Using primarily the Elliott Wave Principle (EWP) to analyze the S&P 500, last week we found:

"Potential positive divergence is developing on several indicators, and as long as last week's 3943 low holds, we should expect a rally. Our primary expectation is for a three-wave move to ideally 4272-4374, but we must now be cognizant the index could stall out at around 4100+/-50 before heading down to 3700-3800."

Besides two intra-day stabs below 3943, the bears failed to close the index daily and even weekly below that level last week. For those who do not know, I work primarily with closing prices because those are the most important price levels of each trading day.

Thus, the bears have tried to push the bulls off the cliff several times but failed. Instead, the index broke back above the prior week's high at 4028 last Friday, which meant a higher high and, thus, a change in trend from down to up.

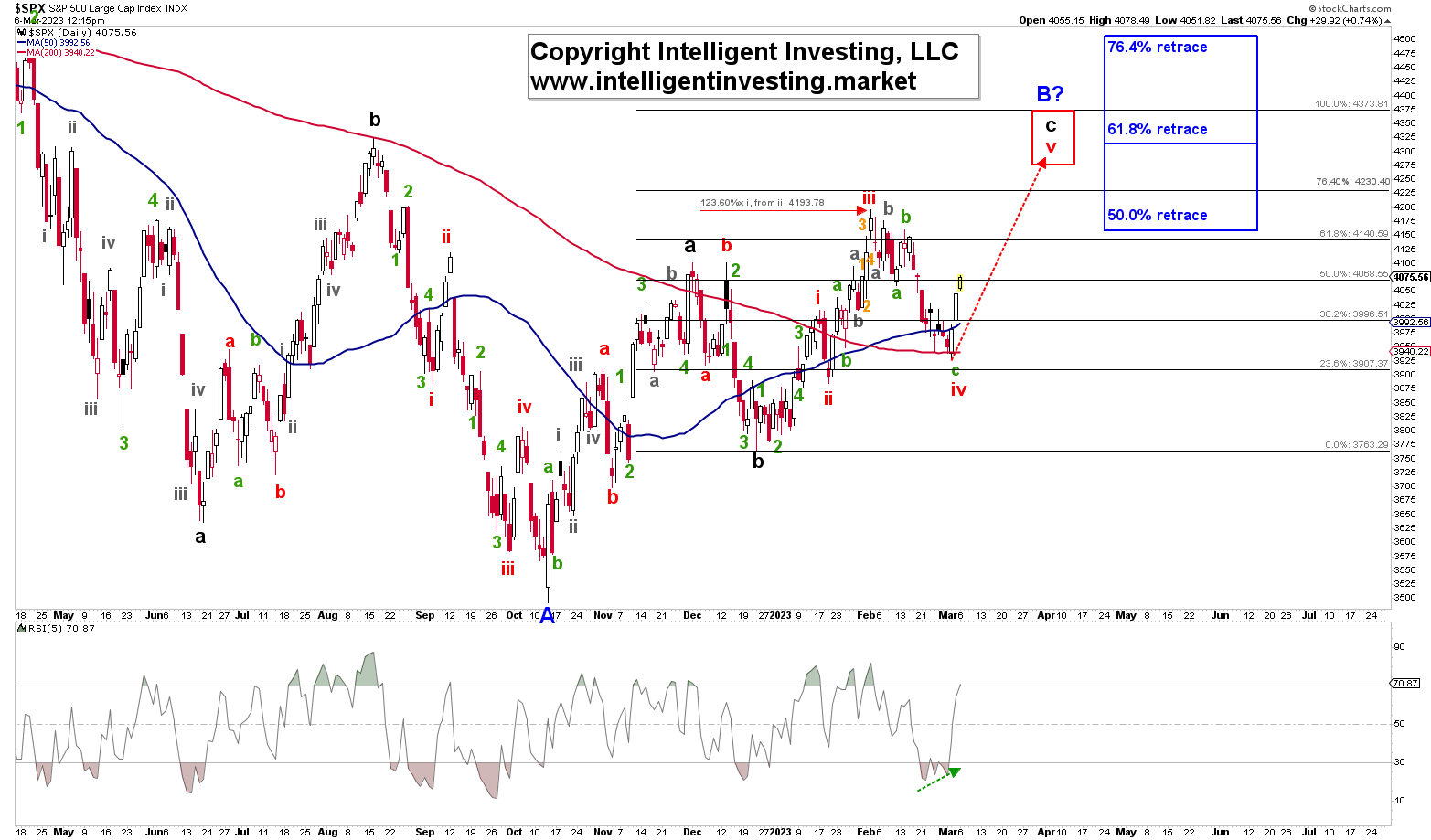

Figure 1

Our primary expectation for a red W-v of an Ending Expanding Diagonal (EED) rally back to 4270-4375 remains. Note, as said last week:

"Remember that because we are likely dealing with an EED, we may not see a [impulse] move for the last W-v to ideally 4273-4374. Instead, we should expect more a-b-c's. Besides, since Diagonals are less reliable than impulses, we give it more wiggle room."

The detailed EWP count for the decline in February and the current anticipated three-wave rally to ideally SPX4270-4375 can be found here. However, with last week's continued move lower, we are still left with at least two less-than-ideal counts since the December lows presented the previous week: the EED vs. a larger a-b-c. See figure 2 below for an update on the alternate a-b-c EWP count.

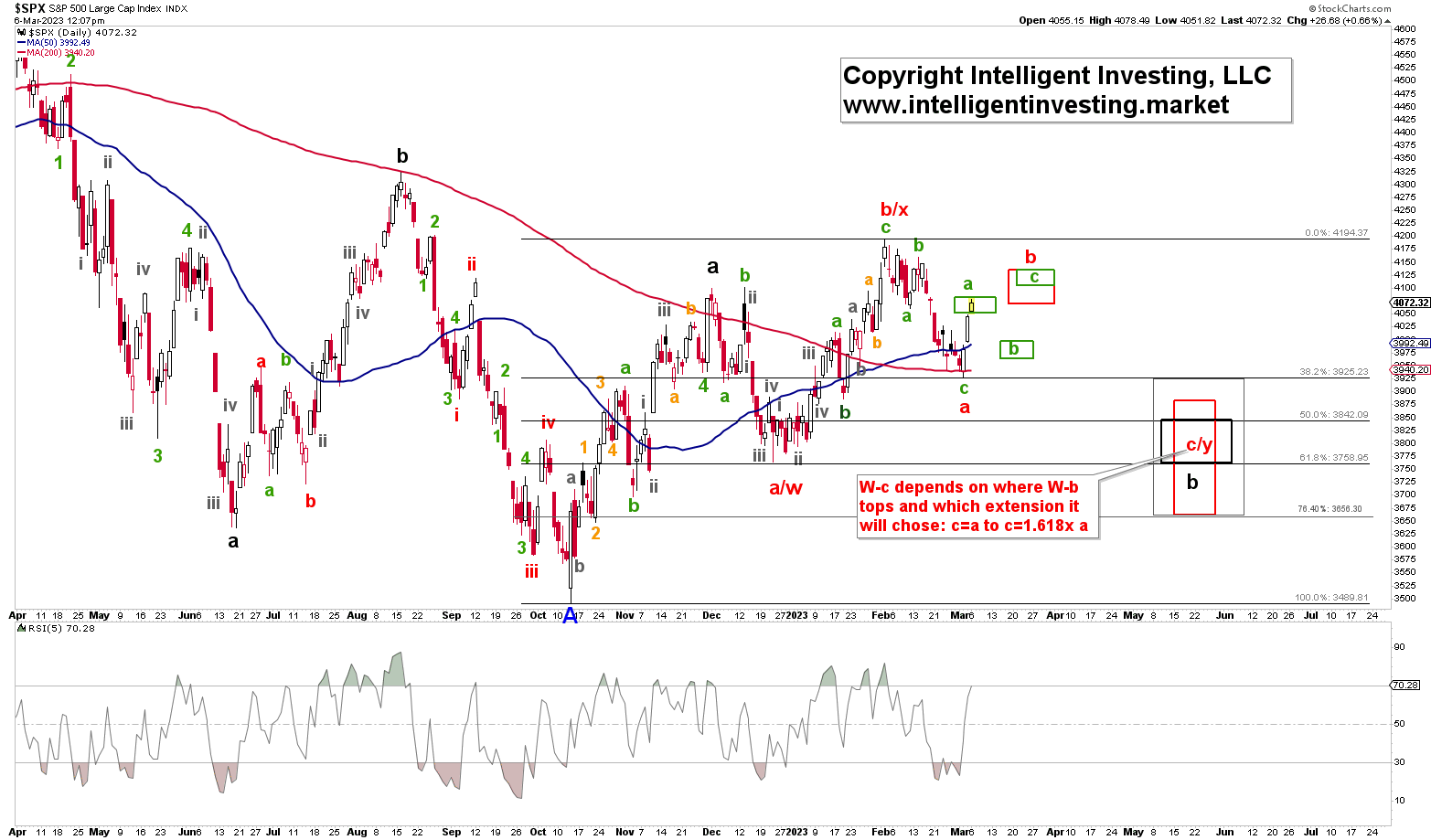

Figure 2

Last week we found for the alternate EWP count:

"If the index continues below 3940, we must concede and anticipate a three-wave move down to 3700-3800. In that case, even a strong rebound, a B-wave counter-trend rally (see Figure 2 above), should be expected at any moment because the downside looks relatively complete. The first order for the bulls is a move above the last Thursday's 4028 high, followed by a break back over the February 17 high at 4081."

Although the index did not close below 3940 on any day last week, the low at 3928 does increase the odds for this alternate option, so we must remain vigilant. But the index moved above 4028 and is getting close to 4081.

Thus, we can add more detail to this alternate EWP option in that the SPX has now reached the ideal green W-a target zone, similar to the EED (see above). The green W-b down to ideally 3975-4025 should be expected over the next few days, especially since the short-term technical indicators are now very overbought before green W-c starts. Besides, the S&P 500 has, since the October low last year, had four consecutive up days only once and three successive up days only three times.

Bottom Line

Although the index did move to as low as 3928, it never closed on any day below 3943, and the positive divergence observed last week kicked in the current rally. We now should anticipate a short-term pullback to 3975-4025 before the index tries for another rally to ideally 4270-4375, our preferred scenario, or stall out at 4125-4150, which is our alternate scenario.

A move above 4170 will seal the deal for the bulls, whereas a drop below last week's low (3928) seals the deal for the bears. Lastly, please remember that the markets have been in terribly overlapping structures since the October lows, with an unclear structure to the downside since it topped out at 4195. This overlap decreases the certainties with which we can forecast the markets, and one should trade accordingly: smaller positions, quicker profit-taking, cut losers sooner, tighter stops, etc.