Investing.com’s stocks of the week

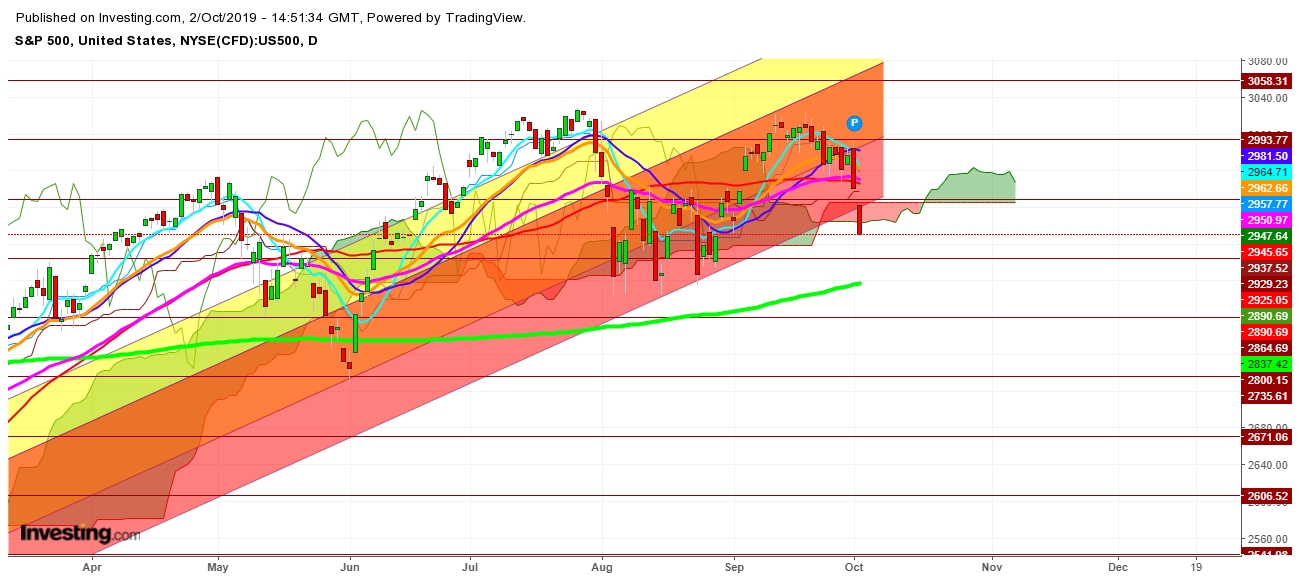

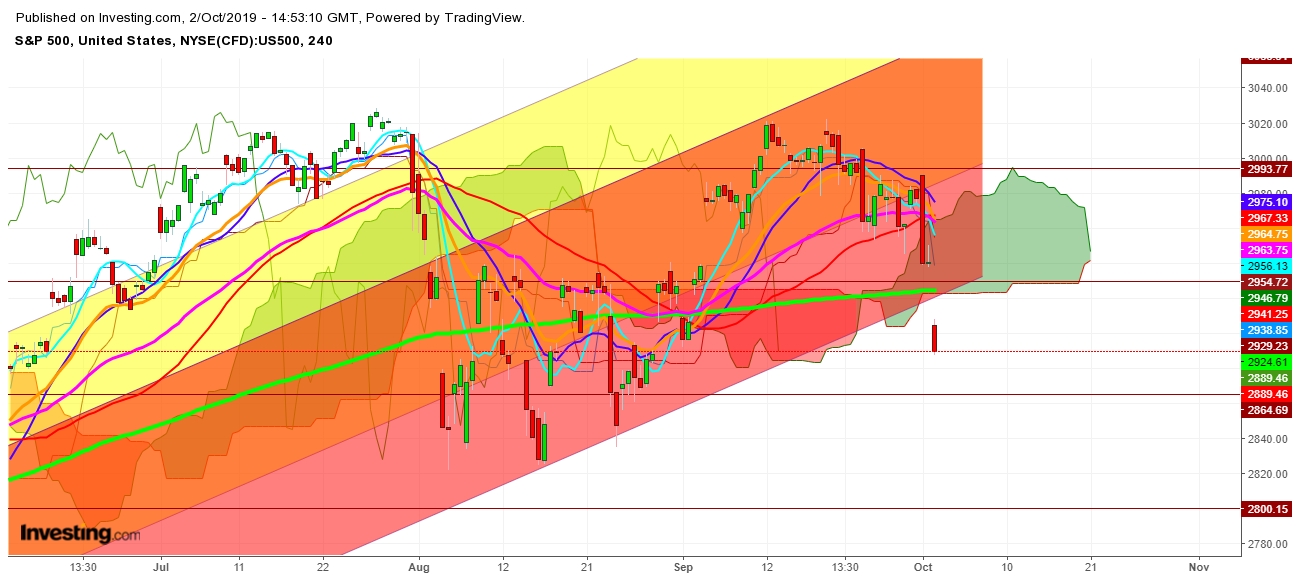

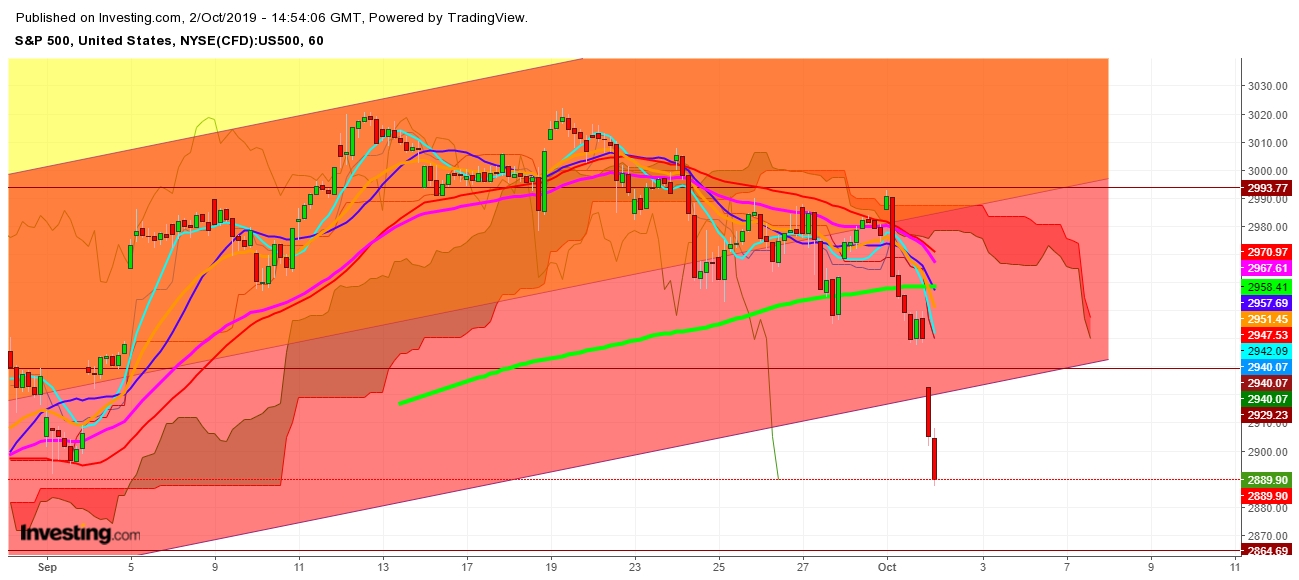

On analysis of the S&P 500, I find that the fear of a slowdown seems to be turning into meltdown fever. Since the S&P started to slide after remaining in silence, this slide seems to be steeper after the announcement of PMI data and U.S. adp. No doubt that the weakening conditions in Europe and the slowdown in China are adding up to the same thing essentially: worries that the global economy is slowing and giving investors reason to run for safety.

Although, the U.S. Federal Reserve, which cut interest rates for the second time this year in September, has indicated it would rely on economic data to determine future rate cuts; but the central bank may reduce borrowing costs in October during its upcoming meeting at the end of this month.

Finally, I conclude that the S&P 500 has stepped into negative territory where the thick presence of bears may result in pushing the U.S. equity indices towards the equity meltdown.

Disclaimer

1. This content is for information and educational purposes only and should not be considered as an investment advice or an investment recommendation. Past performance is not an indication of future results. All trading carries risk. Only risk capital be involved which you are prepared to lose.

2. Remember, YOU push the buy button and the sell button. Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from an investment and/or tax professional before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.