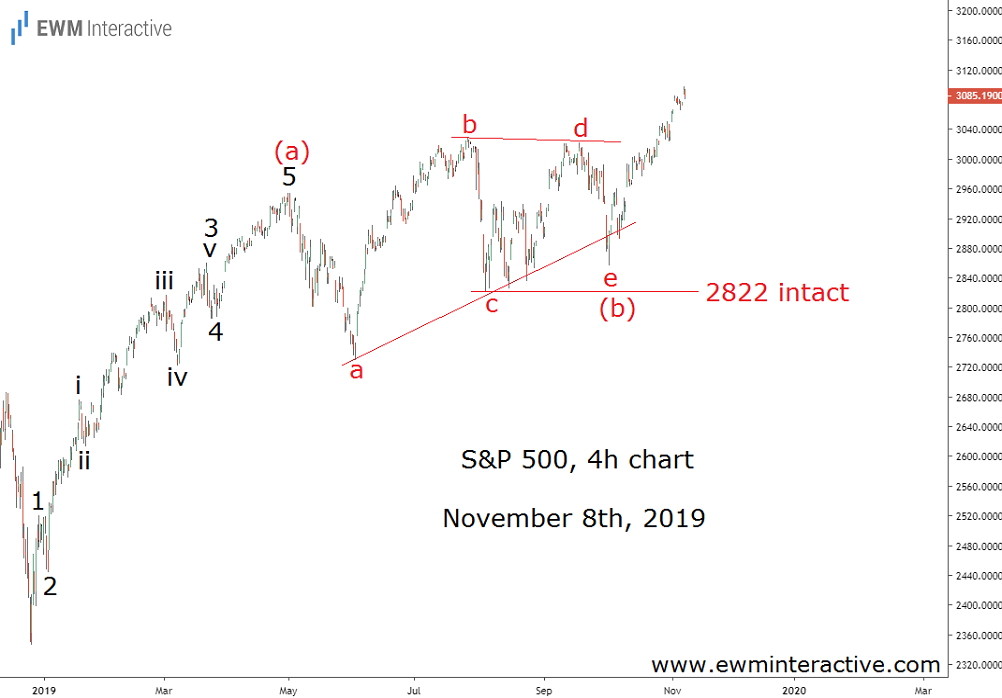

The S&P 500 reached new all-time highs on the back of better-than-feared earnings season and improved US-China trade prospects. The index closed at 3085 Thursday, bringing its 2019 tally to the impressive 23.1%.

But was there a way to predict this move instead of just explaining it after the fact? To paraphrase Warren Buffett, the trader of today does not profit from yesterday’s growth. In other words, traders must be able to anticipate the market’s next move. The chart below, shows how this can be done with the help of Elliott Wave analysis.

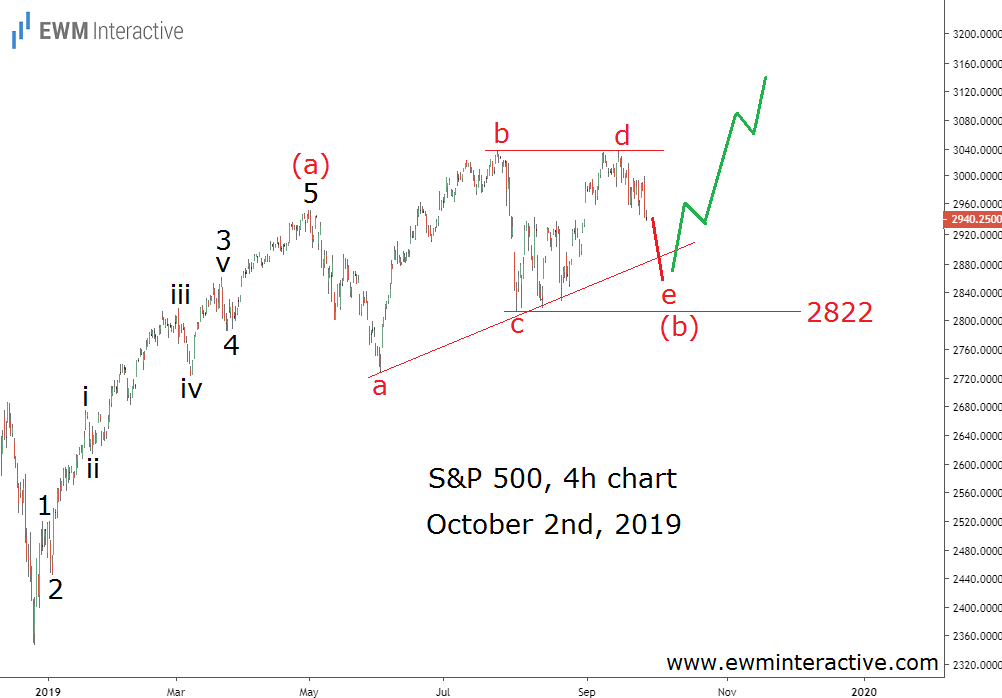

The 4-hour chart put the S&P 500 ‘s entire 2019 progress into Elliott Wave perspective. It revealed that the recovery from 2346 to 2954 was a five-wave impulse, labeled 1-2-3-4-5 in wave (a). The rest seemed to be an almost complete a-b-c-d-e triangle pattern in wave (b).

This meant that more strength in wave (c) towards 3100 could be expected as soon as wave “e” completes the triangle. In addition, the analysis helped us identify a specific invalidation level for this bullish count. Wave “e” was not supposed to breach the bottom of wave “c” at 2822. Over a month later now, the updated chart below shows how things went.

Wave “e” ended at 2856 on October 3rd, comfortably above the 2822 invalidation level. At that point the impulse-correction wave cycle was complete and it was time for the bulls to return. Nearly 230 points to the north later, we can say that all the positive market-related news certainly helped the S&P 500. However, we don’t think it caused the rally since there was a complete bullish pattern already in place