interesting relationship to a metric which I call Gamma Neutral. Gamma Neutral is the theoretical price where the total gamma in the SPX options market is equal to zero.

The study of market gamma is basically the study of risk in the options market. A large portion of options trading is done under the premise of a delta-neutral hedging program. Since the "delta risk" has theoretically been hedged by the programmatic traders, "gamma" becomes the primary metric that risk managers must track and manage.

Not surprisingly, the volatility of the S&P 500 is therefore related to gamma metrics.

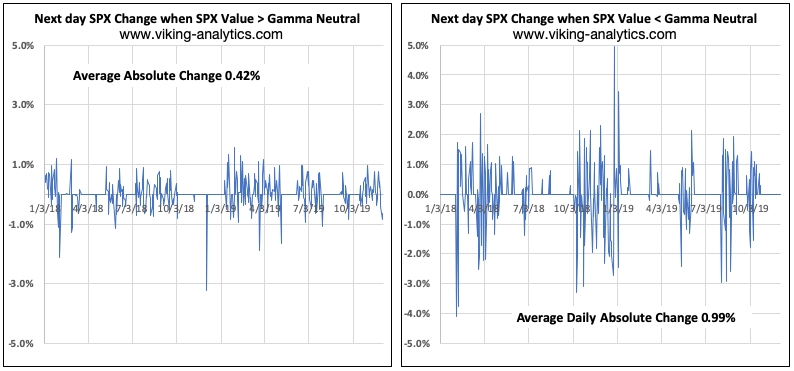

In the graphs above, we can see that the volatility of the S&P 500 is muted when the value of SPX closes above Gamma Neutral. When SPX closes below Gamma Neutral, volatility increases dramatically - on an absolute value basis, it more than doubles.

These are complicated topics, so please visit my website to learn more, or you can write to me at erik@viking-analytics.com.