As the S&P 500 (SPX) continues to move along our primary expectation, we continue to keep an eye on the $4400 target. Namely, last week, see here, as the index had just bottomed, we did not have enough price data available yet to elucidate if:

"[the] low at $3884, which is the 50% retrace of red W-i, [was] technically enough to consider the correction complete."

As such, we concluded last week

"We cannot yet dismiss red W-ii becomes more pronounced and subdivided. It can be in green W-b to around $3950+/-25 before green W-c down to $3820-50 takes hold. But, if the index closes above this week's high, then red W-iii is essentially confirmed, barring an irregular flat W-ii. "

Still, we "prefer[ed] to look higher short- to intermediate-term. Once SPX4300+ is reached, we will become much more cautious in anticipation of the blue C wave."

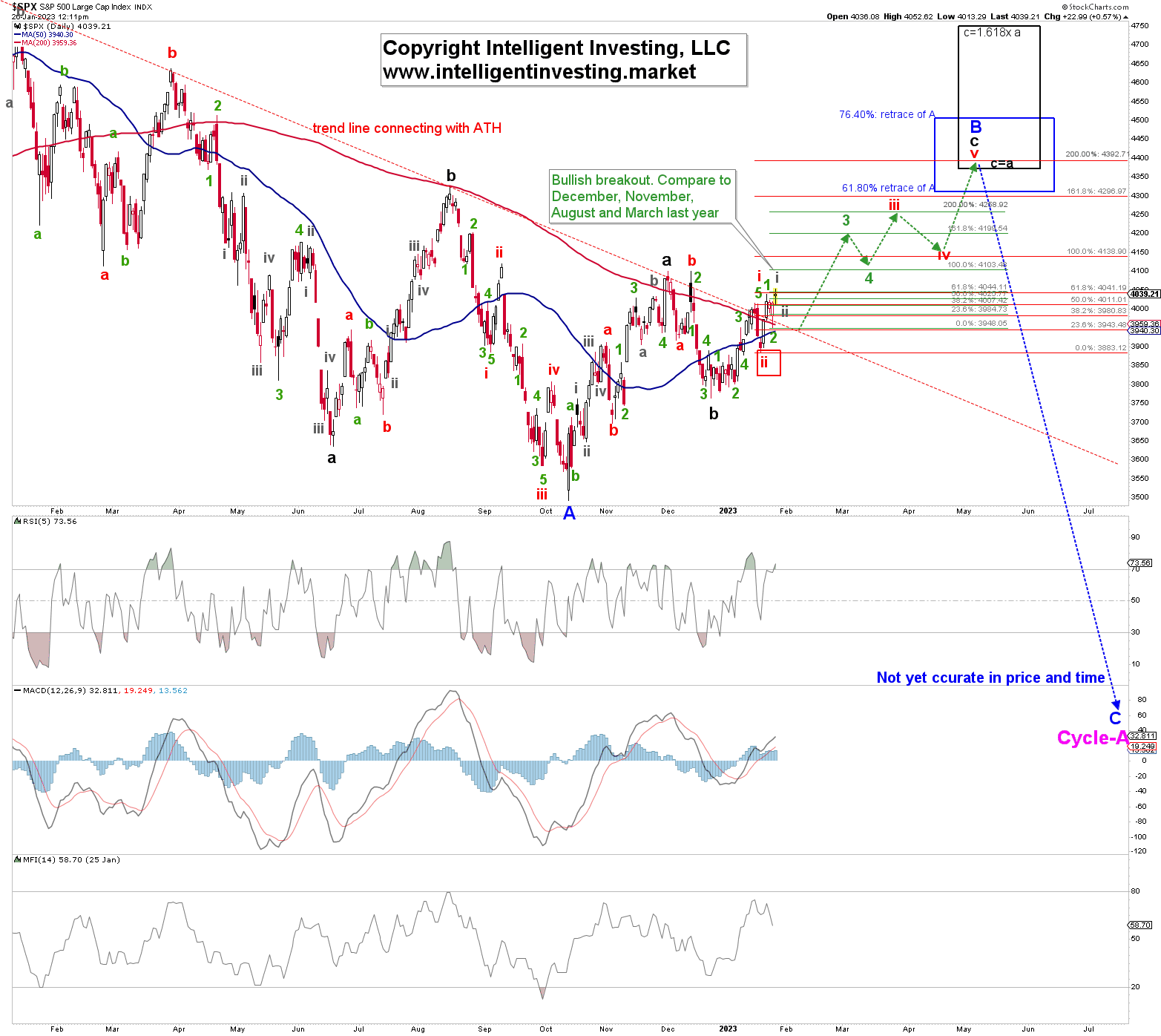

Less than a week later, the index is trading 100p higher, closing above last week's high. Thus our primary expectation, based on the Elliott Wave Principle (EWP), for higher prices was correct, and the rally to SPX4300+ should be underway. See the road map in figure 1 below.

The chart above contains a lot of information, so let us focus on the main points:

- The S&P500 corrected for blue Wave-A (W-A) from the January 2022 all-time high (ATH) into the October low. Blue W-B, a counter-trend rally, has been our primary focus since October 17 (see here). Besides, B-waves tend to typically retrace 62-76% of the initial A wave. That gives us a (blue) target zone of SPX4310-4505.

- B-waves comprise three waves: black (major) W-a, b, and c. Wave-c of W-B should now be underway and subdivide into five smaller waves. Red W-i, ii, iii, iv, and v. Of these red waves, W-iii is now underway. It, in turn, also subdivides into five smaller waves: green W-1, 2, 3, 4, and 5. Lastly, since financial markets are fractal, green W-3 is likely underway and will subdivide into five smaller waves: grey W-i, ii, iii, iv, and v.

- From the EWP, we know that c-waves within a corrective B-wave typically equal the length of W-a or up to 1.618x W-a. That gives us a (black) target zone of SPX 4375-4750. And the 5th wave typically reaches the 200% extension of the 1st wave, measured from the 2nd wave low. Thus, red W-v of black W-c should ideally target $4395+/-5.

Combining these three facts, we have a confluence of three different wave degrees: SPX4310-4505, SPX4375-4750, and SPX4395+/-5. Thus SPX4300-4400 should be our primary focus. Currently, the index should be in grey W-ii of green W-3 of red-W-iii of black W-c of blue W-B. Quite the mouthful, but in other words, the index makes higher highs and lower lows. That is a Bullish sequence.

Besides, the index broke out above its 200-day simple moving average (solid red line in Figure 1) and above the trendline that has held all upside in check between the ATH and mid-January. Both are significant developments, Bullish until proven otherwise. What can that 'otherwise' be? A break below yesterday's low for starters, followed by a break below last week's low. Until that happens, we continue to see no reason for this Bull run we have been tracking since mid-October not to unfold.