As we step into the new year, there’s the usual sense of renewed optimism and the promise of fresh beginnings. However, recent price action in the stock market is casting a bit of a shadow over this sentiment. Momentum in stocks has recently stalled as the calendar turned to 2025, and deteriorating breadth measures are flashing potential warning signs for a deeper pullback.

Adding to the complexity is a potentially more challenging macroeconomic backdrop, as near-term technical trends point to upside risks to interest rates and the dollar. Uncertainty over tariff policy and ongoing geopolitical turmoil are further complicating the macro outlook.

Despite these headwinds, there are plenty of reasons to be optimistic. The economy is holding up well, earnings are expected to grow again this year by double digits (with contributions broadening beyond the mega-cap names), while the artificial intelligence theme continues to support market enthusiasm. President-elect Donald Trump’s incoming administration is also expected to bring a pro-growth agenda, less regulatory oversight, and potentially lower taxes. Of course, some of these policies could be detrimental to inflation and the ballooning U.S. deficit.

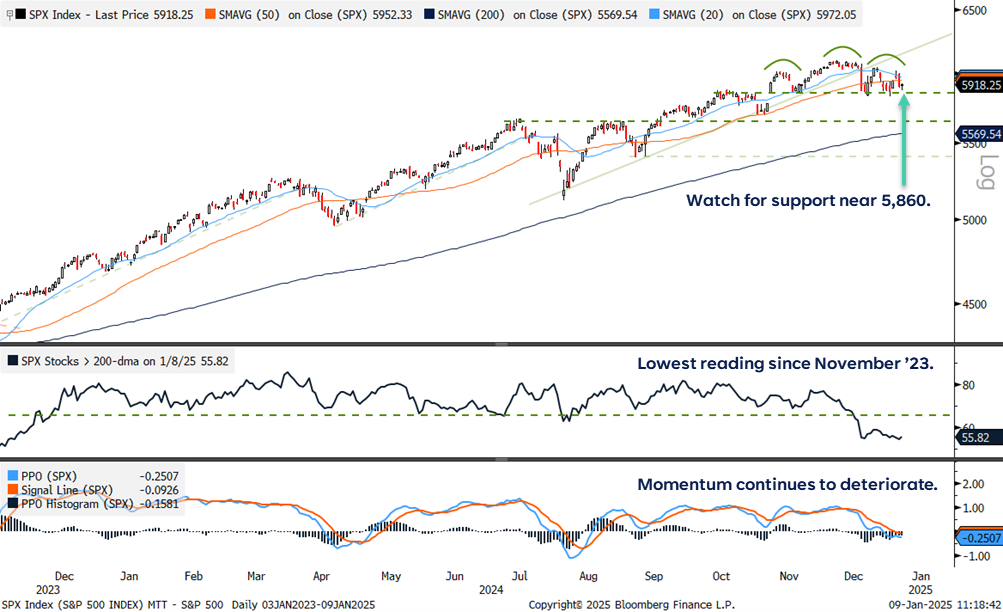

Despite an unseasonably weak end to an otherwise stellar 2024, the broader market is holding up relatively well — especially considering how much higher Treasury yields have recently jumped. As highlighted in the chart below, buyers have stepped in and defended support near 5,860, a level tracing back to the November highs and the post-Election Day price gap. This level also marks the neckline of a potential head and shoulders top formation. A break below 5,860 would complete the pattern and point to a deeper pullback toward the July highs or even 200-day moving average (DMA). Technical damage within the index has been a little more noticeable.

Only 56% of S&P 500 stocks remain above their 200-dma, down from over 75% in late November. Momentum has also turned bearish but has yet to reach oversold levels. The Percent Price Oscillator (PPO) — a momentum indicator based on the relationship between two moving averages — continues to trend lower in a sell position.

Overall, the weight of the technical evidence suggests the recent pullback may not be over. However, the silver lining to a deeper drawdown is that it could provide a potential buying opportunity back into this bull market, as most importantly, the S&P 500 remains above its longer-term uptrend, with cyclical stocks primarily leading the way.

Bulls Are Holding the Neckline for Now

Source: LPL Research, Bloomberg 01/09/25

Disclosures: Past performance is no guarantee of future results. All indexes are unmanaged and can’t be invested in directly.

Seasonal Setup

Seasonal signals have turned mixed this month. As an update to last week’s LPL Research blog (Santa Claus Rally in Jeopardy), the S&P 500 posted a loss during the Santa Claus Rally period. Historically, a negative return during this seven-day stretch has led to positive but below-average S&P 500 returns (the average annual return is 6.1% for negative signals vs. an average gain of 10.4% for positive signals). However, yesterday’s modest 0.2% gain on the S&P 500 was enough to trigger a positive return for the First Five Days of January indicator, another seasonal indicator developed by Yale Hirsch, creator of the Stock Trader’s Almanac.

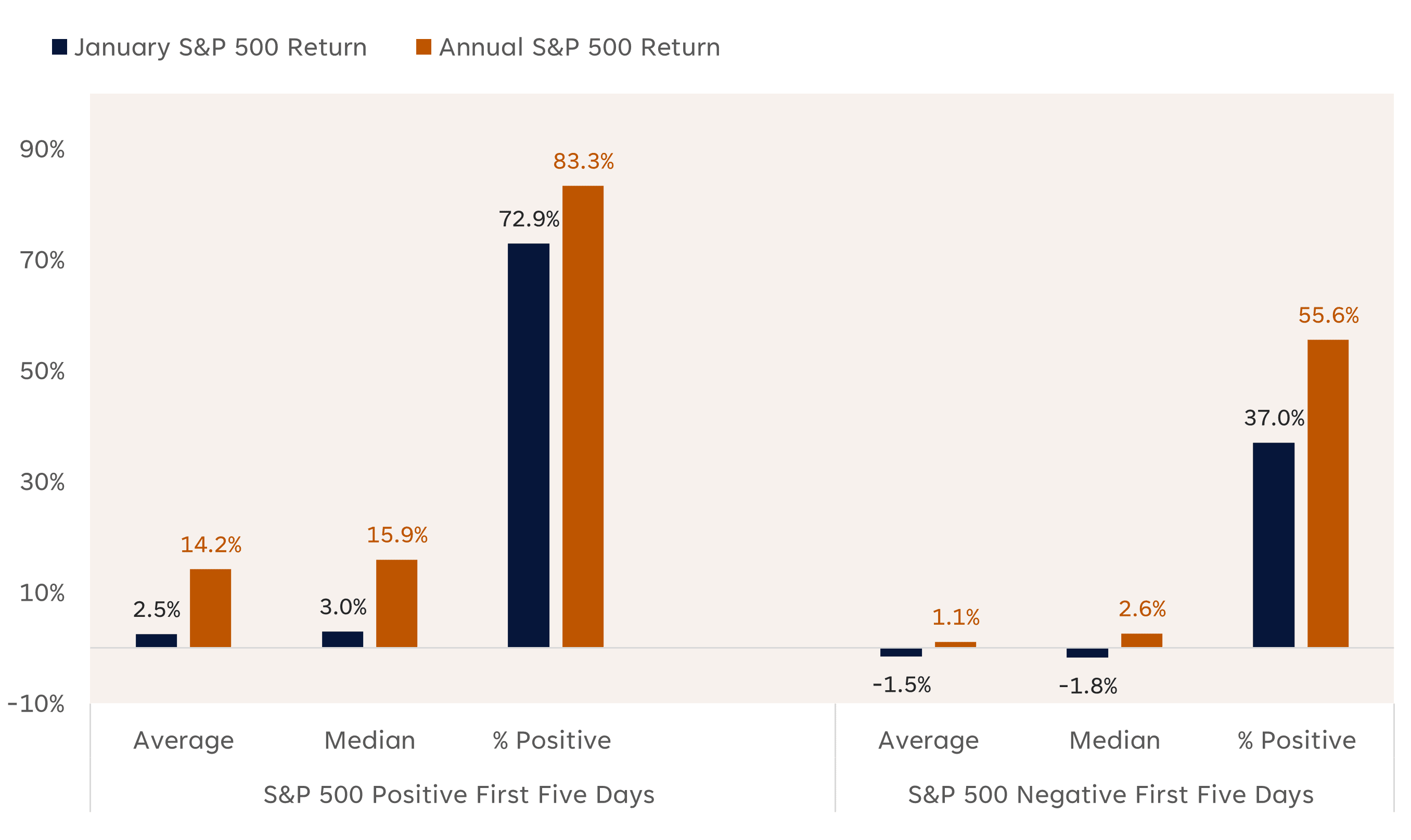

As highlighted below, when the indicator is positive, the S&P 500 has historically generated an average annual return of 14.2% since 1950, with 83.3% of years also producing positive returns. In contrast, when the S&P 500 trades lower during the first five days, average annual returns fall to only 1.1%, with 55.6% of occurrences producing positive results.

First Five Days of January Indicator (1950-2024)

Source: LPL Research, Bloomberg 01/09/25

Disclosures: Past performance is no guarantee of future results. All indexes are unmanaged and can’t be invested in directly. The modern design of the S&P 500 stock index was first launched in 1957. Performance back to 1950 incorporates the performance of the predecessor index, the S&P 90.

Summary

Stocks are struggling to gain traction in the new year. Recent signs of inflation pressure and reduced expectations for Federal Reserve rate cuts have pushed rates to uncomfortably high levels, complicating the macro backdrop. Unfortunately for stocks, near-term technical trends point to additional upside risk for Treasury yields.

Based on this backdrop and the current technical setup for the broader market, we believe a deeper pullback remains potentially on the table as market breadth and momentum wane. However, despite the near-term risks, we believe investors should give the bull market the benefit of the doubt as its uptrend remains in place. Seasonal signals have also been mixed as this year’s positive First Five Days indicator follows a negative Santa Claus Rally period, leaving the January Barometer to settle the seasonality score for 2025. A positive month would be a welcome sign for stocks, as according to Yale Hirsch, “As goes January, so goes the year.”