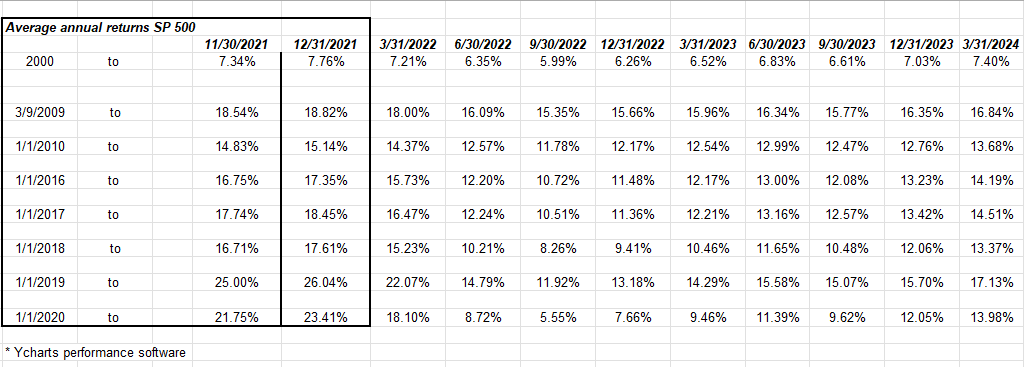

This S&P 500 annual return table shows the annual returns for the benchmark for various periods going back to 1/1/2000.

From 1/1/2000 through 3/31/24, the annual return for the S&P 500 is just 7.40%, the only return that looks reasonable the last 23 years.

Looking at the S&P 500 Annual Return Data by Decade:

- 2000 to 2009: 1.25% per year

- 2010 to 2019: 13.55% per year

- 2020 to 3/31/24: 13.89% per year

Nasdaq 100 (QQQ’s) – Not Shown on Table

- 2000 to 2009: -12.67%

- 2010 to 2020: +20.30%

- 2020 to 3/31/24: +19.95%

Here’s an interesting data point: 01/01/2000 through 3/31/24 (QQQ): +4.41% (lower than the S&P 500’s return for the same period).

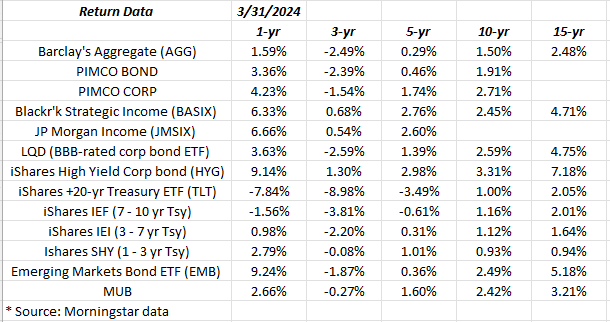

Bond Annual Returns:

High-yield credit has done well the last year in terms of absolute returns.

Note the 3-year returns for just about every bond sub-asset class on the spreadsheet. 5-year isn’t much better either.

Updating the spreadsheets after the close tonight, (4/3/24), I caught Rick Santelli on CNBC’s Fast Money. Rick is still looking for higher interest rates and judging by some of the comments out of the Sohn Conference today on deficits and gold, maybe that’s the right bet.

Take a look at the 10-year return on the TLT, just 1% (per year).

Maybe the buy signal will be when the 10-year returns all turn negative.

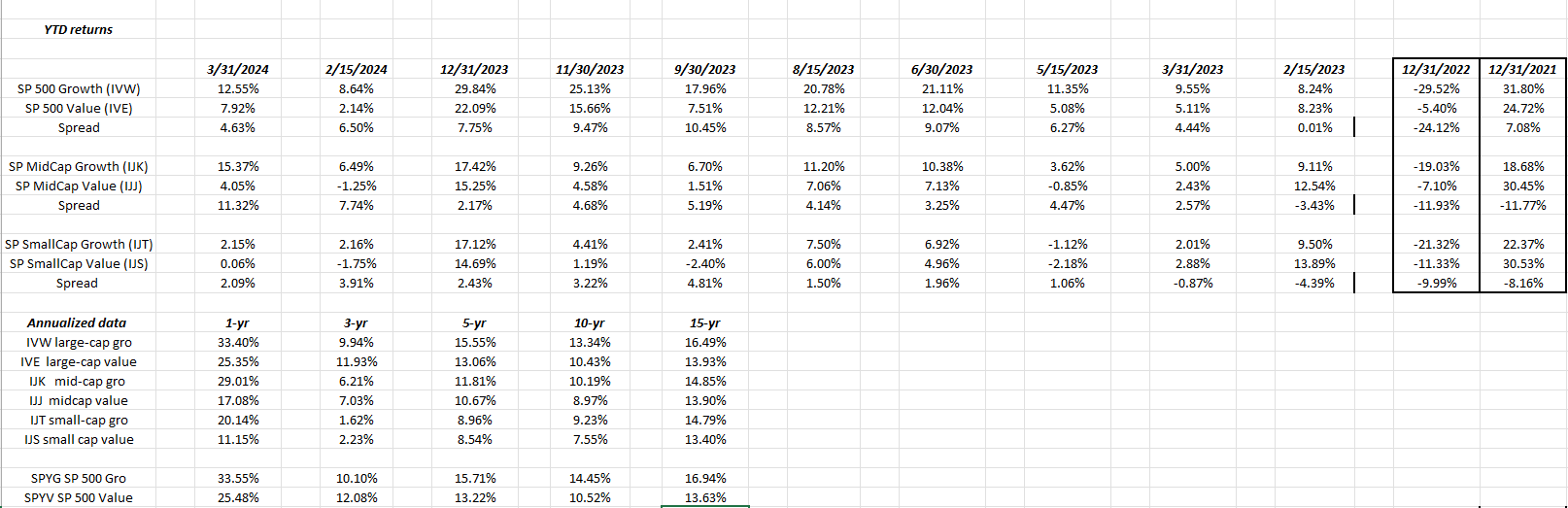

Style-Box Update:

Small and mid-cap had a decent 2021 and 2022 (far right) but large-cap and growth re-asserted themselves last year and in Q1 ’24.

Small and mids had a strong Q4 ’23, but look at mid-cap growth in Q1 ’24. Not sure what drove that.

The annual returns for all the style boxes (bottom rows) are not bullish. Maybe the 3-year returns for small and mid, but that’s about it – they are still single digits.

Conclusion:

Make of this what you will. I update the numbers just for my own edification. The one bullish metric for annual returns is the 23-year return on the Q’s vs the S&P 500. That surprised me (this was the first time I’d run the QQQ data.)

None of this is advice or an opinion. Past performance is no guarantee of future results. Investing can involve loss of principal even over the short-term. Readers should gauge their own comfort with portfolio volatility and adjust their portfolios accordingly.

Thanks for reading.