Each quarter Dr. David Kelly, the Chief Global Strategist for JP Morgan and his team, publish the “Guide to the Market” (GTTM) which is 70 – 75 pages chock full of some of the best capital market, economic and Federal Reserve data you can find in one place. Dr. Kelly holds a conference call the first day or two of each quarter and runs through what he thinks is important in “the Guide”.

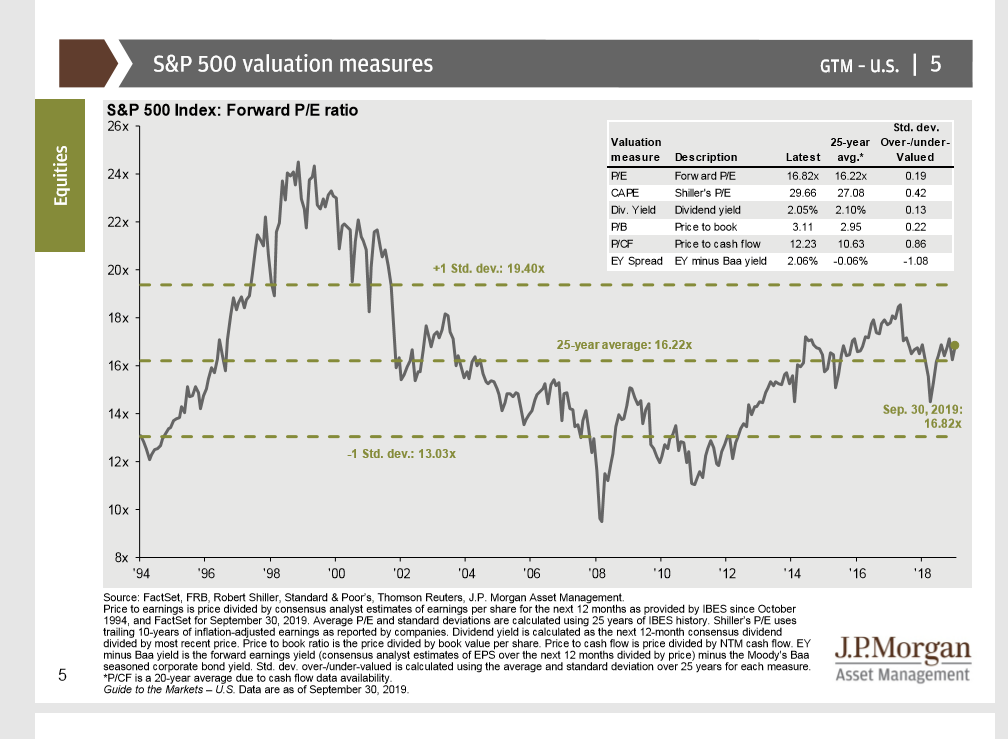

This chart has always caught my eye as it provides a great longer-term perspective on the S&P 500's valuation.

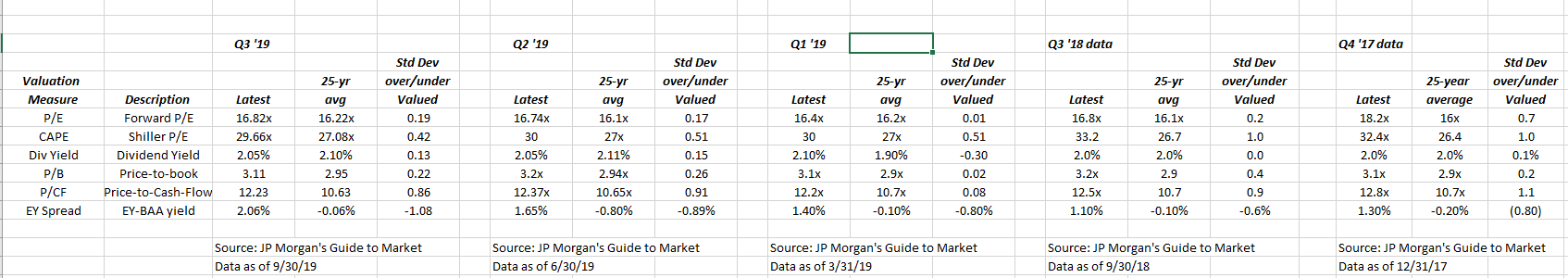

Tracking the S&P 500 valuation page chronologically provides some perspective on the valuation changes over shorter periods of time.

The fact is the data hasn’t really varied much over the last 2 – 3 years. The EY – BAA yield spread looks undervalued.

The GGTM is one of the few places investors can get the S&P 500 “cash-flow valuation” and if you track it on the spreadsheet, it shows the S&P 500 a little overvalued relative to historical ranges, but certainly not alarmingly so. I’d love to see that metric as of March 2000.

By the way, the GGTM was published on 9/30/19, and at that time the S&P 500 closed the quarter at 2,976.74, while the Nasdaq closed the quarter at 7,999.34.

So What Is The Likelihood Of An S&P 500 Correction At Present?

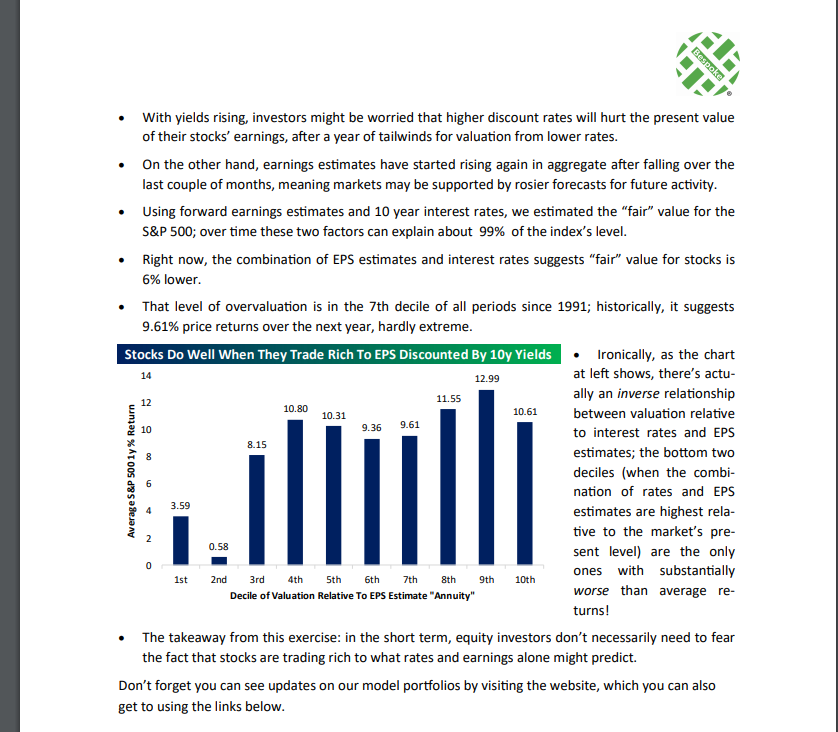

Bespoke thinks that the S&P 500 is about 6% overvalued, and suggests a 9% – 10% return for the S&P 500 over the next year.

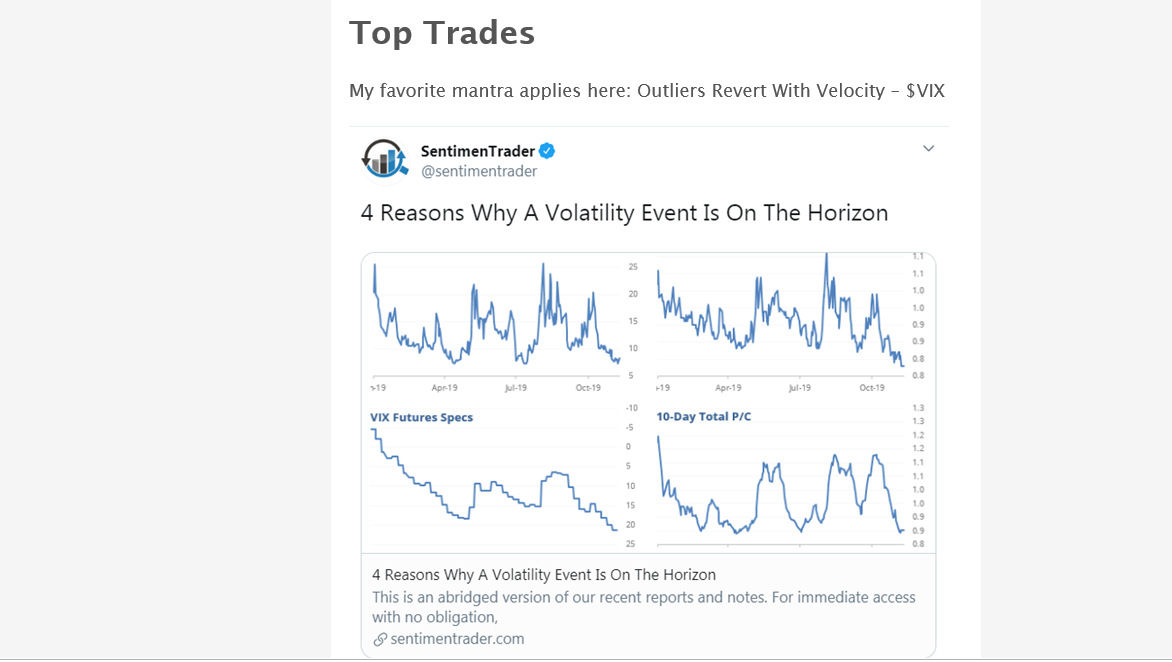

On the flip side, Samantha LaDuc (@SamanthaLaDuc) posted this as part of her blog this weekend:

Samantha’s Wednesday, November 13th, 2019 blog post:

Summary / conclusion:

In a year where the S&P 500 will likely finish up 25% or so, a 6% correction (the amount Bespoke thinks the S&P 500 is overvalued), or a market flush like Samantha LaDuc is looking for might be just what the doctor ordered in terms of flushing out the latest surge in bullish sentiment.

It’s still a long way from the type of secular bear market we saw in 2001 – 2002 and then again in 2008.

One of the interesting aspects to me the last few years is how quickly sentiment changes: I can practically guarantee you that if we get a 3% in the S&P 500, sentiment will turn south quickly and within a few weeks, bears will be near highs again. It’s happened numerous times since 2008.

Remember this is just an opinion. Draw your own conclusions and understand your own emotional makeup.