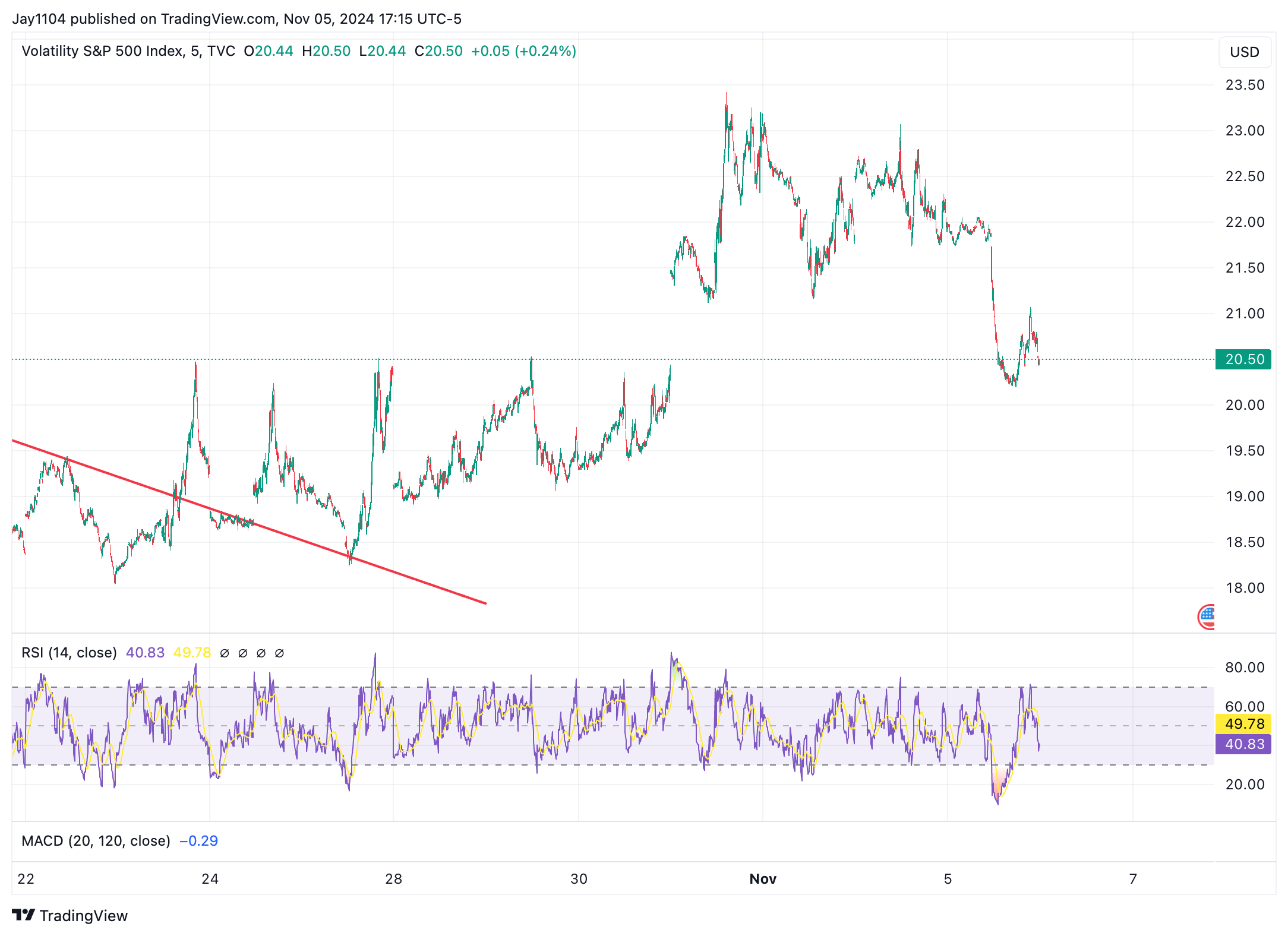

Stocks ended the day higher amid an implied volatility crush, with the VIX index dropping sharply. The VIX closed the gap from its significant rise on Thursday, October 31.

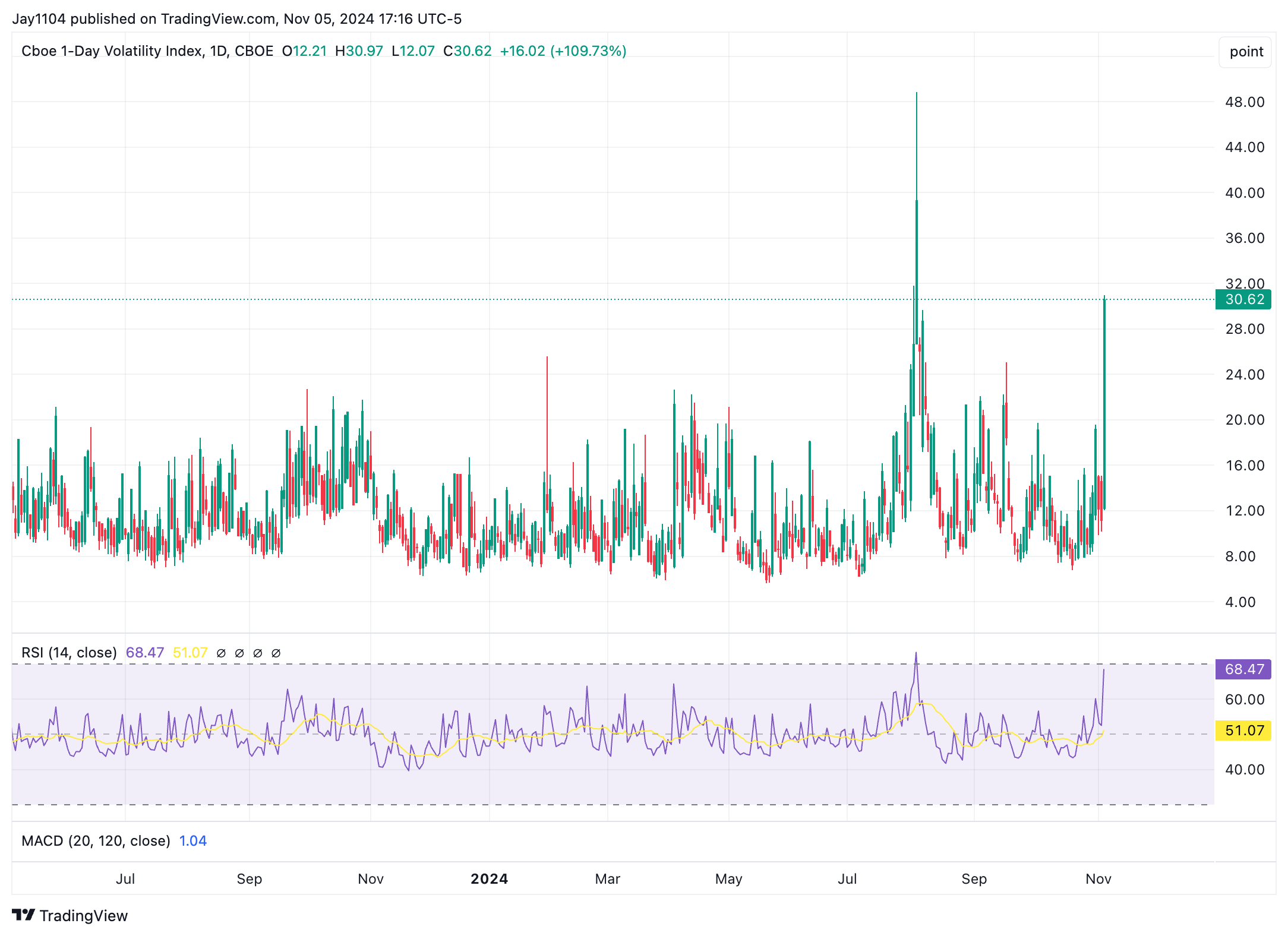

More interesting was the VIX 1-Day rose by, get this, 110% to close at 30.6.

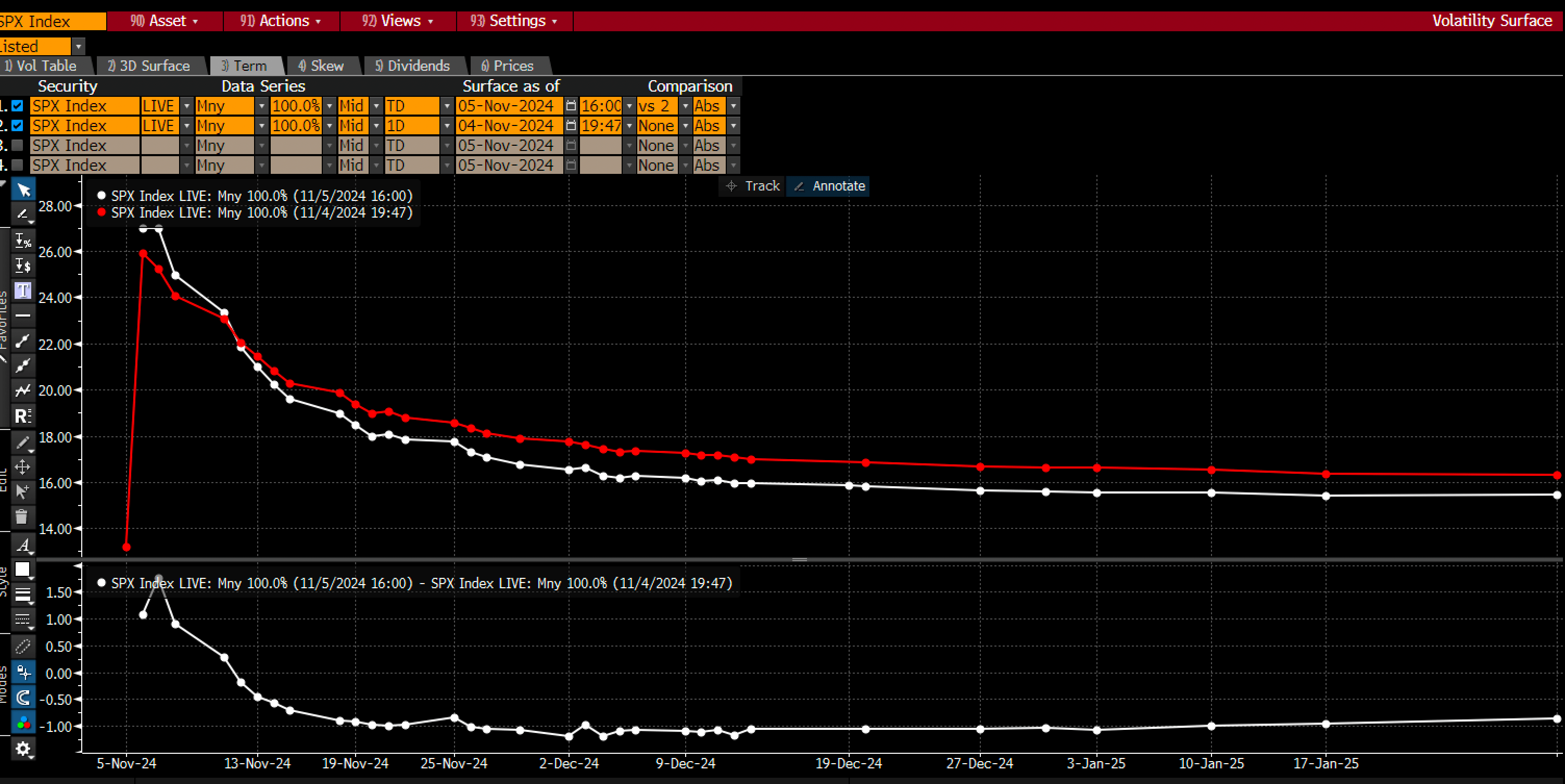

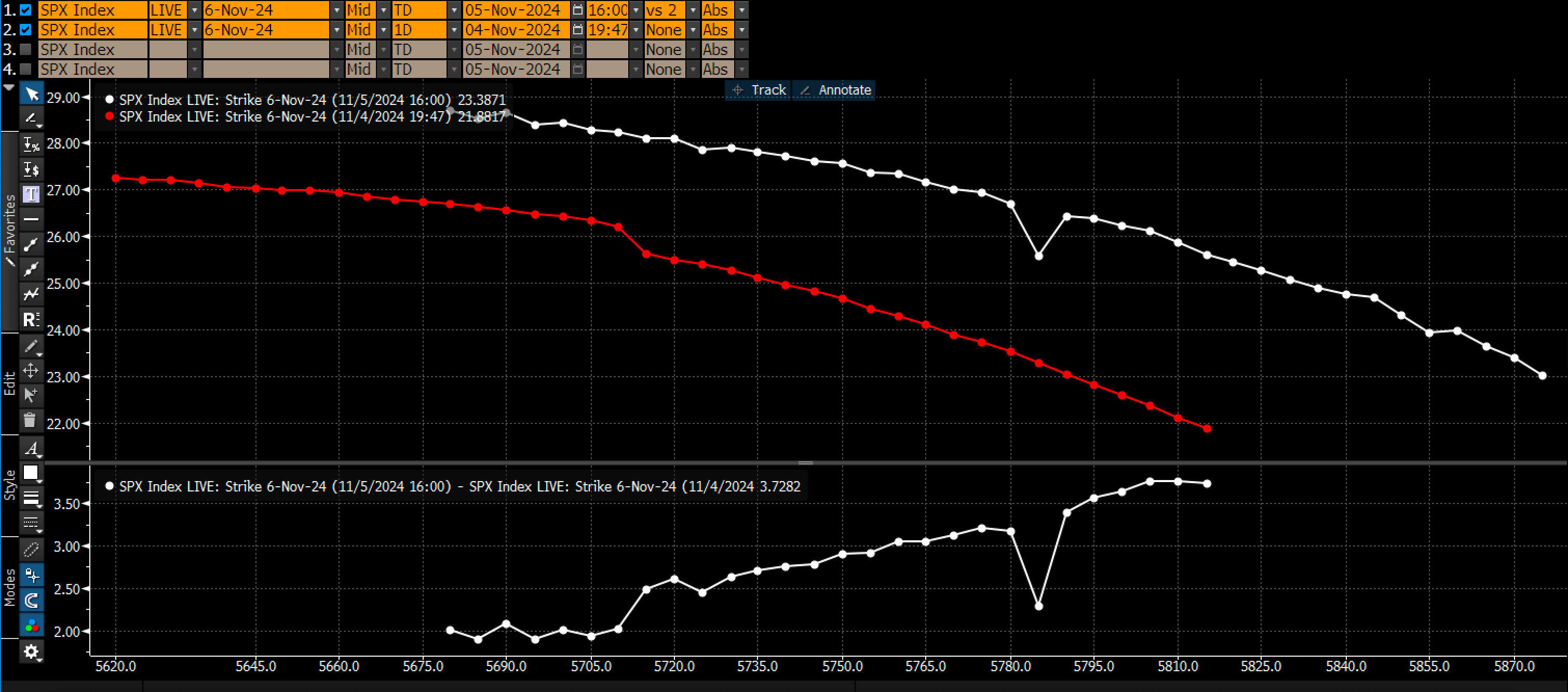

Yesterday’s S&P 500 term structure shows a significant increase in implied volatility from yesterday, rising from around 13.3 to approximately 27.

More interesting, however, was how implied volatility varied by strike price, with higher strike prices experiencing a larger increase than lower ones.

For example, the IV for the 5,810 strike price for today’s expiration rose to 25.85 from 22.1, an increase of 3.75 percentage points.

Meanwhile, the IV for the 5,750 strike rose to 27.57 from 24.67, a gain of 2.9 percentage points. This suggests a strong demand for higher strike prices yesterday.

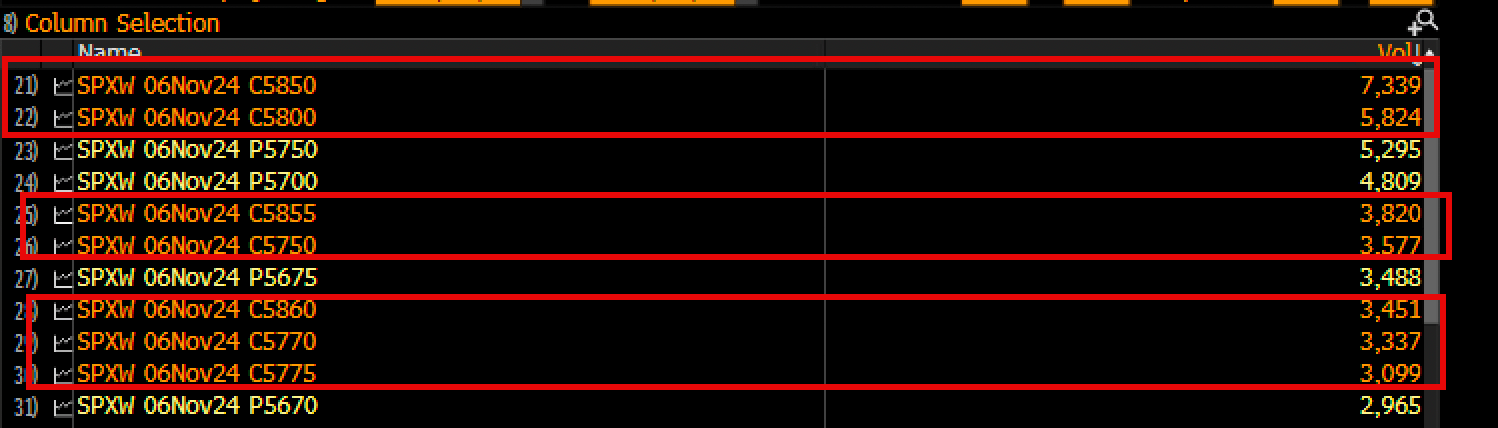

When reviewing options trading for today’s expiration, we find that within the 98% to 102% moneyness range, 7 out of the top 10 trades were call contracts.

That activity likely explains why the VIX 1-Day rose so sharply while the S&P 500 also moved higher, with the VIX index falling steeply, contributing to much of the move in the broader index.

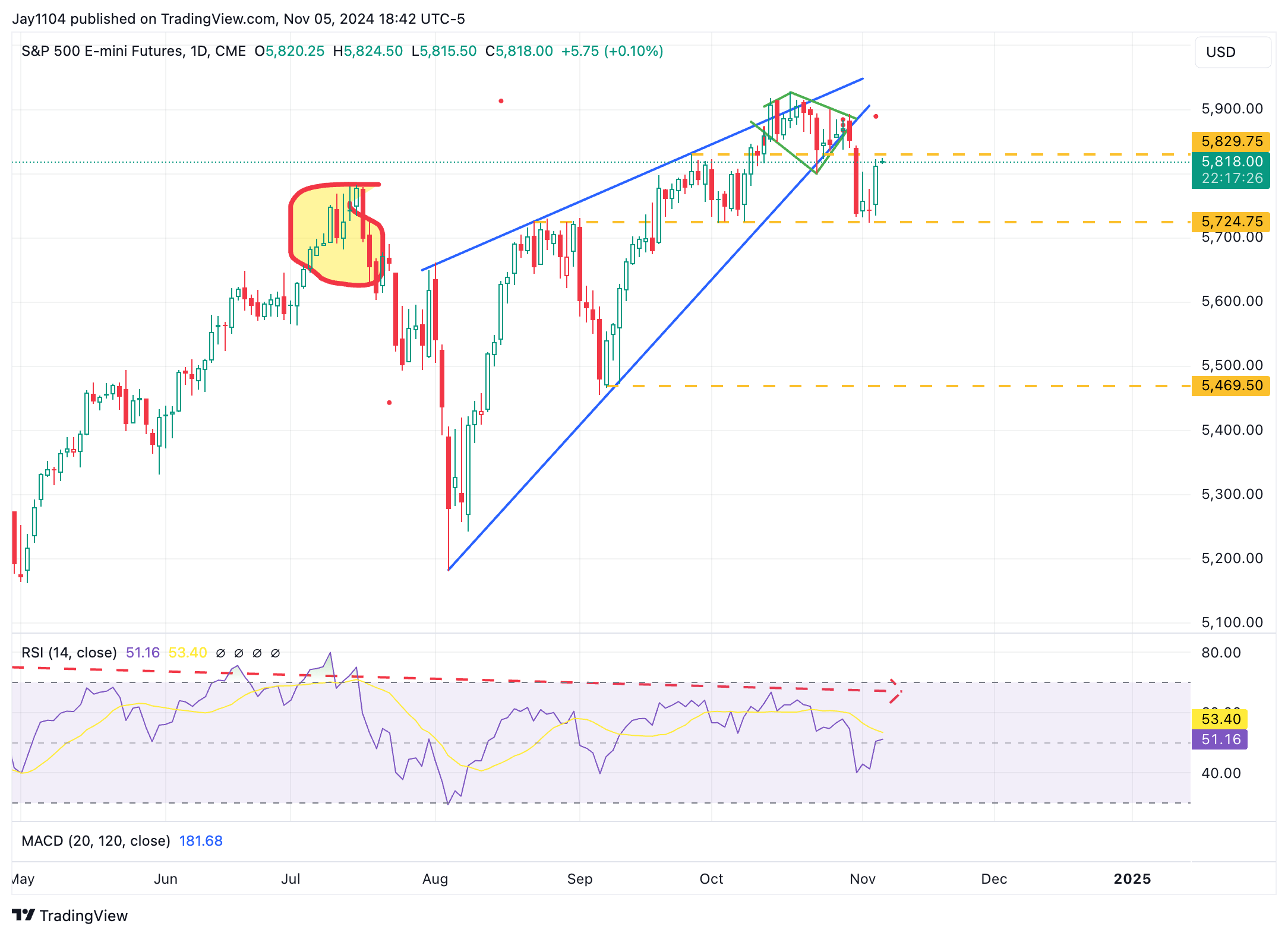

Meanwhile, the S&P 500 didn’t pull back yesterday as I thought it might.

I also wasn’t expecting such a rapid decline in the VIX and implied volatility. There’s clearly still a risk of an implied volatility crush today, and whether the market rallies on that crush will depend on how the options market is positioned overall.

If there weren’t an election with pending results, I’d look at this chart and see a bearish setup, with a breakdown from the diamond pattern and a clean break from the rising wedge.

But until the S&P 500 breaks below 5,725, we need to respect the upside potential.

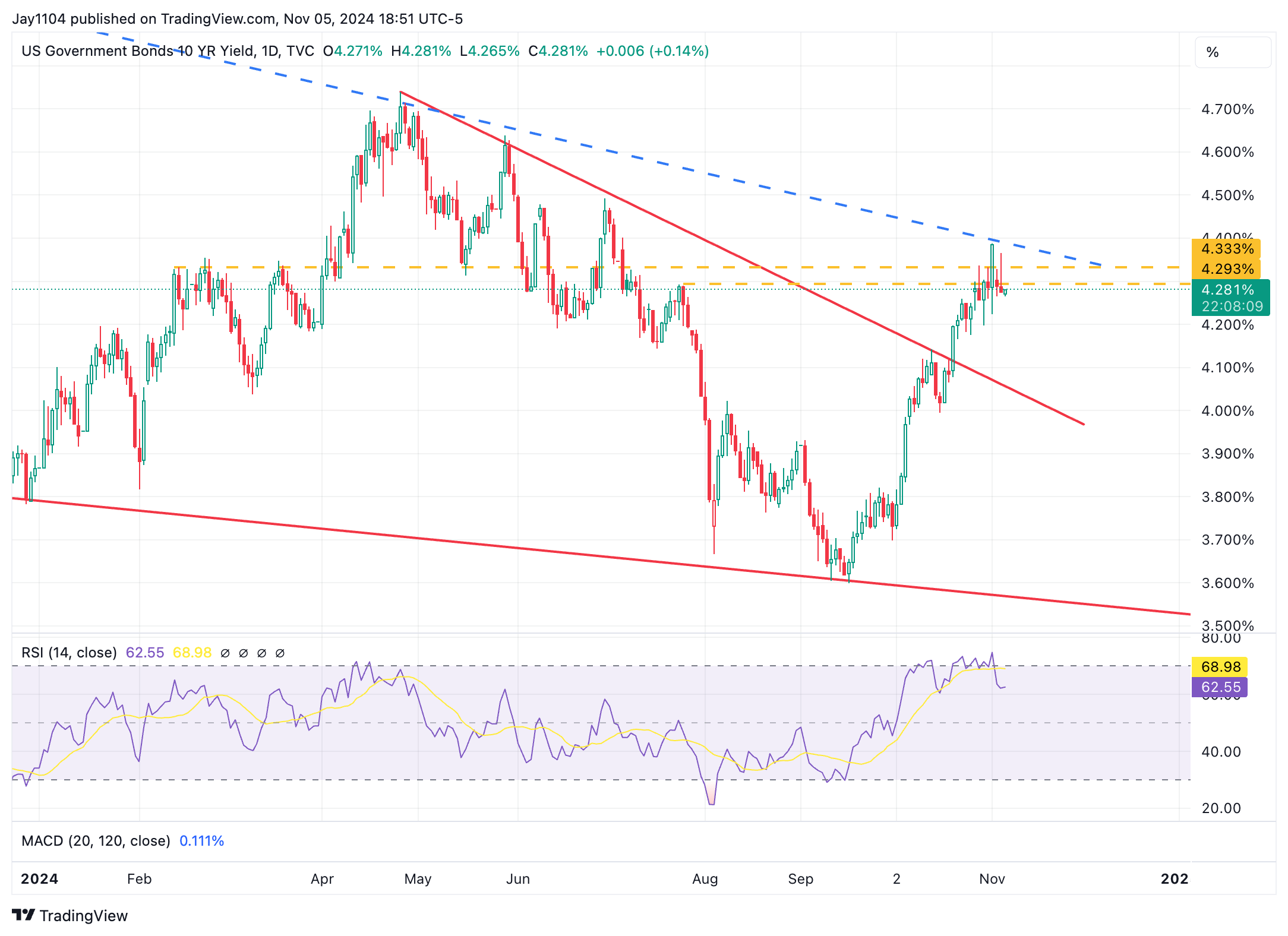

The 10-year rate rose by nearly 8 basis points throughout most of the day after hotter-than-expected ISM services data but then pulled back following a strong 10-year Treasury auction at 1 PM. We’re still waiting to see if the 10-year can push beyond 4.40%.