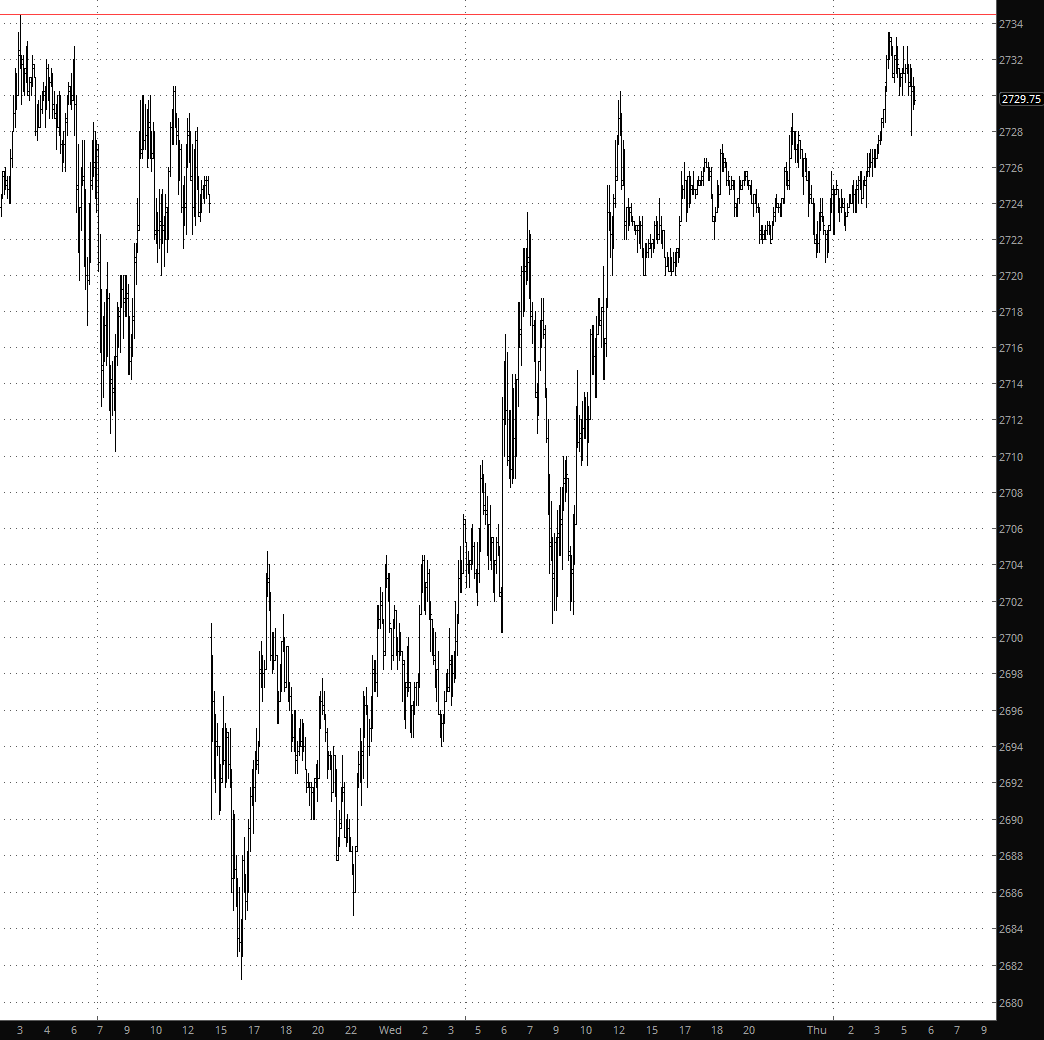

The inability of the stock market to hold a downtrend more than two days is driving me insane (again). It has been two years since there has even been a drop off lasting a couple of weeks.

It was just a month ago that we were in the throes of an all-too-brief bout of excitement. But, looking back, it’s evident that 90% of the move was confined to just two trading sessions. Yep. That was it. For two years of waiting, we got just two days of glory. The next morning was a panic low, and bang, we were back into the unending quagmire.

S&P 500

So things have become dull quickly again. Even with what should be super bearish news (Gary Cohn fleeing the White House and a major trade war loudly telegraphed), the market doesn’t seem to care anymore. At the moment, we’re close to, medium-term, a rather important level of resistance. This is our fifth “white bar” day in a row, so it’s clear the bulls are fighting back and want to seize control again.

For myself, I remain rather aggressively short at 233%. A substantial amount of this sum is in slow-moving instruments (but fascinating charts) iShares JPMorgan (NYSE:JPM) USD Emerging Markets Bond (NASDAQ:EMB), iShares iBoxx $ High Yield Corporate Bond (NYSE:HYG), and SPDR Barclays (LON:BARC) High Yield Bond (NYSE:JNK) (indeed, those are my only ETFs and my only large positions). The rest is scattered amongst a hodgepodge of small shorts.

For my bearish brethren, if there are any left, I can only offer this piece of exciting news, hot off the press: