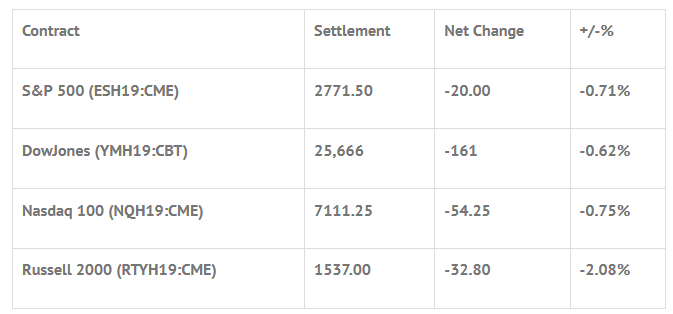

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 7 out of 11 markets closed higher: Shanghai Comp +0.14%, Hang Seng -0.89%, Nikkei -0.65%

- In Europe 12 out of 13 markets are trading lower: CAC -0.34%, DAX -0.46%, FTSE -0.34%

- Fair Value: S&P +6.95, NASDAQ +36.87, Dow +34.27

- Total Volume: 1.5mil ESH & 1.6k SPH traded in the pit

Today’s Economic Calendar:

Today’s economic calendar includes Challenger Job-Cut Report 7:30 AM ET, Jobless Claims 8:30 AM ET, Productivity and Costs 8:30 AM ET, EIA Natural Gas Report 10:30 AM ET, Lael Brainard Speaks 12:15 PM ET, Consumer Credit 3:00 PM ET, Fed Balance Sheet and Money Supply 4:30 PM ET.

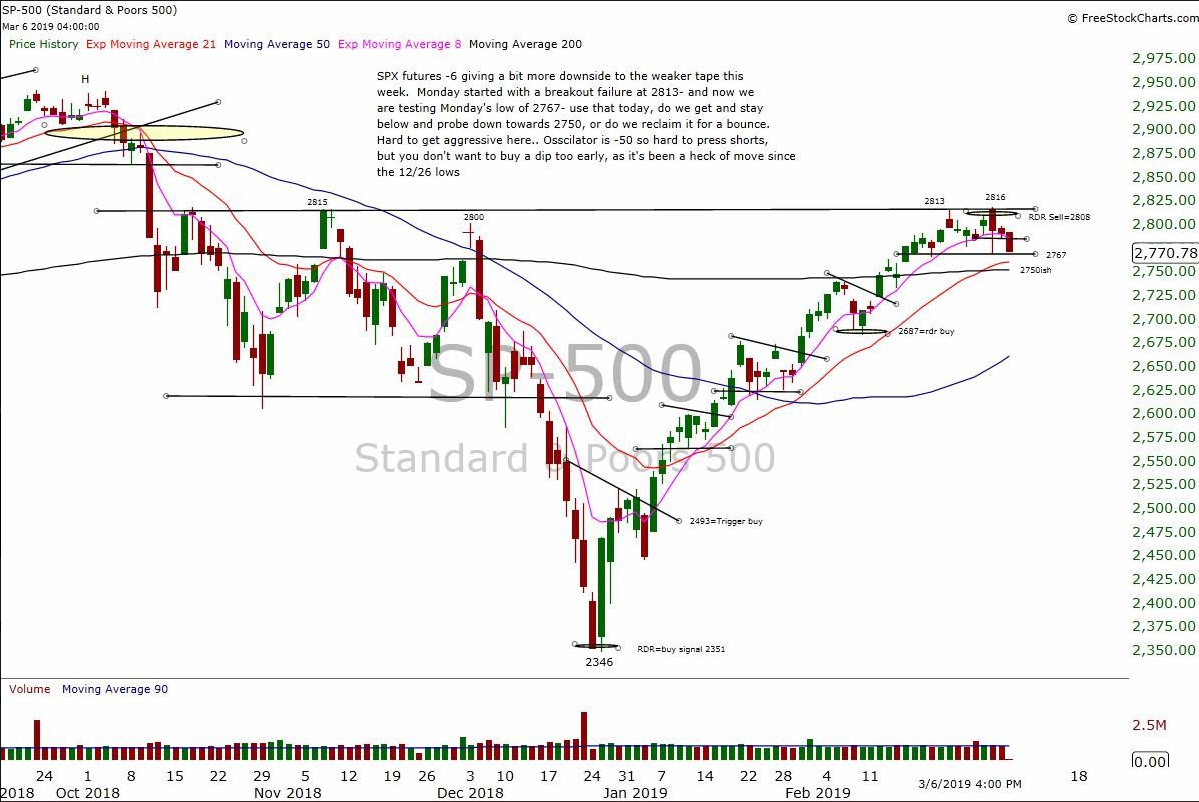

S&P 500 Futures: #ES Continues To Slide

Chart courtesy of Scott Redler @RedDogT3 – $spx futures -2. Does the orderly pullback get disorderly?

During Tuesday nights Globex session, the S&P 500 futures (ESH19:CME) printed a high of 2792.75, a low of 2781.50, and opened Wednesday’s regular trading hours at 2790.50.

After a small uptick the ES got hit by a series of sell programs that initially pulled the futures down to 2781.25 going into 9:00. From there, the ES rallied up to the vwap at 2786.50, sold off to a lower low at 2775.00 at 9:30, then after another bounce up to the vwap at 2784.25, made a lower high before again selling off down to 2772.00 going into 10:00 CT.

The futures continues to sell off down to a lower low at 2772.25, then bounced up to 2780.25, followed by a ‘double bottom’ at 2769.50 around 12:20. The ES then bounced up to the 2776.50 area, down ticked to 2772.00 before pushing up to 2778.75. After that, the futures pulled back down to 2773.00, bounced up to 2777.00 as the MiM started to showed $80 mil to buy, then dropped down to 2768.25 as the MiM dropped to $30 million to buy.

The ES rallied back up to 2776.00 just before the 2:45 cash imbalance reveal showed $39 mil to buy. On the 3:00 cash close the ES traded 2773.00, and went on to settle at 2770.50 on the 3:15 futures close, down -20.75 handles, or -0.73% on the day.

In the end, the overall tone of the ES was weak. In terms of the days overall trade, total volume was high, with 1.5 million futures contracts traded.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Any decision to purchase or sell as a result of the opinions expressed in the forum will be the full responsibility of the person(s) authorizing such transaction(s). BE ADVISED TO ALWAYS USE PROTECTIVE STOP LOSSES AND ALLOW FOR SLIPPAGE TO MANAGE YOUR TRADE(S) AS AN INVESTOR COULD LOSE ALL OR MORE THAN THEIR INITIAL INVESTMENT. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.