Investing.com’s stocks of the week

What will the S&P 500 bring next week? That is the subject of discussion in our next premium analysis due out late Sunday!

Over a month ago, on November 8th, we published an article demonstrating the Elliott Wave principle‘s ability to predict relatively large moves in the S&P 500. As the move in question progressed we decided to take a closer look into its structure to see what is left of it.

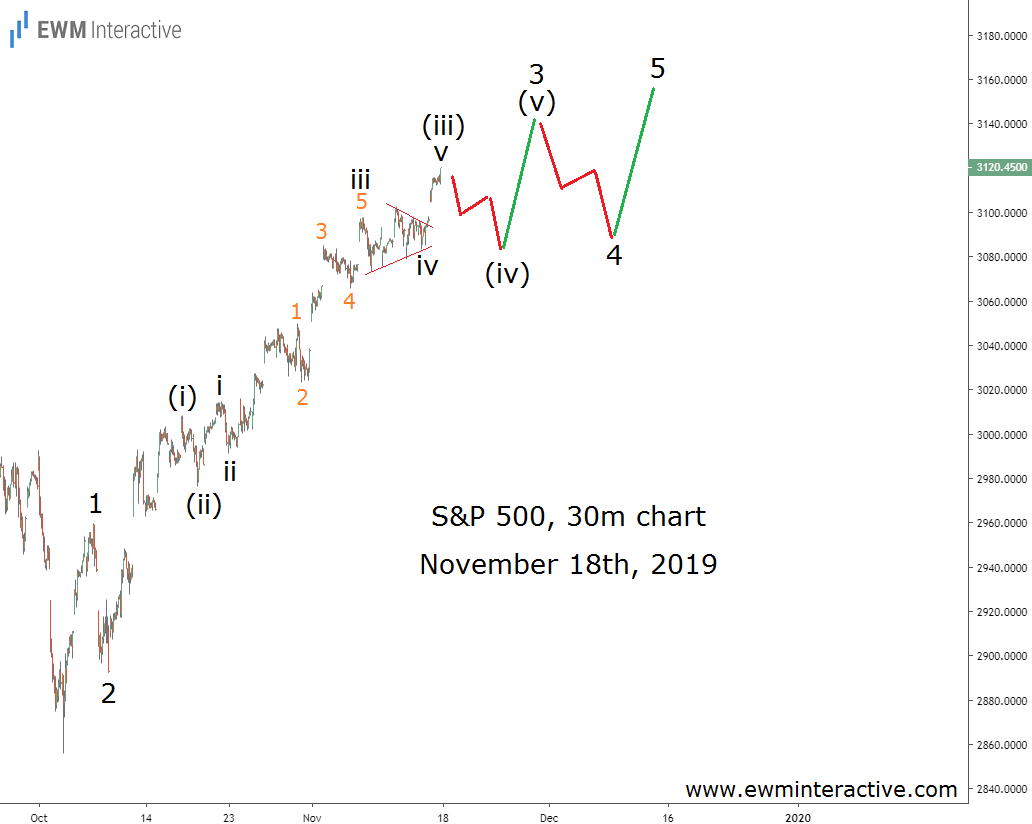

The chart below was part of the analysis our subscribers received on November 18th. In other words, before the latest trade talk developments, the UK election and the Fed interest rate decision. Yet, it turns out traders didn’t have to wait for all that news in order to make sense of the S&P 500.

Almost a month ago, the stock index was hovering around 3120 and was clearly in an uptrend. Trends tend to develop in five-wave patterns, called impulses. Hence, we thought one such impulse has been in progress since the bottom at 2856 in early-October. According to this idea, the S&P 500 had to make a couple of fourth and fifth waves before the pattern can be completed. Waves (iv) and (v) of 3, and waves 4 and 5 were still missing.

Elliott Wave Analysis Helps Predict Consecutive S&P 500 Moves

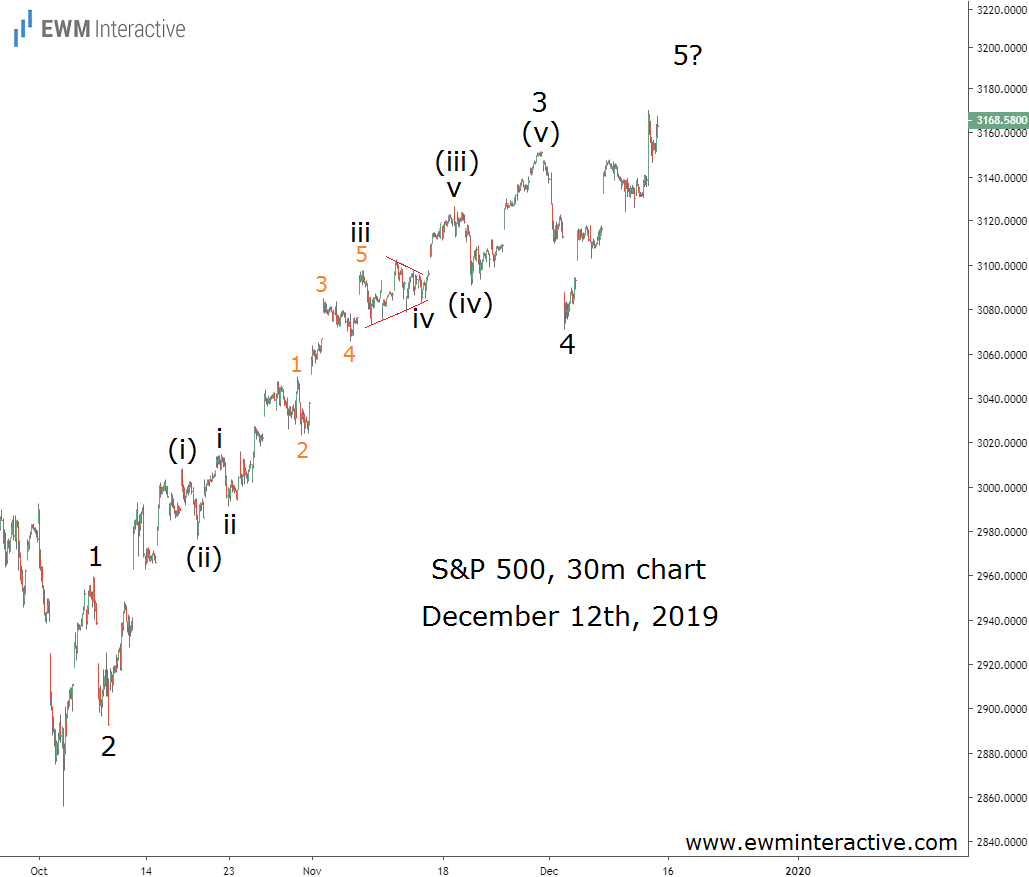

Fast-forward to December 12th, the U.S and China seem to have agreed on a tentative trade deal, Boris Johnson’s party won the UK election and the Fed kept interest rates unchanged. The S&P 500, by the way, developed exactly as planned.

Wave (iv) was a small dip to 3091 on November 20th. Seven days later, on November 27th, the index made a new all-time high of 3154 in wave (v) of 3. Wave 4 was a sharp selloff to 3070 by December 3rd. Wave 5, which appears to be still unfolding, led the bulls to 3176 yesterday.

The future of the Brexit saga, the trade war and the Fed’ interest rate policy remain unpredictable. The patterns, however, are already giving us a hint about the S&P 500’s next step…