The weather isn’t the only thing taking a turn for the worse as summer winds to a close; the so-called 'FANG' stocks (Facebook), (NASDAQ:Amazon), Netflix (NASDAQ:Netflix) and Googl) that led the US stock market as a whole higher throughout the summer have also been backsliding.

All four stocks saw a big dump Wednesday, spurred by concerns over privacy as Facebook COO Sheryl Sandberg testified to Congress – and those losses have carried over into today’s trade, with FB, AMZN and GOOG all shedding more than 2% (NFLX is in positive territory so far after losing more than 5%). From a classic technical analysis perspective, underperfomance among the “generals” that led the charge higher off the April lows is a potential warning sign that the rally could be tiring, though we’re hesitant to draw too strong of a conclusion based on just one holiday-shortened week of trading.

Pull Back

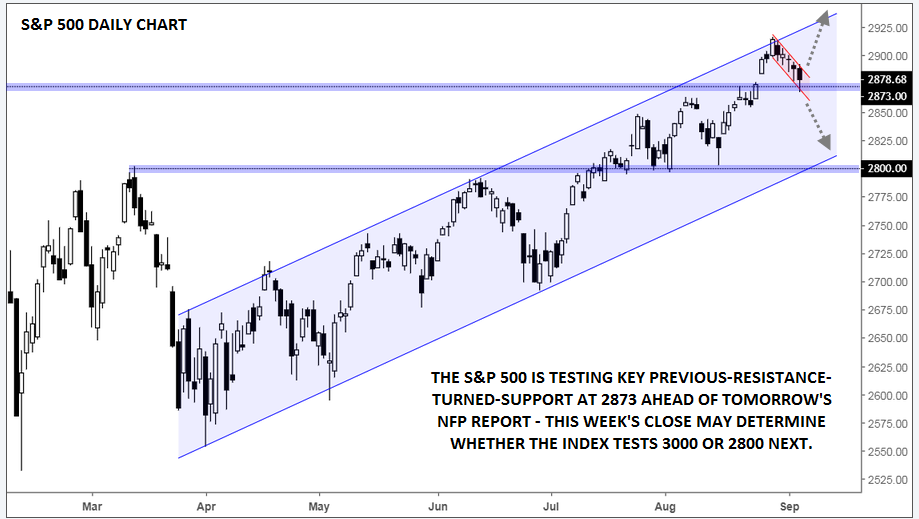

Turning our attention to the S&P 500 chart, prices have pulled back to test a critical support level at 2873, the previous record high from January. In a healthy uptrend, this previous resistance level would be expected to provide support and set the stage for a rally on to new highs. Indeed, the price action over the last three weeks could represent a small “bullish flag” pattern, which if confirmed with a break above today’s high, would project a measured move objective up around the 3000 area.

On the other hand, a break and close below 2873 support could expose the lows from last month, and the bottom of the five-month bullish channel, around 2800 next. With the always-critical Non-Farm Payrolls report set for release tomorrow morning, it should be a very interesting close to the week for US stock traders indeed.

Source: TradingView, FOREX.com

Cheers