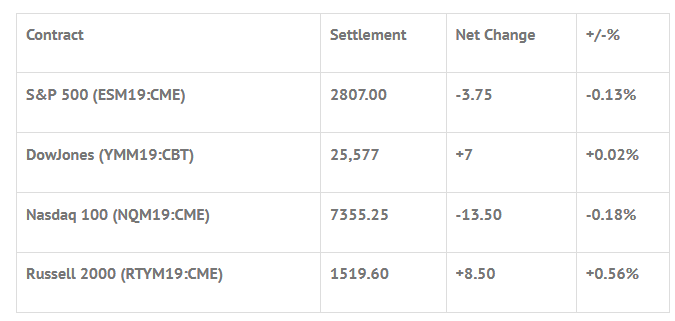

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 9 out of 11 markets closed higher: Shanghai Comp -1.51%, Hang Seng +0.15%, Nikkei +2.15%

- In Europe 11 out of 13 markets are trading higher: CAC +0.64%, DAX +0.19%, FTSE +0.19%

- Fair Value: S&P +4.81, NASDAQ +27.13, Dow +18.85

- Total Volume: 1.78mil ESM & 203 SPM traded in the pit

Today’s Economic Calendar:

Today’s economic calendar includes the 8-Week Bill Settlement, Patrick Harker Speaks 8:00 AM ET, Housing Starts 8:30 AM ET, Redbook 8:55 AM ET, S&P Corelogic Case-Shiller HPI 9:00 AM ET, FHFA House Price Index 9:00 AM ET, Consumer Confidence 10:00 AM ET, Richmond Fed Manufacturing Index 10:00 AM ET, and Eric Rosengren Speaks 8:30 PM ET.

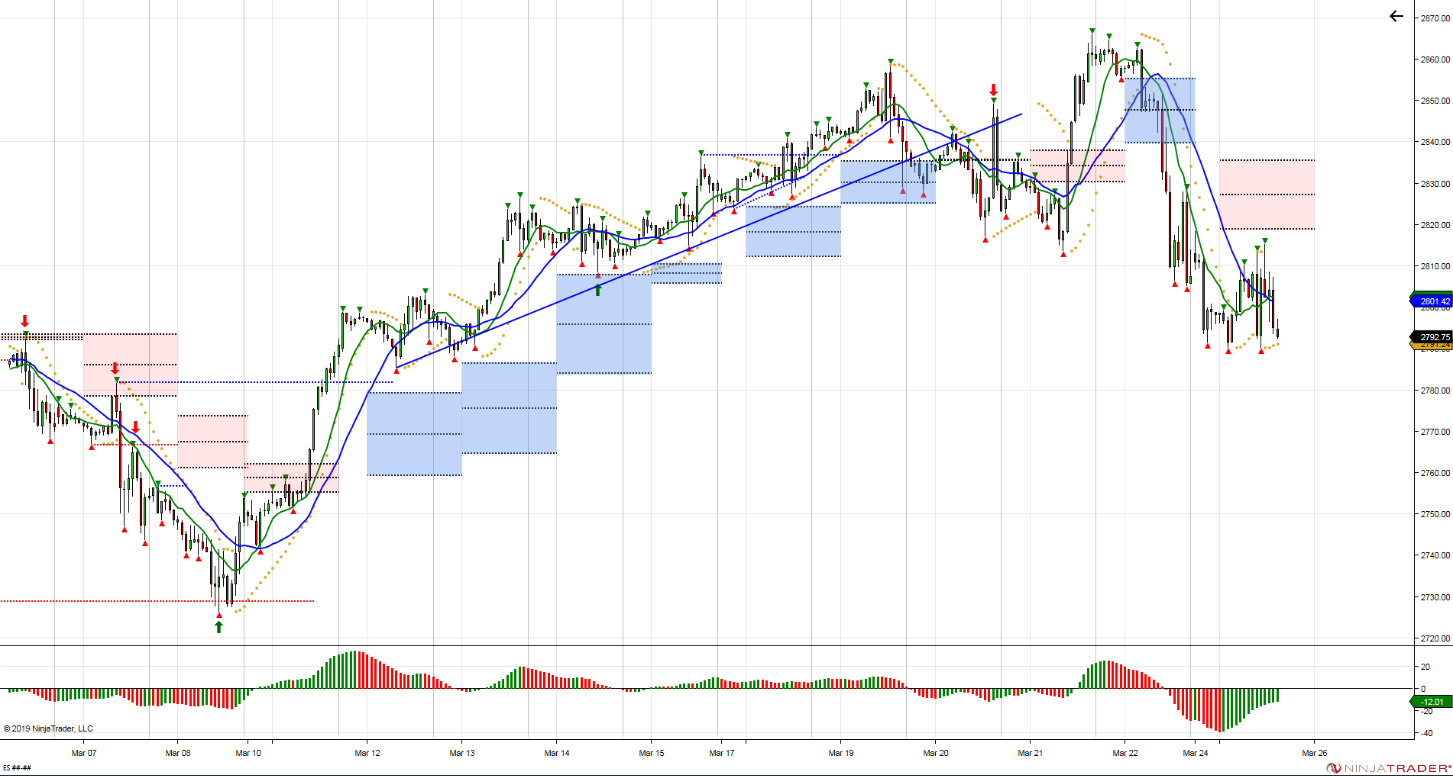

S&P 500 Futures: #ES Rollercoaster, Down But Not Out

Chart courtesy of Stewart Solaka @Chicagostock – $ES_F After Friday’s failure to see buyers defend 3D pivot support and closing below, today’s pivots above the market providing overhead resistance and pressure lower keeping sellers in control.

During Sunday nights Globex session, the S&P 500 futures (ESM19:CME) printed a high of 2818.50, a low of 2790.25, and opened Monday’s regular trading hours at 2801.75.

The initial thrust up to 2813.50 just after the 8:30 CT futures open was quickly countered by a selloff down to 2790.25. From there, the ES staged a rally to test the Globex high, but petered out just short, printing a RTH at 2818.25. After that, the futures retraced back to VWAP, and held steady there going into the afternoon.

By 1:30, the weakness had continued, and a slow grind took the ES back down to make a new low at 2789.50. It was the third time testing the Globex low for the day, and only made a new low by 3 ticks, then quickly ran up to 2807.75.

Going into the close, the ESM went on to print 2804.75 on the 2:45 cash imbalance reveal, which showed $433M to sell, then printed 2803.50 on the 3:00 cash close, and 2807.25 on the 3:15 futures close.

In the end, the overall tone of the ES was balanced, trading sideways in a 26 handle range. In terms of the days overall trade, total volume was on the high side, with 1.7 million futures contracts traded.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Any decision to purchase or sell as a result of the opinions expressed in the forum will be the full responsibility of the person(s) authorizing such transaction(s). BE ADVISED TO ALWAYS USE PROTECTIVE STOP LOSSES AND ALLOW FOR SLIPPAGE TO MANAGE YOUR TRADE(S) AS AN INVESTOR COULD LOSE ALL OR MORE THAN THEIR INITIAL INVESTMENT. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.