- S&P 500 Monitoring purposes; Long SPX on 3/25/22 at 4543.06.

- Monitoring purposes Gold: Long GDX (NYSE:GDX) on 10/9/20 at 40.78.

- Long Term SPX monitor purposes; Neutral

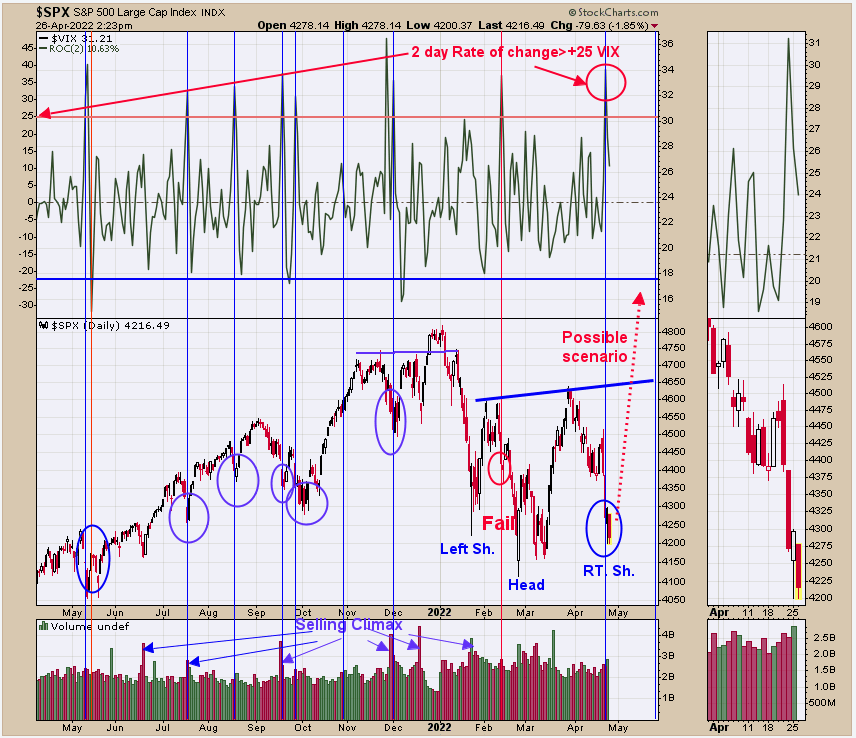

We updated this chart from yesterday, when we said:

“The top window is the 2 day (Rate of Change) for the VIX; readings above 25 on this indicator (current reading is 26) suggests a low is near; happed 8 times since last May with one failure which works out to 88% success rate. The pattern forming on SPX could be a Head and Shoulders bottom where the Right Shoulder is completing now. This potential Head and Shoulders bottom has an upside target to 5150 which would be a new high. Don’t have it shown but NYSE Summation index needs to see +1000 range near mid May for a bull market signal (on a previous report) for 2022 other wise sideways market at best this year.”

Added to the above, today’s light volume test of Monday’s low is a bullish sign suggesting bottom is forming.

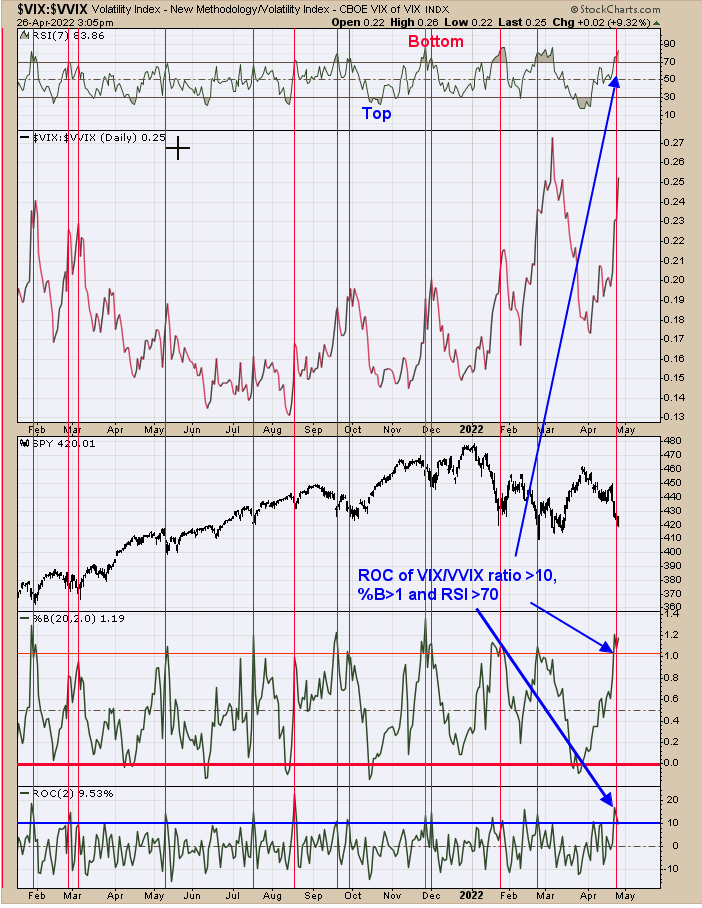

VIX measures the fear in a market and the VVIX is the VIX of the VIX. So the VIX/VVIX ratio is a good indicator that can define panic and panic only forms at bottoms in the market. The acceleration of the VIX/VVIX ratio helps to pin point where all the panic is occurring.

The bottom window is the “rate of change” (ROC) of the VIX/VVIX ratio and high readings above +10 suggests panic (high came in yesterday +15). Next window up is the Percent B. The percent B shows when it above its upper Bollinger Band (>1) or below its lower Bollinger band (

Top window is RSI for the VIX/VVIX ratio which also measures acceleration and shows excess with readings reach above +70 (current reading is 84). We marked with red lines the times when all three indicator for the VIX/VVIX ratio reached bullish levels. Will this time be different?

The top window is the Inflation/Deflation ratio. Last week it closed above its previous 2020 high suggesting a breakout. Right after that high, it tumbled the next four days creating an “Up thrust” suggesting a consolidation is starting. If the Inflation/Deflation ratio starts a consolidation so will the XAU (GDX).

As pointed out in yesterday’s report, the pattern that may be forming on XAU is a Head and Shoulders bottom where the Head is the October low. Head and Shoulders pattern have symmetry both in time and price. The Left Shoulder formed over 5 months and suggests the Right Shoulder may take as long and could complete in the October or November timeframe. Still a bull market but sideways action over the next 5 or 6 months is possible.