SPX Monitoring purposes; Long SPX on 10-29-24 at 5832.92

Our Gain 1/1/23 to 12/31/23 SPX= 28.12%; SPX gain 23.38%

Monitoring purposes GOLD: Long GDX on 10/9/20 at 40.78.

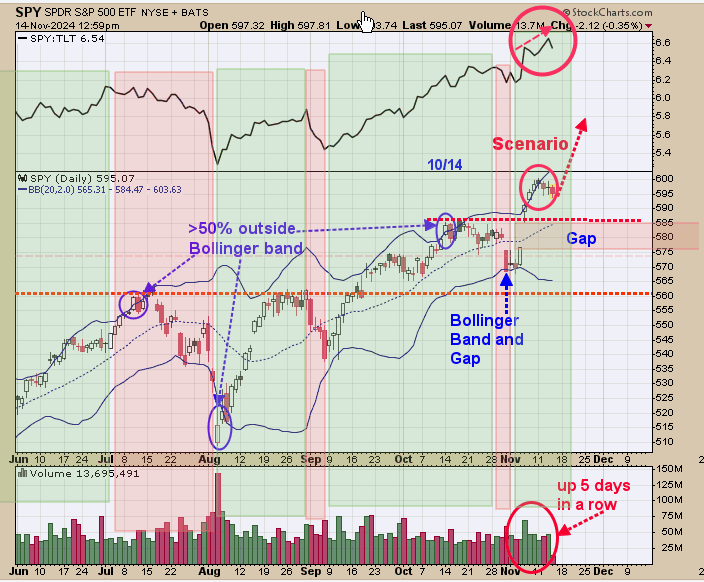

We are up 31.40%; SPX is up 25.7% so far this year. The top window is the SPY/TLT ratio. We noted in shaded green where both the ratio and SPY are making higher highs (bullish) and noted in shade pink where the ratio is making lower highs as SPY is making higher highs (bearish). Currently, the ratio is making higher highs suggesting at some point the SPY will make higher highs.

The bottom window is the volume for the SPY. The green volume shows the SPY was up that day. Notice that going into Monday the SPY was up 5 days in a row which predicts SPY will be higher within 5 days 73% of the time. Long SPX on 10/29/24 at 5832.92.

Above is the weekly SPX with its Bollinger band and the weekly VIX is in the bottom window; next high window is the SPX/VIX ratio. Bullish signs are present for the SPX when the SPX makes higher highs along with the SPX/VIX ratio (see far right window). The bottom window is the VIX.

It is said that a trending market occurs when the VIX stays below 17 (the current VIX reading is 13.99). Support lies at the previous high near 585 SPY. The intermediate-term trend is up until at least year's end.

Monday we showed the monthly cumulative up-down volume for GDX with its Bollinger band and the monthly cumulative advance/decline for GDX with its Bollinger band. Buy signals were triggered when both indicators close above their mid Bollinger band which came in May 2024. Most signals of this type last 1 ½ years or longer. We updated the shorter-term view for GDX on Thursday suggesting a low was near (see yesterday’s report).

Above is another bullish signal for GDX in the short term. The second window down from the top is the daily inflation/deflation ratio with its RSI in the top window. Bullish signals for GDX are triggered when the RSI nears 30 and turns up (current reading is 31.13). We noted in shaded green on the inflation/deflation ratio graph the times when this ratio reached .14 which appears to be a triple bottom. This chart gives another clue that GDX is making a low in this area.