- SPX Monitoring purposes; Long SPX on 10-29-24 at 5832.92

- Our Gain 1/1/23 to 12/31/23 SPX= 28.12%; SPX gain 23.38%

- Monitoring purposes GOLD: Long GDX on 10/9/20 at 40.78.

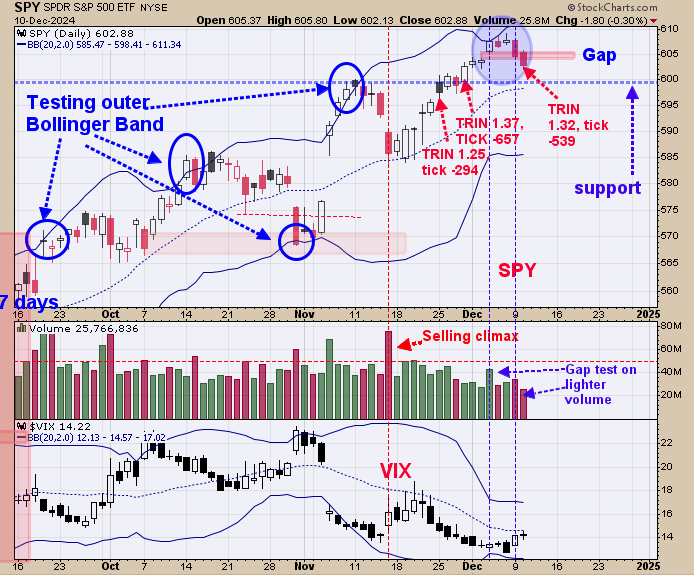

We are up 36%; SPX up 27% so far this year. Yesterday’s pull back in the SPY tested last Wednesday gap up on lighter volume which in turns suggests support (noted on chart above).

We also noted in red the TRIN and Tick closed that reached panic near the 600 SPY range in late November, which suggests support near the 600 SPY.

Today the TRIN closed at 1.32 and tick at -539 which shows panic and suggests SPY near another low. Bigger trend remains up and short term market is near another low. Long SPX on 10/29/24 at 5832.92.

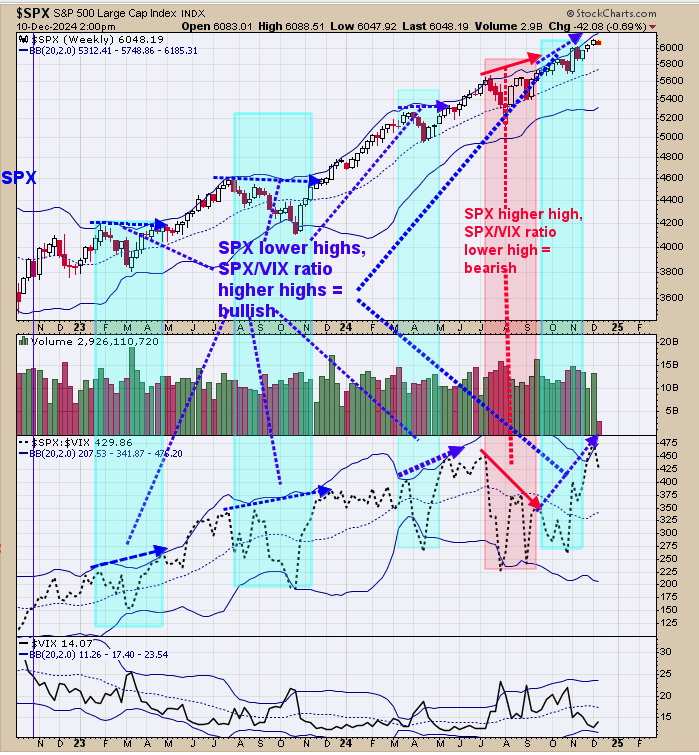

The above chart looks at the bigger picture. Top window is the weekly SPX and next lower window is the weekly SPX/VIX ratio. A bearish divergence is present when the weekly SPX makes higher highs and the weekly SPX/VIX ratio makes lower high (noted in shaded pink). This bearish divergence didn’t play out as market went to new highs.

However we have examples in the past this bearish divergence did produce highs in the market. We noted in shade Green where SPX has made lower highs and the SPX/VIX ratio made higher highs. This condition is a positive divergence for the SPX as it common for the SPX/VIX ratio to lead the SPX.

Currently, we have the weekly SPX making higher highs along with the weekly SPX/VIX ratio suggesting the current rally should continue. Still expect higher price before year is out but this week could produce a mild pull back.

We updated this chart from yesterday and yesterday’s commentary still stands, “The bottom window is the daily GDX advance/decline with an 18 day moving average and next higher window is the daily GDX up down volume with an 18 day moving average.

Multi-week (most multi-month) lows form when both indicators close below -40 and than turn up. November 15 the bottom window indicator closed at -42.45 and next higher window indicator closed at -48.45.

We shaded in light pink on the GDX chart (top window) the support area. It appears another uptrend in GDX is or has started.” Added to above; both indicators gained ground today; showing GDX is getting stronger.