In times of market turmoil, it’s tempting for traders to get caught up in the day-to-day headlines and take their eyes off the proverbial ball.

Last week’s breathtaking -12% swoon in U.S. indices provides a perfect case study: while we don’t want to downplay the massive human and economic cost of coronavirus, the related tumble in U.S. equities has certainly provided bullish traders an opportunity to scoop up firms that, at least according to the most recent earnings reports, continue to increase profits while they’re “on sale.”

With 95% of the companies in the S&P 500 reporting results, the “blended” earnings growth rate (using companies that have reported and estimates for the 5% of companies that haven’t yet reported) is +0.9%, according to the earnings mavens at FactSet. This marks the first quarter of positive year-over-year earnings growth since Q4 2018 (note that the effects of the Trump Administration’s corporate tax cuts, which went into effect at the start of 2018, made annualized comparisons tough throughout last year).

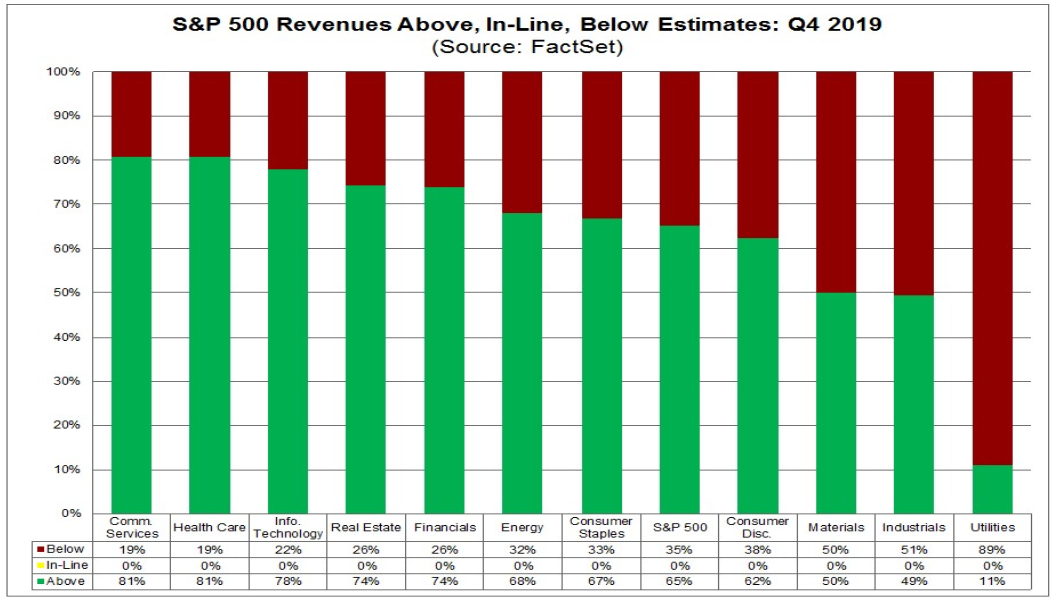

More to the point, 71% of S&P 500 companies beat consensus analyst earnings estimates, roughly in-line with the 1- and 5-year averages, while 65% of firms beat revenue forecasts, well above the 1- and 5-year averages. Generally speaking, top-line revenues are more difficult to manipulate than earnings, so the stronger-than-expected revenue figures paint a bullish fundamental picture for U.S. stocks heading into 2020.

As the chart below shows, sales in the Communication Services and Health Care sectors were particularly strong relative to expectations, while the Utilities sector reported generally disappointing revenues:

Of course, the stock market is a forward-looking animal, so traders will be keen to see if U.S. companies can maintain the positive momentum amidst the economic disruptions stemming from the spread of coronavirus in Q1.

As of the start of the week, 68 companies in the S&P 500 had issued negative earnings guidance for the first quarter, while just 32 companies issued positive guidance. Likewise, analysts have slashed Q1 earnings estimates by -3.3%, which is only slightly higher than the -2.3% average decline in quarterly EPS forecasts that we’ve seen over the last ten years. In the coming weeks, we fully expect more companies will be forced to acknowledge negative impacts from COVID-19, which will likely provide a headwind for U.S. stocks.

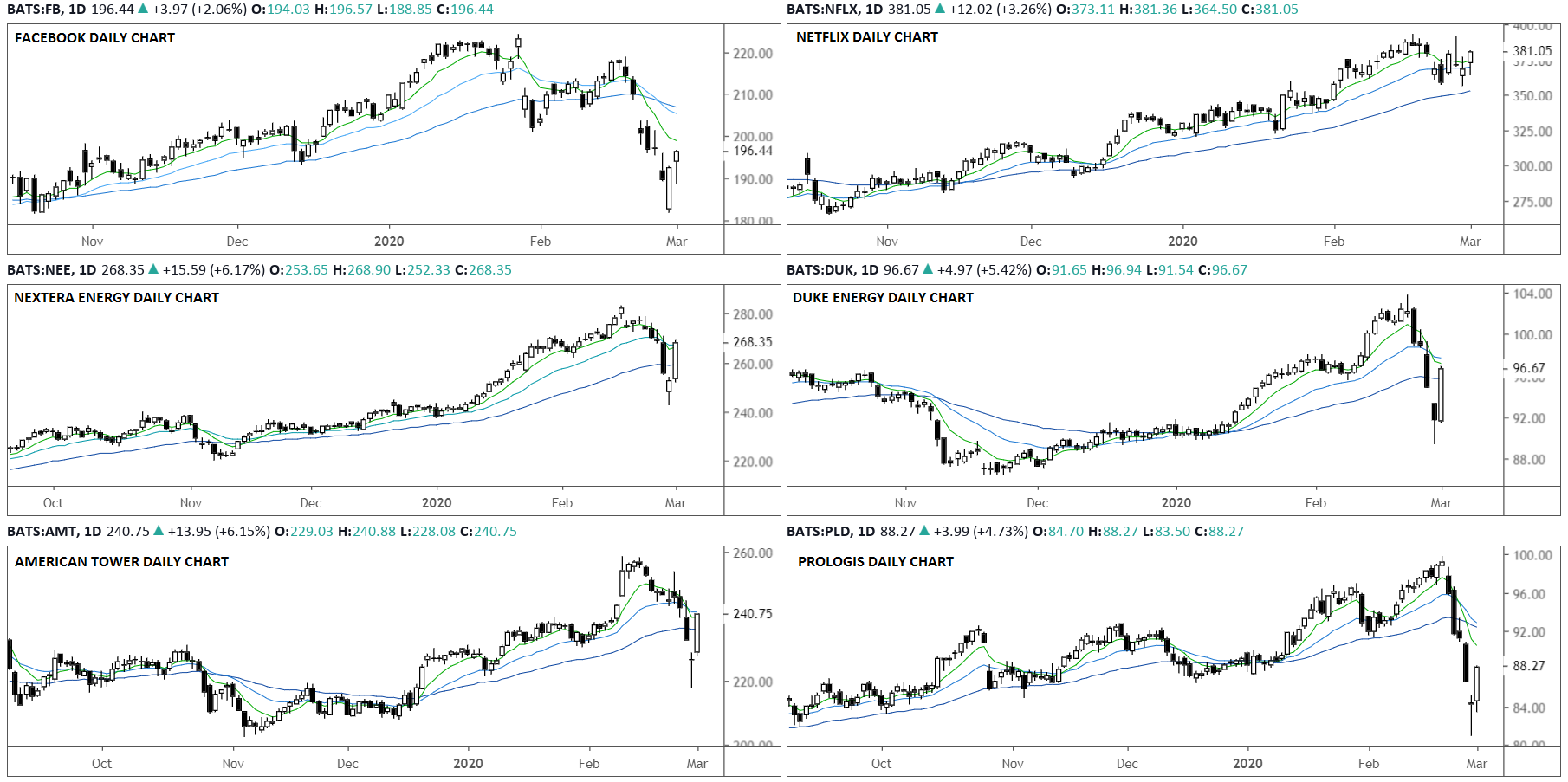

Drilling down a bit, the Technology sector has the highest revenue exposure to China, COVID-19’s epicenter, at 13.4% vs. 4.8% for the broader S&P 500 and may therefore be particularly vulnerable to downgrades. That said, among the so-called FAANG stocks, Facebook (NASDAQ:FB) and Netflix (NASDAQ:NFLX) have essentially zero direct exposure to China and are therefore in a better position to weather the proverbial storm. Both of these companies would also benefit from users staying inside in an effort to limit their exposure to the disease.

In contrast, the Utility and the Real Estate sectors have among the least exposure to Greater China, so those may be other areas for U.S.-focused value hunters to monitor. The biggest names in these sectors include Nextera Energy (NYSE:NEE), Duke Energy (NYSE:DUK), American Tower (NYSE:AMT) and Prologis (NYSE:PLD). These stocks, along with the Utility and Real Estate sectors more broadly, also offer solid dividend yields and may therefore benefit from further risk aversion in the broader markets.