In Sunday’s QuickTakes, Eric, Joe, and I raised our outlook for S&P 500 earnings as well as our price targets for the index. We did so because we believe that Trump 2.0 represents a major regime change from Biden 1.0 (or was that Obama 3.0?).

The corporate tax rate will be lowered from 21% to 15%. Personal income from tips, overtime, and Social Security might not be taxed. Many onerous regulations on business will be eliminated. This was already set to happen when the Supreme Court ruled earlier this year that businesses could challenge regulatory overreach in court.

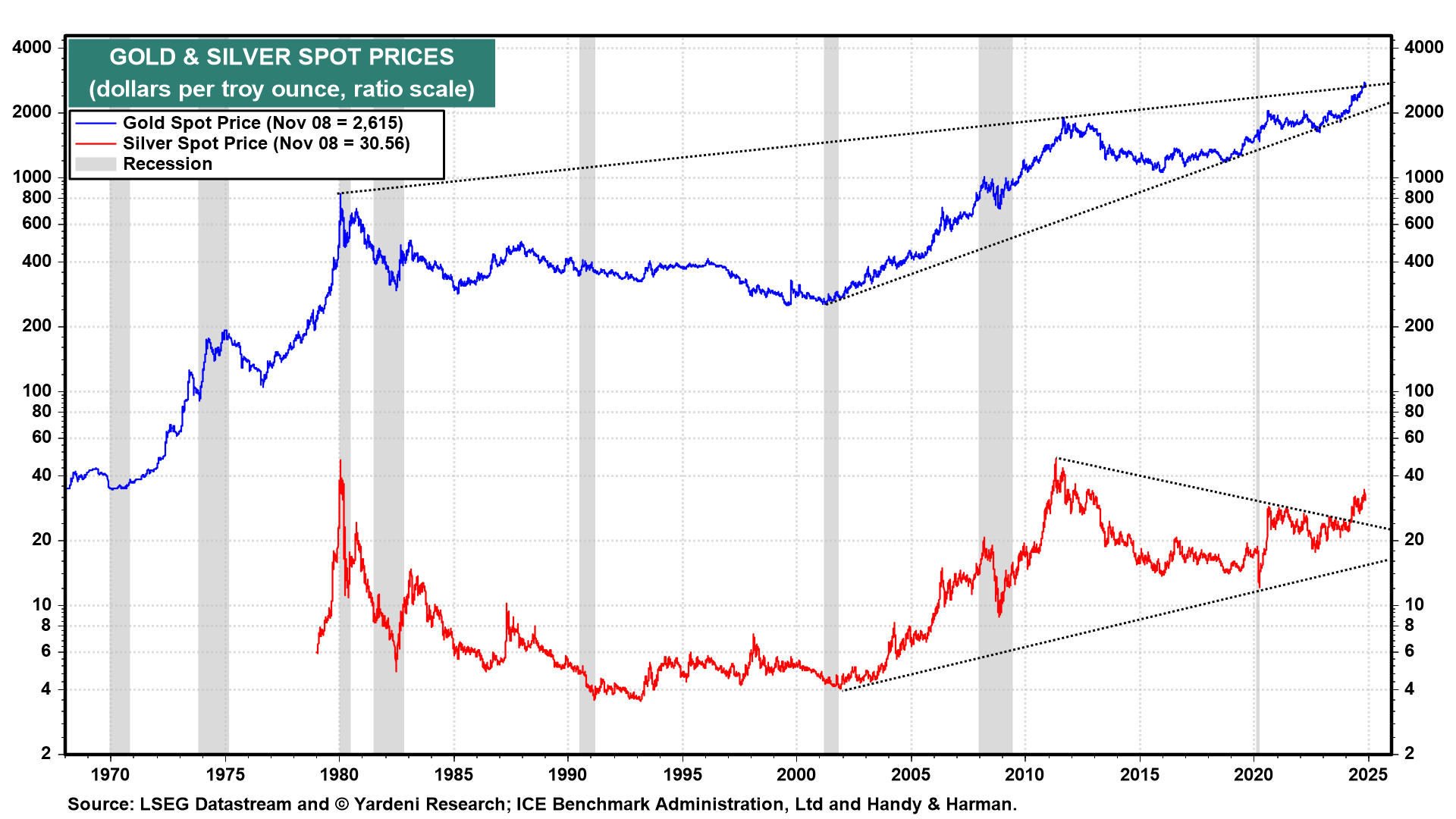

In addition, today’s major geopolitical crises might be settled sooner rather than later. That certainly is reflected in the weakness in the price of gold as well as the price of oil in recent days.

We expect that better economic growth will boost federal government revenues and that Elon Musk will succeed in slowing the growth in federal government spending. GDP growth might actually keep pace with mounting government debt.

The Fed’s cut in the federal funds rate (FFR) by 25bps on November 7 together with the 50bps cut on September 18 suggest to us that Fed officials are oddly oblivious to the strength of the economy, the backup in bond yields, and the outlook for more fiscal stimulus. If Fed officials continue to cut the FFR, they risk a rebound in price inflation rates and a melt-up in the stock market.

We concluded the QuickTakes note with: “So, we are changing the subjective probabilities of our three scenarios as follows: Roaring 2020s (55%, up from 50%), 1990s-style meltup (25%, up from 20%), and 1970s-style geopolitical and/or domestic debt crisis (20%, down from 30%).”

We’ve updated our YRI Earnings Outlook, which is posted on our website, to reflect our increasing confidence that our Roaring 2020s scenario remains on track and might be on a faster track:

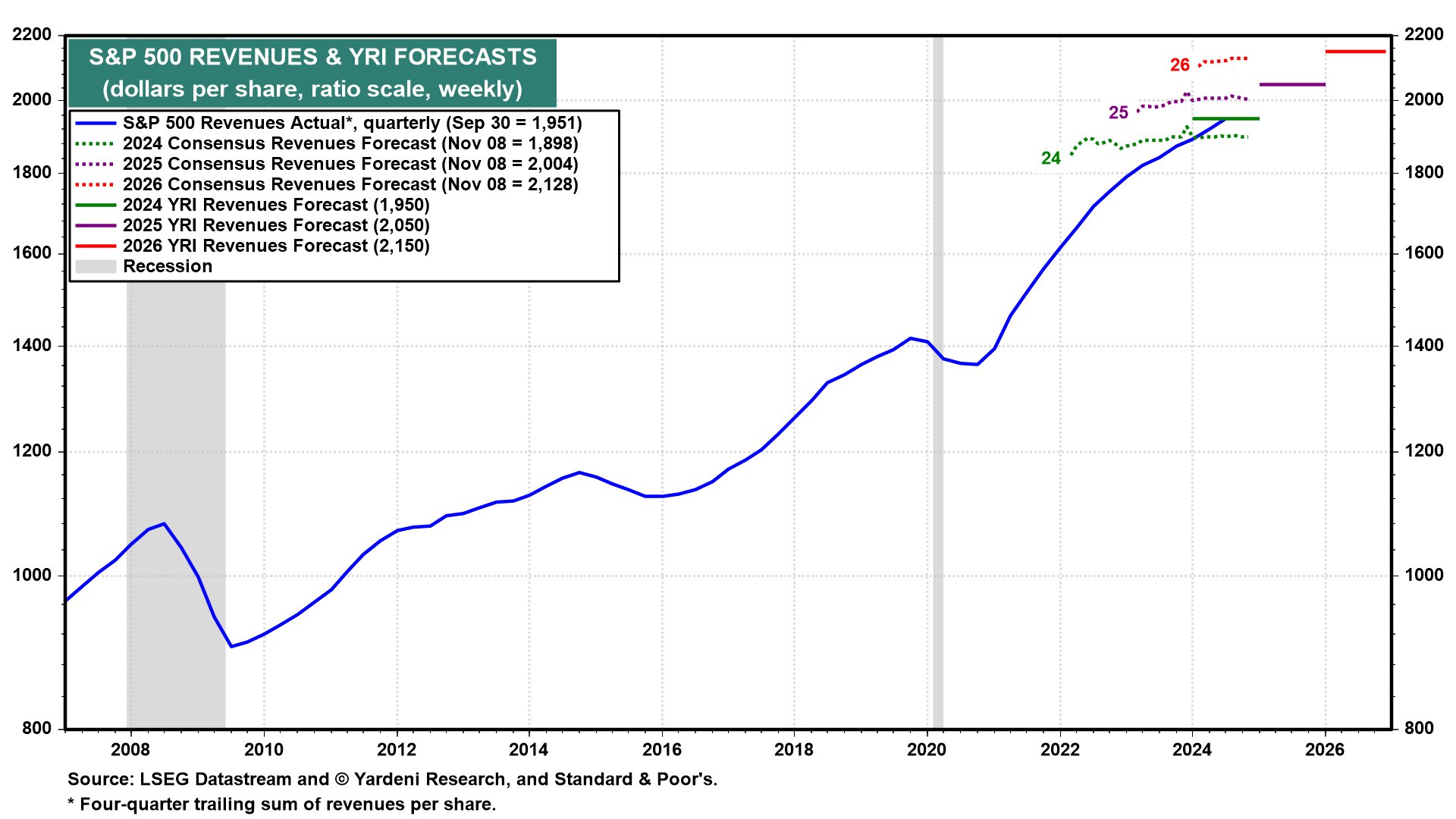

S&P 500 Revenues

Revenues per share for the S&P 500 companies in aggregate should total $1,950 this year, we estimate, up 4.2% from last year’s level. We are expecting increases of 5.1% next year and 4.9% in 2026.

That’s a fairly conventional outlook as long as the global economy continues to grow, with strength in the US offsetting weakness elsewhere in the world, especially China and Europe.

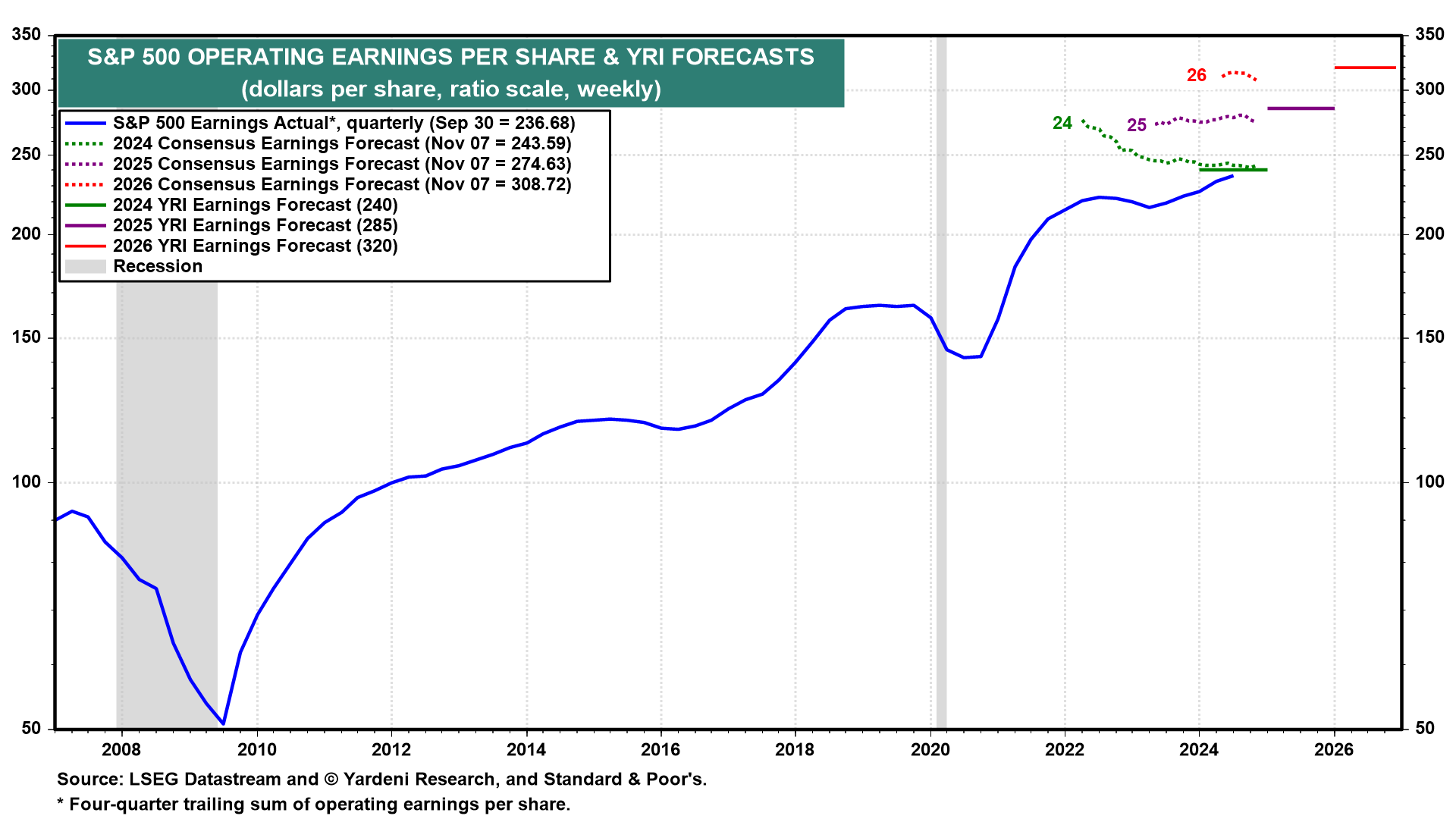

Earnings

We are lowering our S&P 500 earnings per share (EPS) forecast for this year from $250 to $240 mostly because of strikes and hurricanes. That’s still up 8.4% y/y. On the other hand, we expect that Trump 2.0 will boost earnings over the next two years.

So we are raising our 2025 EPS projection from $275 to $285 (up 18.8%) and our 2026 EPS estimate from $300 to $320 (up 12.3%).

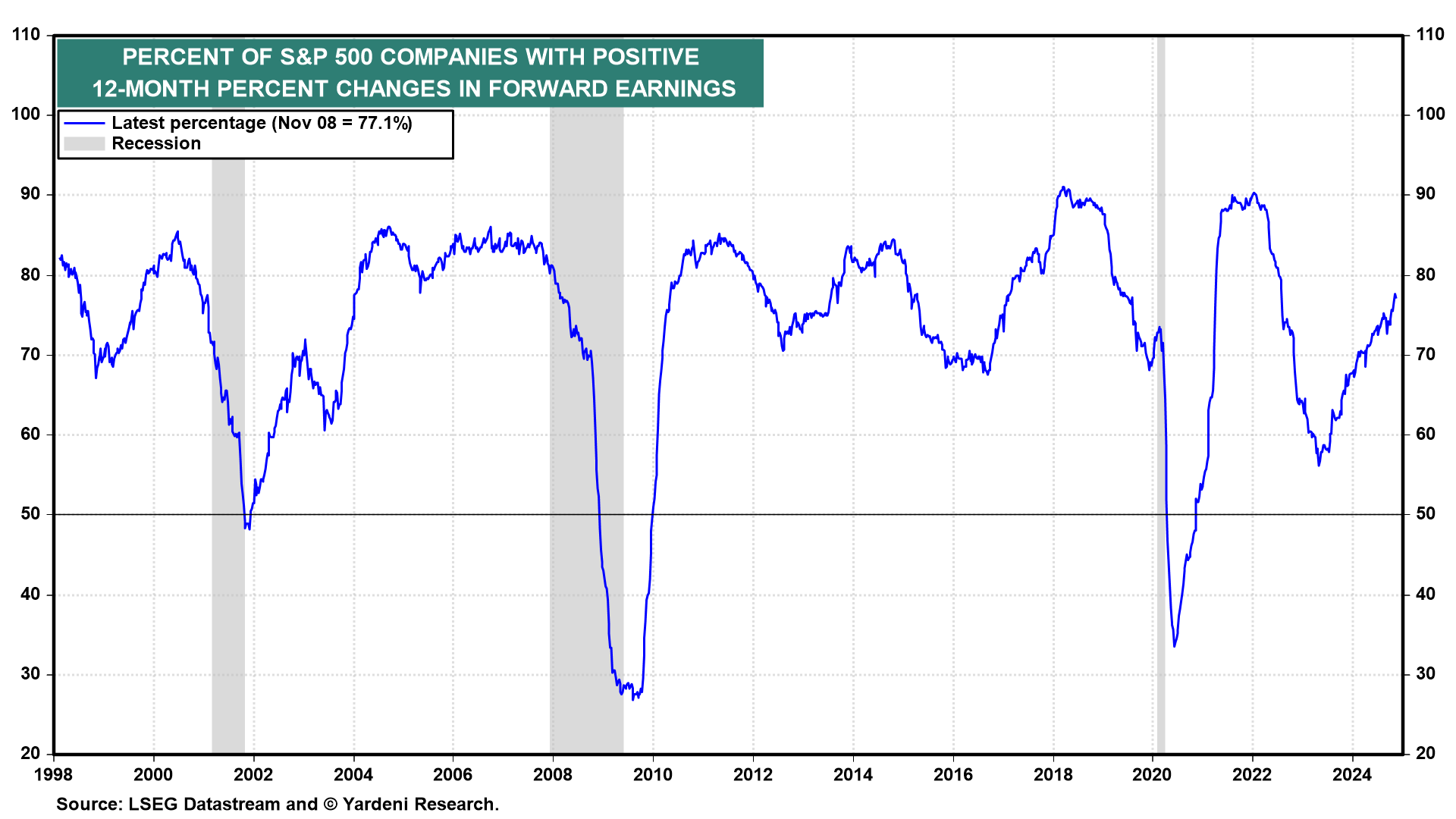

We expect that the percent of S&P 500 companies with positive 12-month percent changes in forward earnings will increase sharply from the current 77.1% reading as analysts adjust their spreadsheets for Trump 2.0’s corporate tax cut.

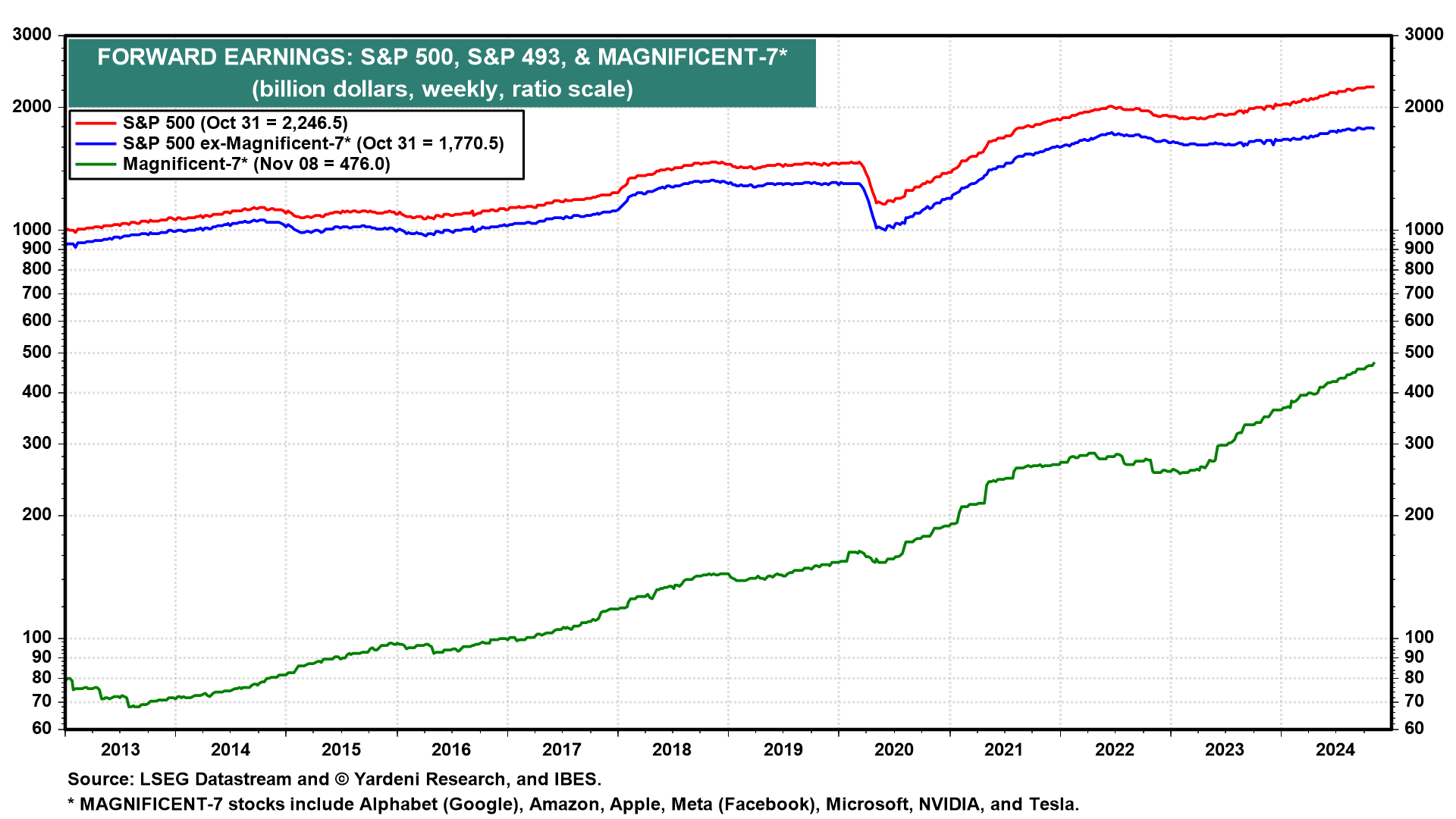

Since the start of 2023, almost all of the increase in S&P 500 aggregate forward earnings has been attributable to rising estimates for the Magnificent-7’s earnings. We expect to see a broadening of the companies and industries for which analysts raise their sights in 2025.

(FYI: Forward earnings is the time-weighted average of analysts’ consensus estimates for the current year and the following one; ditto forward revenues. Forward profit margins we derive from forward earnings and revenues.)

Profit margin

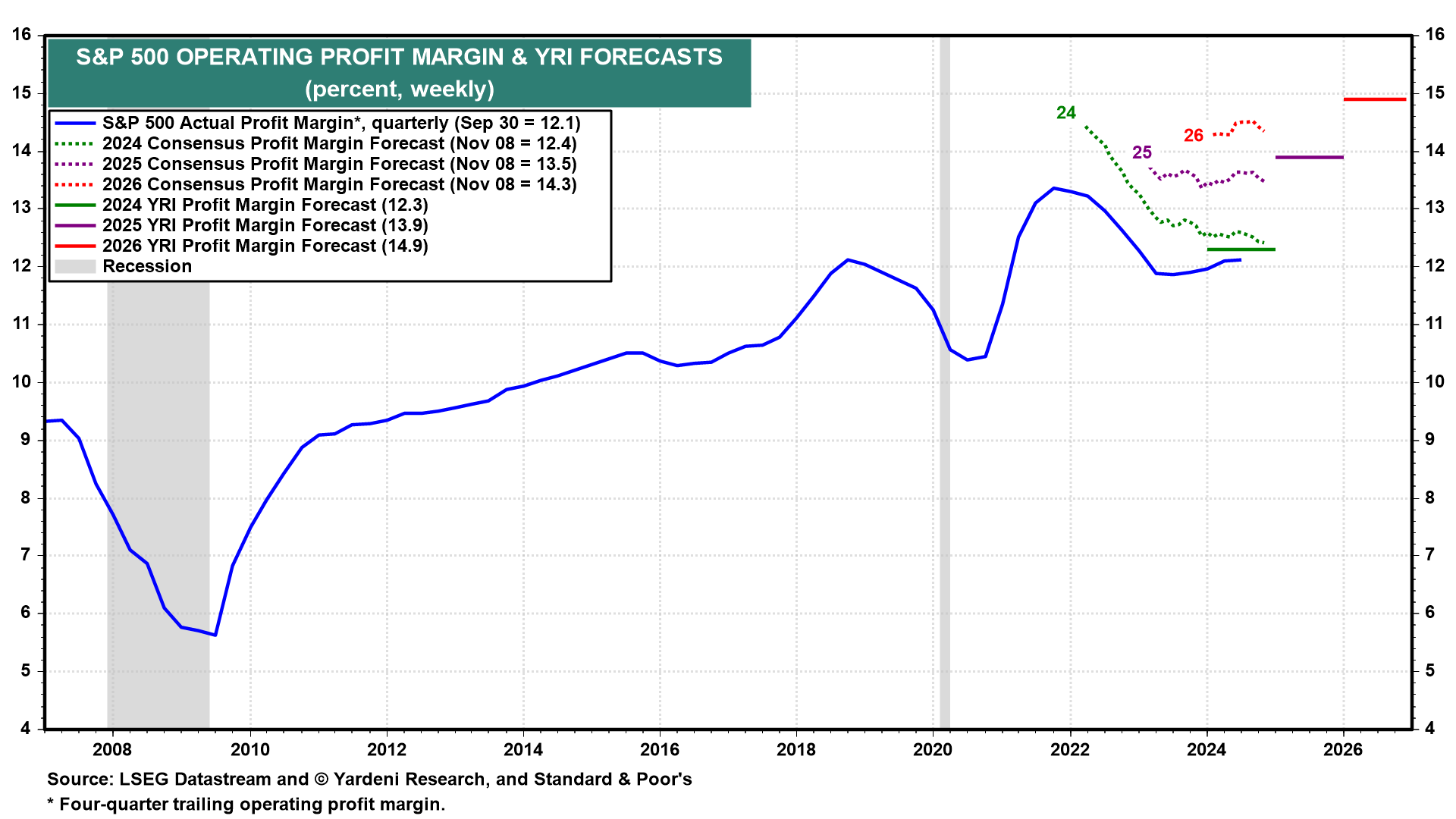

We’ve lowered our S&P 500 forward profit margin projection in 2024 to 12.3% along with our earnings estimate as mentioned above.

However, we are now more confident that the profit margin will rise to new record highs of 13.9% in 2025 and 14.9% in 2026. Tax cuts, deregulation, and faster productivity growth should make that happen.

Valuation & stock price targets

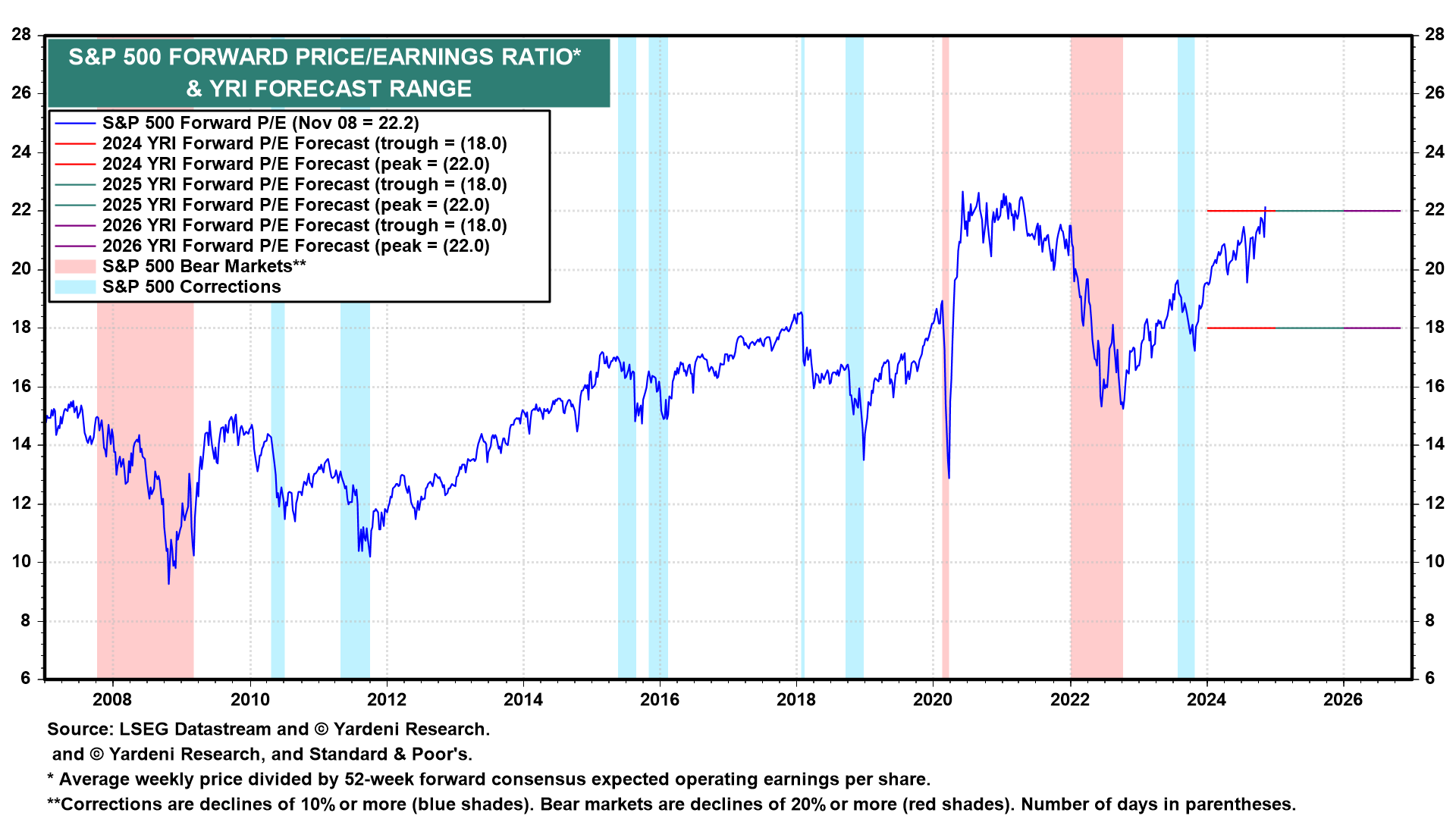

We are raising our projected S&P 500 forward P/E range through the end of 2026 to 18-22 from 16-21. The October 28 Morning Briefing was titled “Valuation In A Resilient Economy.” We argued that stock valuation multiples are driven by investors’ expectations for the longevity of economic expansions.

Multiples rose as they became less fearful of a Fed-led recession during the past three years. Multiples may stay elevated if investors conclude that a recession is less likely over the rest of the decade now that monetary policy is easing while fiscal policy remains stimulative.

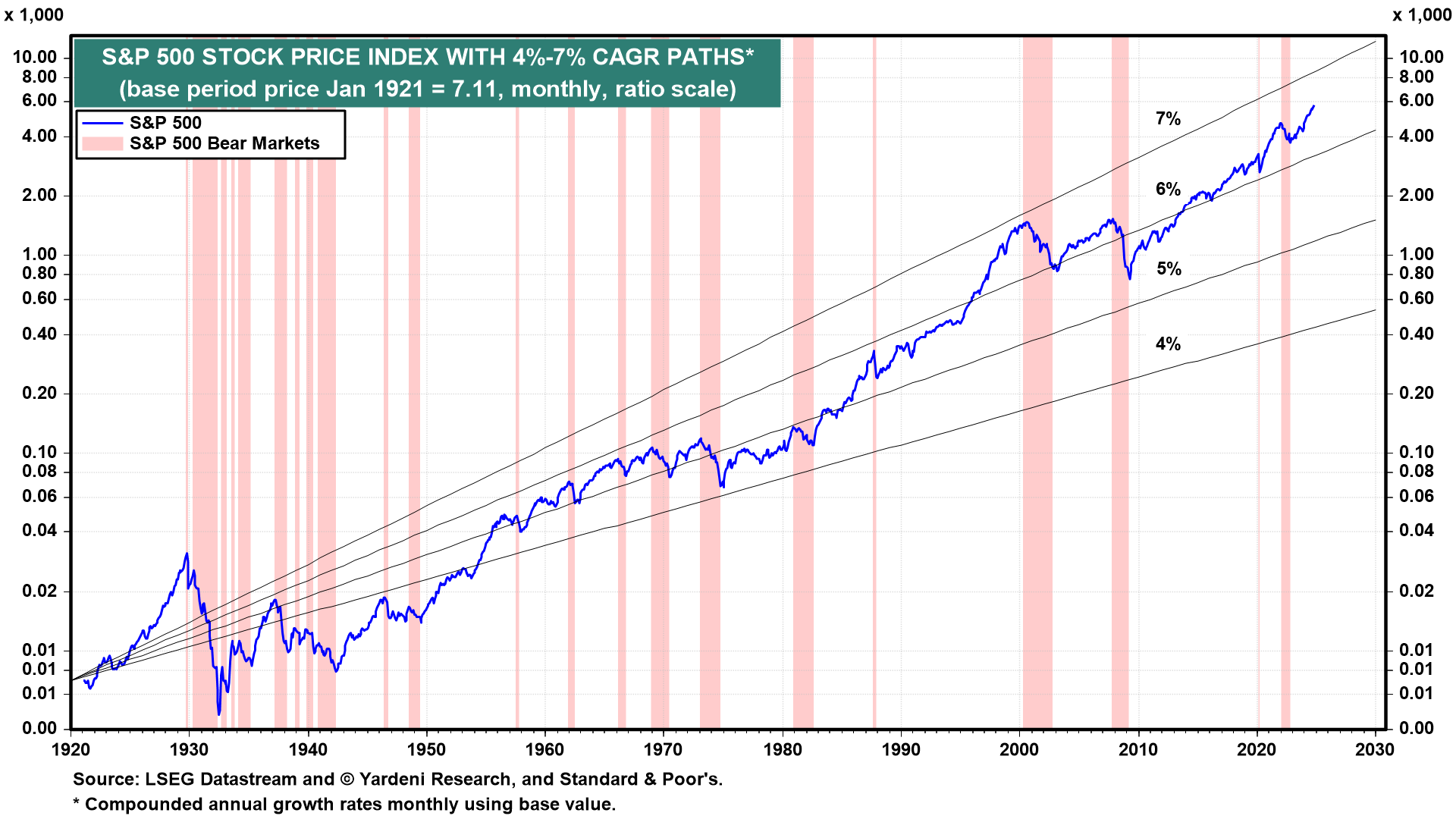

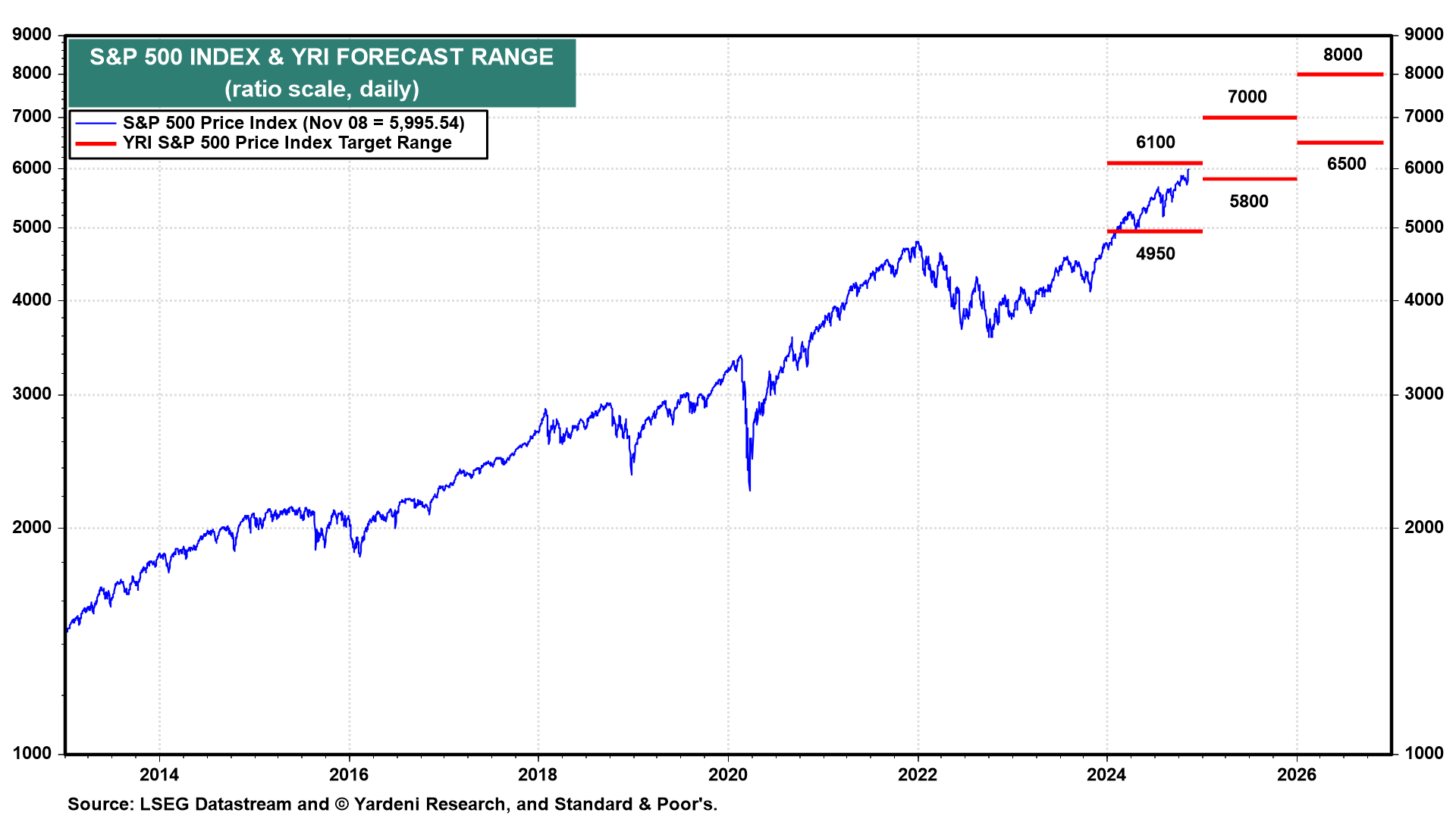

Multiplying our forward EPS estimates by our projected forward P/E ratios yields the following bullish year-end projections for the S&P 500 stock price index: 6100 in 2024, 7000 in 2025, and 8000 in 2026.

S&P 500 at 10,000 by 2029?

We had been projecting 8000 for the S&P 500 by the end of the decade. Under the circumstances, we expect that Trump 2.0 has the potential to drive the index up to 10,000 by then.