A few days ago, I updated you on the bull-versus-bear battle that was going on in the S&P 500, and how the bulls had won this "SPX 4150 or 4550 first" battle. I showed how the rally from the July 19 low, at SPX 4233, had thrown my original ideal,Fibonacci-based Elliott Wave Principle (EWP) count off.

Now, I will go into more detail to figure out if yesterday's high of SPX 4502 was all she wrote or, if we can expect one last wave, to SPX 4550s before the anticipated 200-300p correction starts. Namely, 4502 is only 1.1% less than 4550 and, thus, well within the (market's) margin of error.

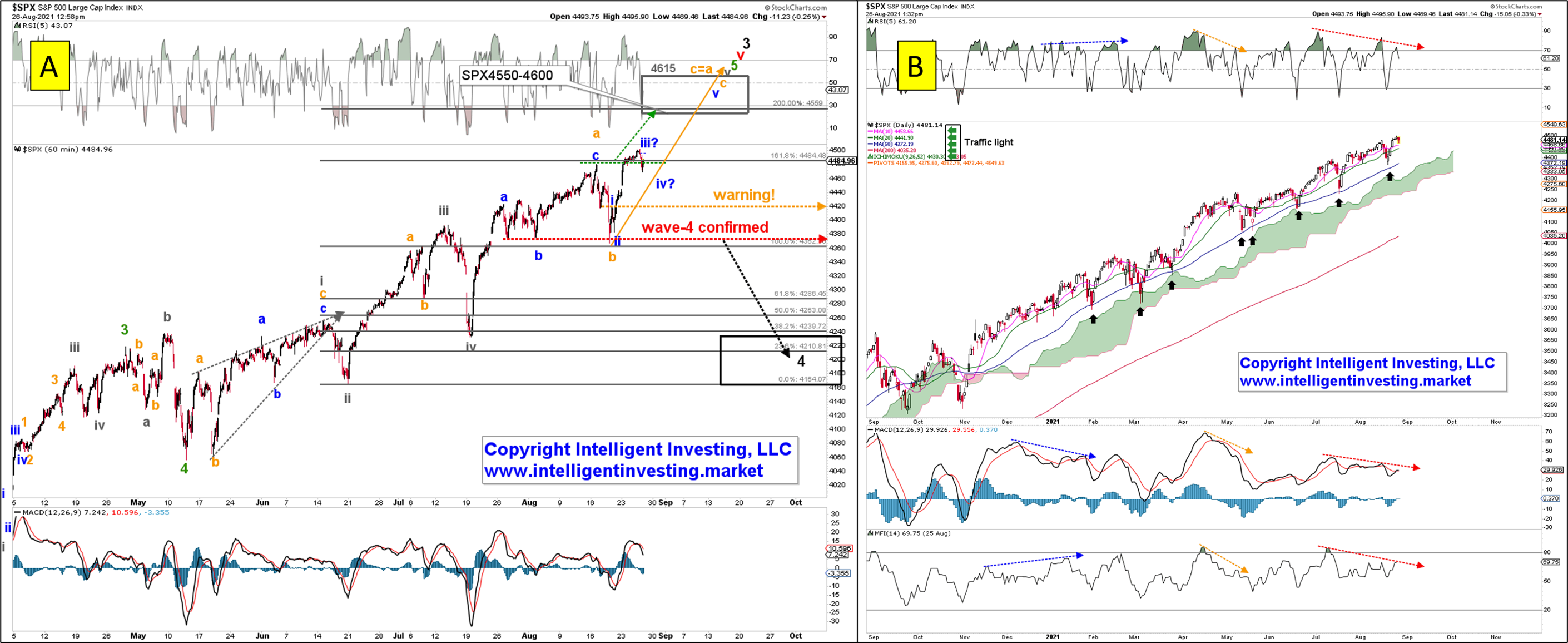

Figure 1: S&P 500 hourly and daily charts with detailed EWP count and technical indicators.

Let me start with the hourly chart: Figure 1A:

It shows a slightly different detailed EWP count that was presented two days ago. Here you can see that the index can, if it wants to, complete one last (blue) nano wave-v (talk about micro counting!) to SPX 4550-4600 with an ideal target of SPX 4559. But, as said, yesterday's high is already good enough. If the index breaks below SPX 4420, a severe warning is given to the bulls that the black wave-4 ideal target zone of SPX 4160-4240 will be reached in the coming days before SPX 5000. This option will be fully confirmed on a daily close below last week's low at SPX 4368. Thus, know your risk-reward up here, as I am simply starting to run out of waves to count. And when that happens, I become cautious.

Figure 1B shows the daily chart with technical indicators. Note how the index is well above all its crucial simple moving averages (SMAs) and has essentially held the 50-day SMA as support since November. As such, using these SMAs, and the Ichimoku Cloud, I devised a "traffic light:" as long as the price is above the 10d, 20d, 50d, it is "go." But, as soon as the index closes below the 10d SMA, the light will turn a little orange: downside risk increases. Each subsequent close below the next SMA will tell us the "traffic light" is turning redder and redder, which means caution. In this manner, we have an objective way of knowing what to expect next, most likely. Of course, the traffic light is not predictive, but it gives us an idea if the odds of a continued rally are.

Currently, the traffic light is 100% green: Go. However, the technical indicators are presently negatively diverging with price (red dotted arrows). Although I always say, "divergence is only divergence until it is not, but it must be noted." It suggests the current rally is losing steam and strength. The blue and orange arrows show that such divergence can last for a while before the market responds. And that, in some cases, while a few indicators are down, others are up. E.g., during November 2020 through January 2021. Hence, one must pay attention to all indicators to get a better idea, and not just one. It's all about the weight of the evidence, remember.

Thus, while the micro EWP count can still allow for a final rally to ideally SPX 4550-4600, we also have – thanks to the EWP – cut-off levels below which this rally will not happen.

Besides, although the index's daily chart is still in a strong uptrend, the technical indicators look tired. A reset, i.e., oversold conditions, may be necessary to allow the next rally to ideally SPX 5000.