This style box update (returns sourced from Morningstar) leaves someone reading it, with plenty of reasons to be cautious.

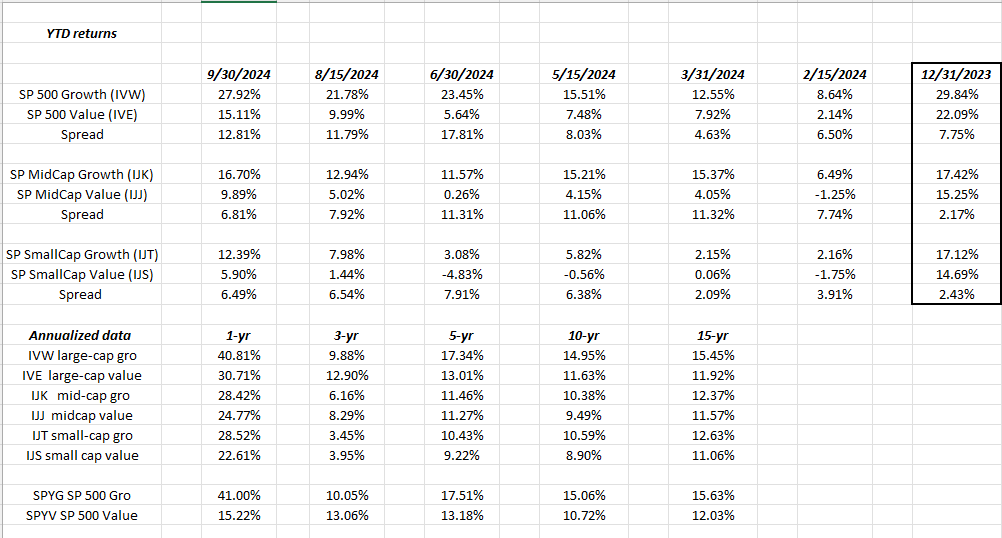

The first 10 rows shows the returns for large-cap, mid-cap and small-cap value vs growth styles.

The bottom 10 rows shows the style boxes 1 through 15-year “annual” returns.

Growth (whether large or small cap) is still leading value returns and has expanded the return difference versus value in 2024.

The last and one of the few years that value has clearly outperformed growth was 2022, the year of monetary policy tightening by the Fed.

Looking back at earlier data (not shown) in 2016, value sharply outperformed growth, and – surprisingly – in 2019, too, but the return differences were minimal, i.e. large-cap growth was up 30% in calendar 2019, while large-cap value returned 31%, using the same proxies on the above spreadsheet.

Conclusion:

Readers will see two more style box updates, before 2025 starts, and that will be on 11/15/24 and then again 12/31/24.

The above data is making me a little more cautious for 2025.

If the S&P 500’s pace continues, it will be the 2nd year in a row of +20% returns for the S&P 500.

Will reserve final judgment until mid-December, early January ’25.

Disclosure: None of this is advice or a recommendation, but only an opinion. Past performance is no guarantee of future results. The data above is sourced from Morningstar. Investing can and does involve the loss of principal even for short periods of time.