- SPX Monitoring purposes; Long SPX on 1/27/25 at 6012.28.

- Our gain 1/1/24 to 12/31/24 = 29.28%; SPX gain 23.67%

- Our Gain 1/1/23 to 12/31/23 SPX= 28.12%; SPX gain 23.38%

- Monitoring purposes GOLD: Long GDX on 10/9/20 at 40.78.

We ended up 29.28% for 2024; SPX up 23.67% for the year. Yesterday’s gap down produced a spike in volume and is most likely a “Selling Climax” (Selling Climax usually ends the decline (see volume window)). It’s common for “selling climaxes” to be tested and the test should be on a lighter volume to keep the bullish setup.

Yesterday’s decline pushed the TRIN close to 1.19 and tick to -448 producing a bullish combination suggesting a low will form as early as yesterday to as late as tomorrow. Today’s light volume rally into yesterday's down gap could produce resistance and in turn produce a test of yesterday’s “Selling Climax” low. Test or no test another rally is coming that may hit new highs. Long SPX on 1/27/25 at 6012.28.

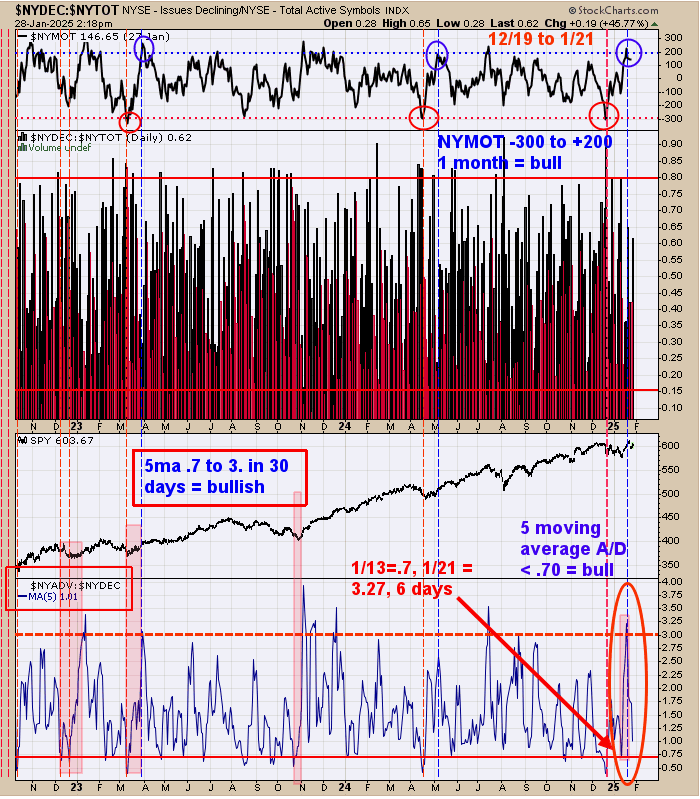

The chart is updated, and yesterday’s commentary still stands, “The above chart shows two indicators that have triggered bullish signs; one for short term and one for intermediate term. The bottom window is the 5-day average of the Advance/Decline (last week we showed the 3-day average). Short-term bullish signs are triggered when this indicator reaches .7 and then rallies to 3.00 in 30 days or less. The last signal did it in 6 days. We noted the previous signal in shaded pink. The top window is the McClellan Oscillator which gives intermediate term signals.

A bullish signal is triggered when this indicator reaches below -300 and then rallies to +200 in 30 days or less. We noted the previous times this indicator was triggered with Red dotted lines (selling climax) to blue dotted lines (a sign of strength). Both indicators were triggered, suggesting a bull market is possible this year.” Added to the above, the previous three signals marked lows that produced good rallies in the coming weeks.

We updated this chart from yesterday; yesterday's commentary still stands, “The second window down from the top is the weekly Inflation/deflation ratio going back to mid-2015. Next window higher is the weekly RSI for this ratio. Bullish signal are triggered when the weekly RSI for this ratio hits below 30 and turns up (which it did in late December).

We noted those times with blue lines. Signals of this type last several months and some longer. The current signal is less than a month old. The current bullish signal could last into July of this year.”