S&P 500 bounced from Monday’s low – is the stock market resuming its uptrend?

The broad stock market index lost 0.04% on Wednesday following Tuesday’s advance of 1.2%. On Wednesday, it reached a new local high of 4,390.35, and on Monday, it was as low as 4,328.08.

There is still a lot of uncertainty concerning monetary policy, and some technology stocks’ valuation concerns, but the investors’ sentiment remains bullish.

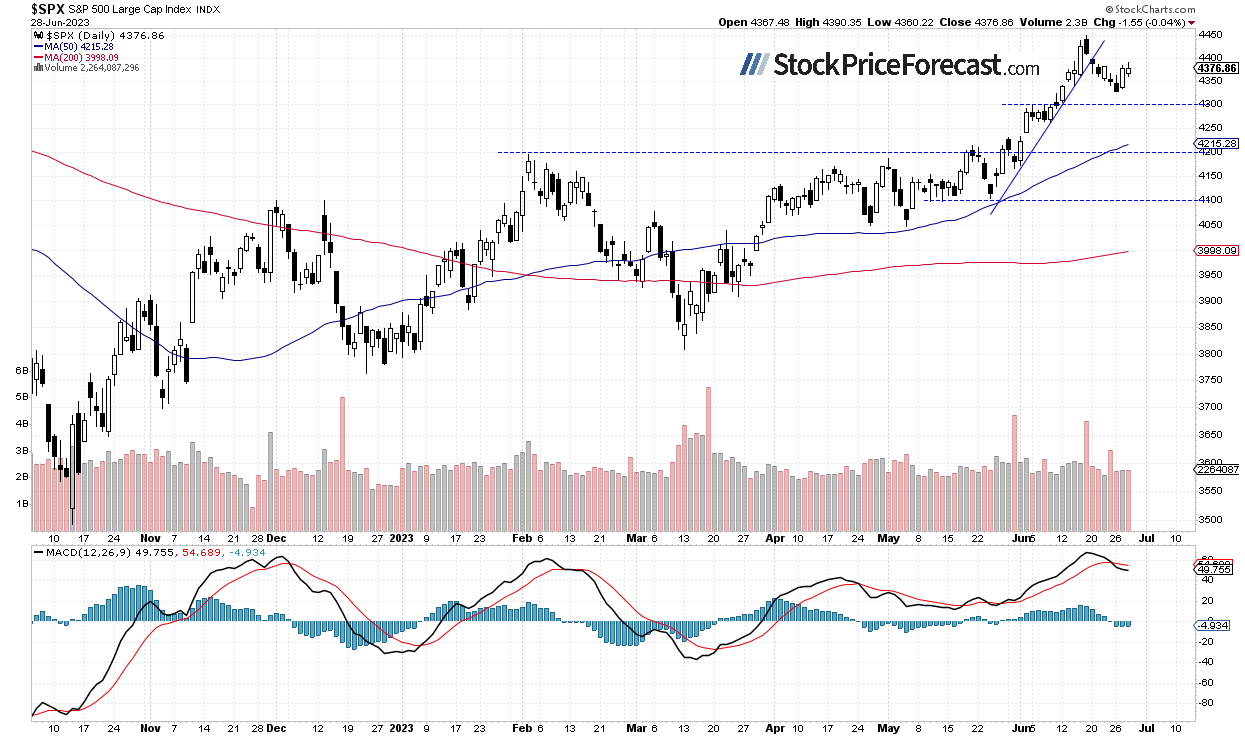

Stocks will likely open 0.3% higher following better-than-expected Final GDP and Unemployment Claims releases. So the S&P 500 may get closer to its yesterday’s high and the 4,400 level. Last week it broke below its upward trend line as we can see on the daily chart:

Futures Contract Got Back Above 4,400

Let’s take a look at the hourly chart of the S&P 500 futures contract. It rallied up to around 4,500 levels on Friday, June 16. Then it retreated to around 4,370. This morning the contract trades along the 4,430 level. The resistance level is at 4,450-4,500 and the support level remains at 4,370-4,400.

Conclusion

The S&P 500 index will likely open higher this morning. The market may get close to the 4,400 level again. It may resume its uptrend following a week-long correction, but the index is still way below its June 16 high of 4,448.47.

Here’s the breakdown:

- The S&P 500 is expected to get close to 4,400 level again.

- Stocks may resume their uptrend.

- In my opinion, the short-term outlook is bullish.

Thank you.