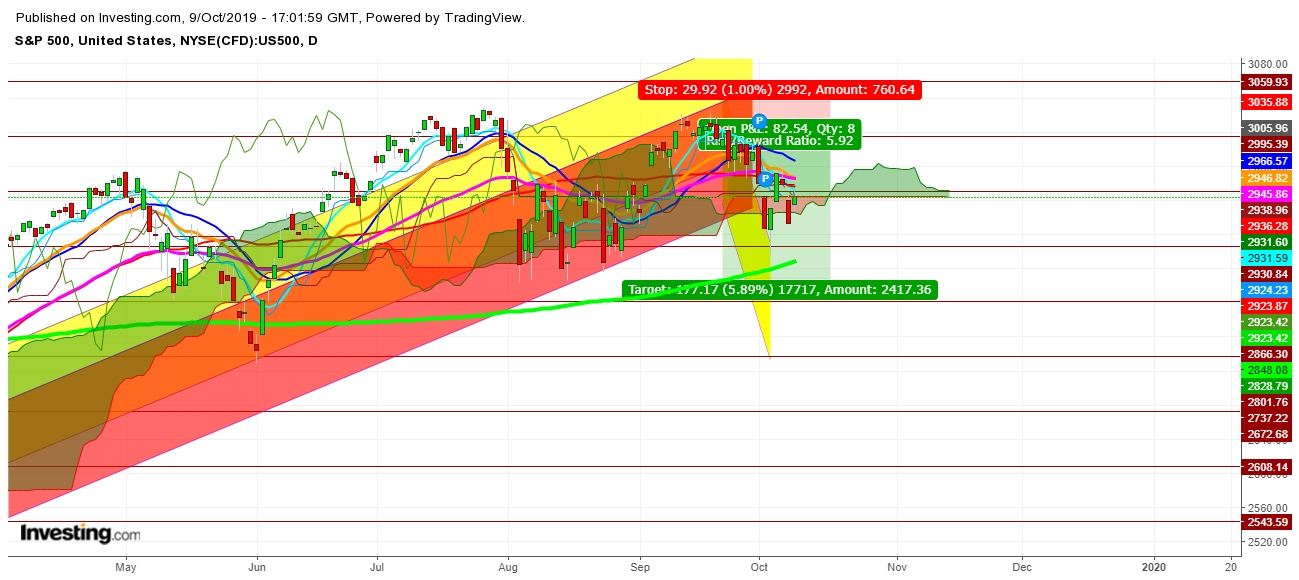

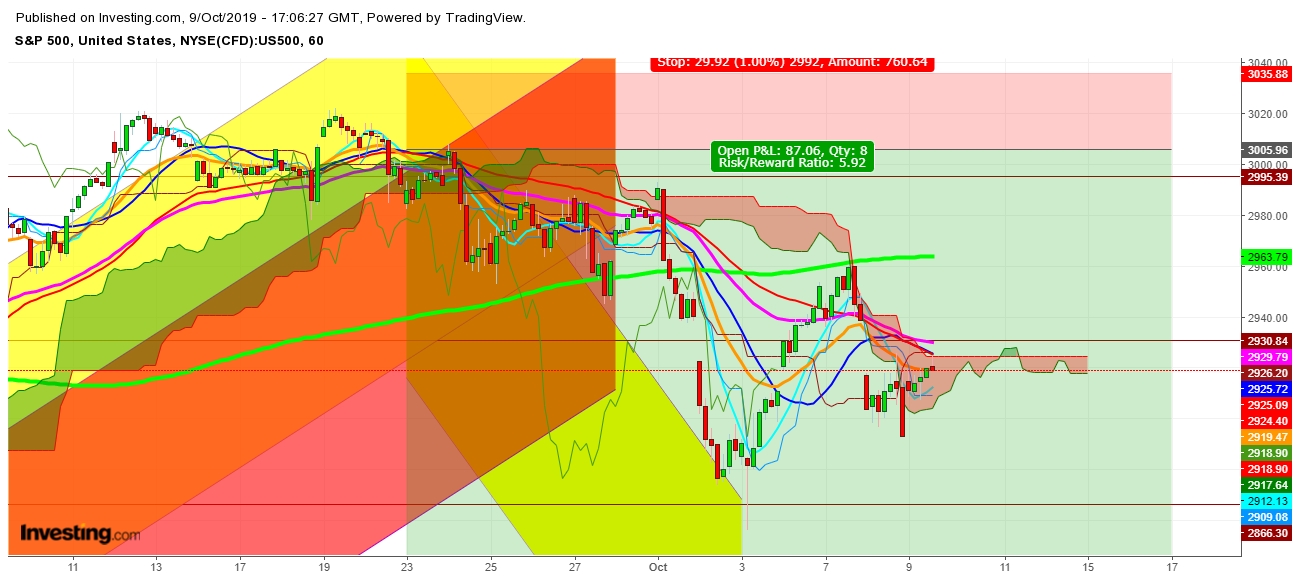

On analysis of the movements of stocks, in different time frames, I find that S&P 500 still looks fearful of a global economic slowdown despite growing hope of partial trade deal between the United States and China this month. No doubt that investors remain cautious about efforts made from both sides to ease trade tension, as the S&P 500 is still trading below its immediate stiff resistance at 2929; amid ‘Ichimoku Cloud’ in a daily chart, which seems like it may remain exhausted through October 17, 2019.

No doubt that both partners of the trade deal are showing extreme eagerness to resolve their year-long tariff tussle at an early date, but on their own terms; which enhance the probabilities of hick-ups to come forward to seal a final deal.

Finally, I conclude that the S&P 500's swinging moves since September 23 has resulted in extreme volatility, which further extends fear of a global economic slowdown. No doubt that gold's steady price still shows the growing uncertainty in global equity markets.

Watch my video on expected S&P 500 trading zones below.

Trading Strategy: Short Position

Entry Level: 2920 – 2925

Stop Loss: 2929 – 2934

Target: 2879 – 2969

Risk/Reward: 1:8

Disclaimer

1. This content is for information and educational purposes only and should not be considered as an investment advice or an investment recommendation. Past performance is not an indication of future results. All trading carries risk. Only risk capital be involved which you are prepared to lose.

2. Remember, YOU push the buy button and the sell button. Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from an investment and/or tax professional before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.