Whilst the S&P 500 bullish trend rages on, there are near-term signs of exhaustion. Yet looking at the leaders and the laggards, it also appears that the driving forces behind these new highs has changed.

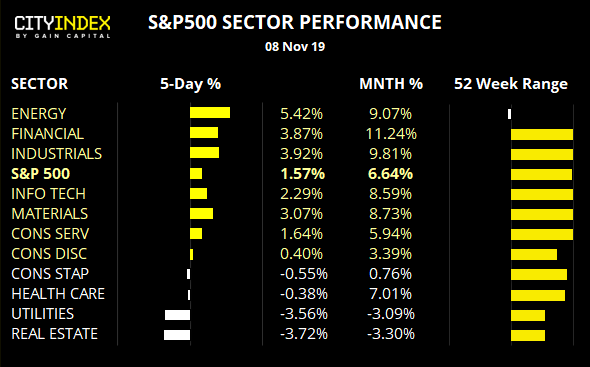

It’s been a good week for energy stocks, with trade optimism and higher oil prices obviously helping. If the deal can go through and commodity prices rise, energy stocks appear quite attractive at their relatively cheap lows. And this shift in trade sentiment has also seen top performers of late reverse course, as real estate, utilities and healthcare have dipped. So, trade talks remain a clear driver of sentiment, and e can’t help but wonder if the December “phase one” signing has actually been aligned with good old Santa’s rally. Time will tell no doubt tell.

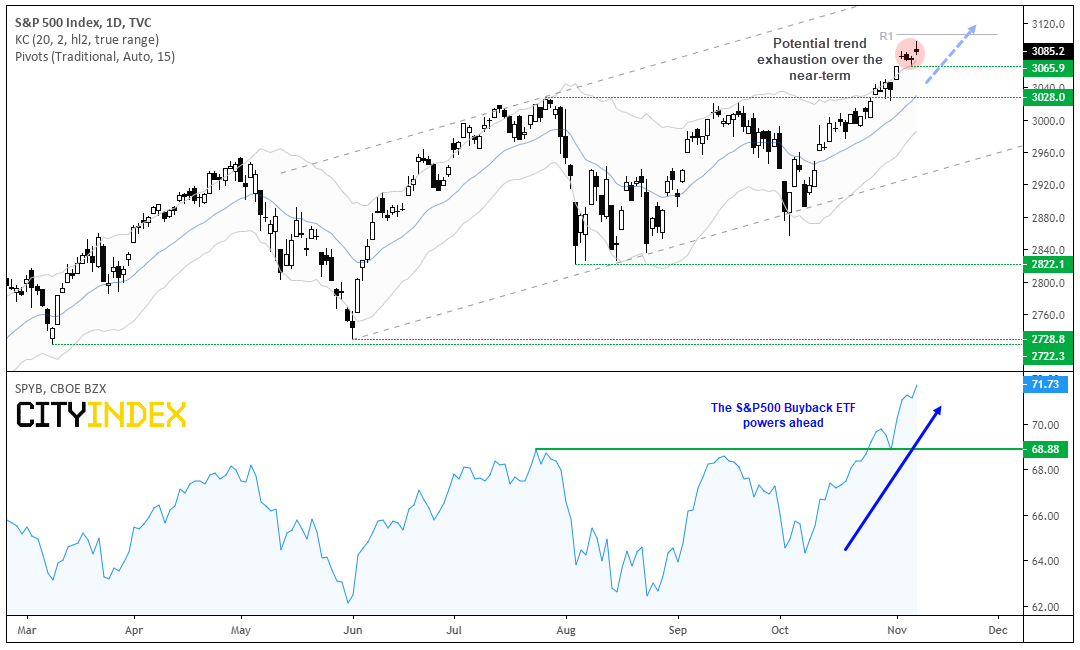

S&P 500: The trend is undeniably strong and the break to new highs reaffirms the bullish channel from the June low. And we can also see that buybacks remain a key driver for the S&P 500 as the buyback index ETF (lower panel) has broken to new highs in tandem with the S&P’s breakout.

That said, a series of indecision candles above the upper keltner band warns of potential trend exhaustion over the near-term, which leaves the potential for a pause in trend or correction. And these candles have formed just beneath the monthly R1 pivot. It’s also worth noting that a bearish pinbar formed, despite the positive news that the US will roll back tariffs as part of a deal.

- If prices break below 3065.9 then a deeper correction is in the cards, although bulls could be eager to buy any dips above 3028 support given the significance of the level.

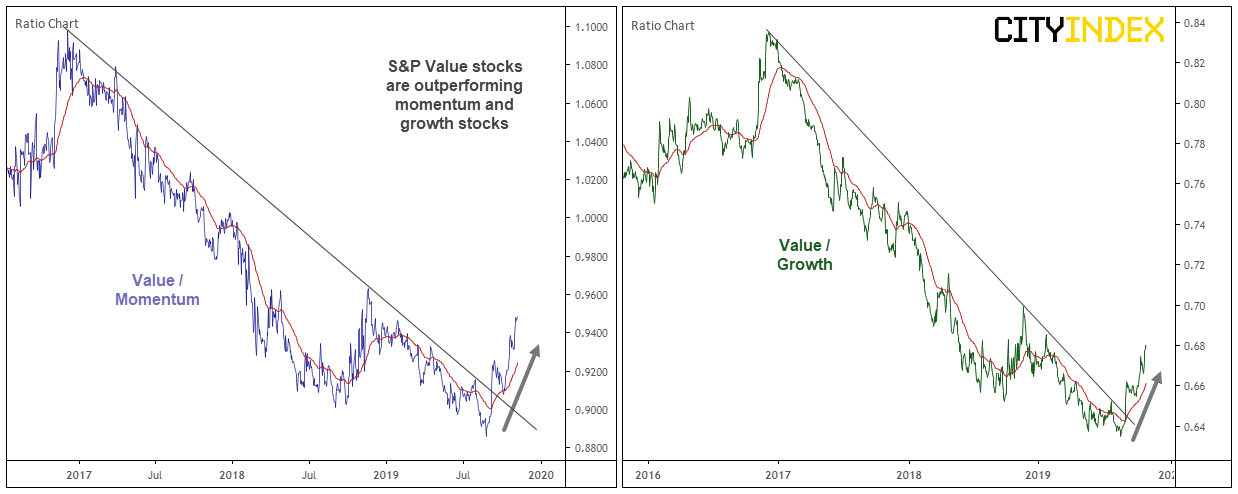

To finish up on a different angle, I can’t help but notice that value stocks are coming back into fashion whilst the S&P 500 breaks to new highs. Value stocks are considered below fundamental value (therefore ‘cheap’ by some metrics) and have mostly underperformed the S&P 500 since the 2009 low. Moreover, value stocks are outperforming both momentum and growth stocks. This could be quite telling regarding the relative value of the S&P 500, as growth stocks revenues are expected to outperform relative to the average company (therefor higher prices) and momentum stocks are those which generally lead the index higher. So if momentum stocks are lagging and growth stocks are now not expected to grow relative to the average, what does this say about the underlying health of this bull market? Whilst this could take some time to play out, the dynamic has certainly changed and is worth keeping track of as this bull market develops.