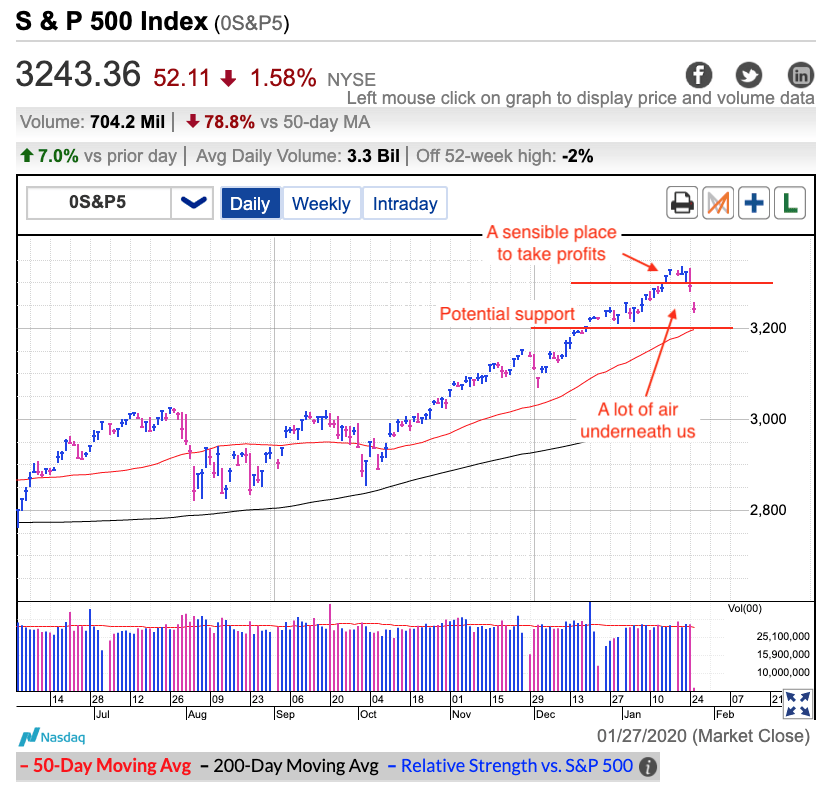

The S&P 500 tumbled for a second day on growing Coronavirus fears. While the odds of a massive epidemic remain very small, the risk is not zero and that is making investors nervous. As high as stocks climbed over the last few months, there was a lot of air underneath us and it doesn’t take much uncertainty to knock down a highflying market.

As I wrote last week, yesterday's tumble shouldn’t have surprised anyone. While history tells us these things don’t have a lasting impact on stocks, they do make a lot of waves in the moment and we were definitely seeing.

The bigger question is if yesterday was the worst of it. And unfortunately, the answer looks like “no.” These things usually end in a capitulation bottom when the selling climaxes and we exhaust the supply of fearful sellers. Yesterday’s market traded mostly sideways and there wasn’t a lot of aggressive selling. The majority of owners held steady through the rocky open and the lack of new supply prevented prices from falling under the early lows. While this stability felt reassuring in the moment, it leaves many owners at risk of getting spooked out. That overhang means the worst could still be ahead of us.

Yesterday morning’s resilient open gave us a great buying opportunity. The early bounce gave us a clear stop-loss level to limit our risk. But if this was going to be a good trade, we would have seen prices climb decisively throughout the day. Instead, the market stumbled into the close. That is never a good sign.

This lethargic close means we probably have lower prices ahead of us. Luckily, most readers of this blog either took profits proactively last week or at the very least used 3,300 as a trailing stop to lock in their profits Friday. Rather than fear this dip, these proactive profit-takers are looking at this dip as a fantastic buying opportunity. Instead of lying awake at night debating whether they should stay in or get out like most investors, these proactive traders are looking at this dip as a fantastic buying opportunity.