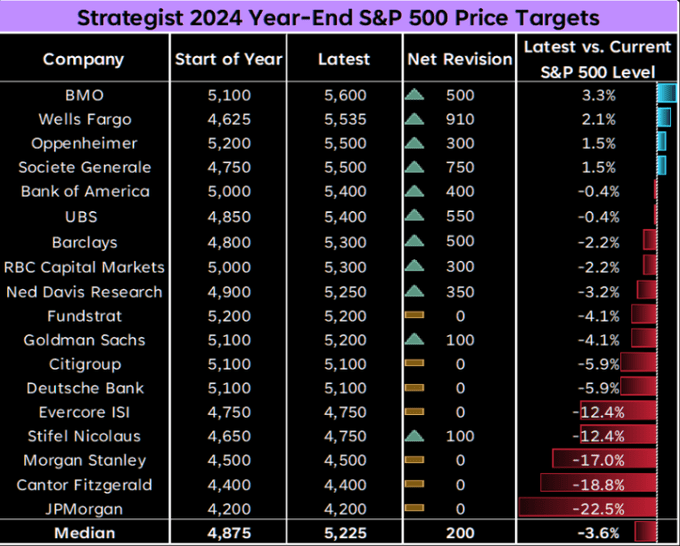

Goldman Sachs recently upped its price target to S&P 500 6300 for the end of this year, along with Evercore ISI upping its year-end target to 6000. Such is not surprising given the strong run in the markets this year. Just two weeks ago, I posted the following chart saying:

“We should soon start getting a raft of S&P 500 price target upgrades for year-end.”

While such a bold number may seem unrealistic, there is a fundamental case to support it.

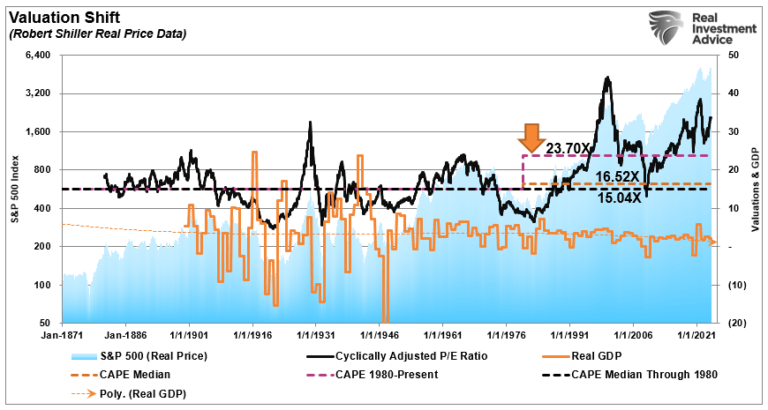

Last week, I discussed how there has been a “Fundamental Shift Higher In Valuations.” In that article, we discussed how that occurred. To wit:

“There are many reasons why valuations have shifted higher over the years. The increase is partly due to economic expansion, globalization, and increased profitability. However, since the turn of the century, changes in accounting rules, share buybacks, and greater public adoption of investing (aka ETFs) have also contributed to the shift. Furthermore, as noted above, the massive monetary and fiscal interventions since the “Financial Crisis” created a seemingly “risk-free” environment for equity risk.

The chart shows the apparent shift in valuations.”

- The “median” CAPE ratio is 15.04 times earnings from 1871-1980.

- The long-term “median” CAPE is 16.52 times earnings from 1871-Present (all years)

- The “median” CAPE is 23.70 times earnings from 1980 to the present.

There are two critical things to consider concerning the chart above.

- The shift higher in MEDIAN valuations was a function of falling economic growth and deflationary pressures, and,

- Increasing levels of leverage and debt, which eroded economic growth, facilitated higher prices.

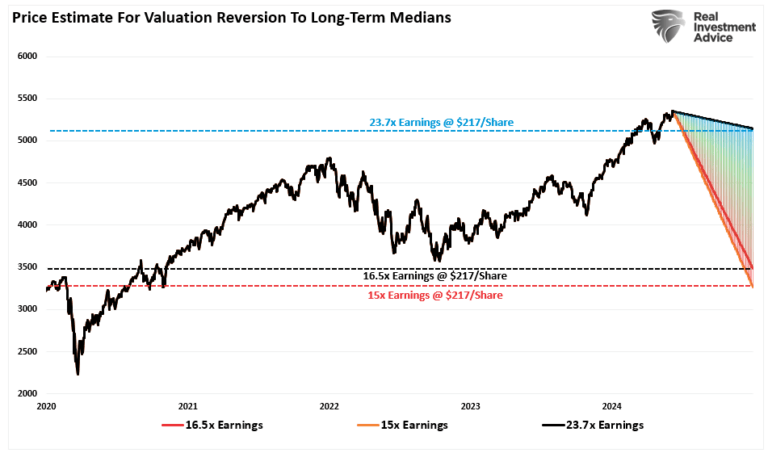

So, the question is, “IF” valuations have permanently shifted higher, what will the next market mean-reverting event look like to reset fundamental valuations to a more attractive level?

We answered that question by analyzing current market prices and expected earnings to determine the shape of such a valuation reversion.

As of this writing, the S&P 500 is trading at roughly $5,300 (we will use a round number for easy math). The projected earnings for 2024 are approximately $217/share. We can plot the price decline needed to revert valuations using the abovementioned median valuation levels.

- 23.70x = 5142.90 = 3% decline

- 16.52x = 3584.84 = 33% decline

- 15.04x = 3263.68 = 38.5% decline

However, that story’s “other side” is where a multiple expansion occurs.

S&P 6300 – The Other Side Of The Story

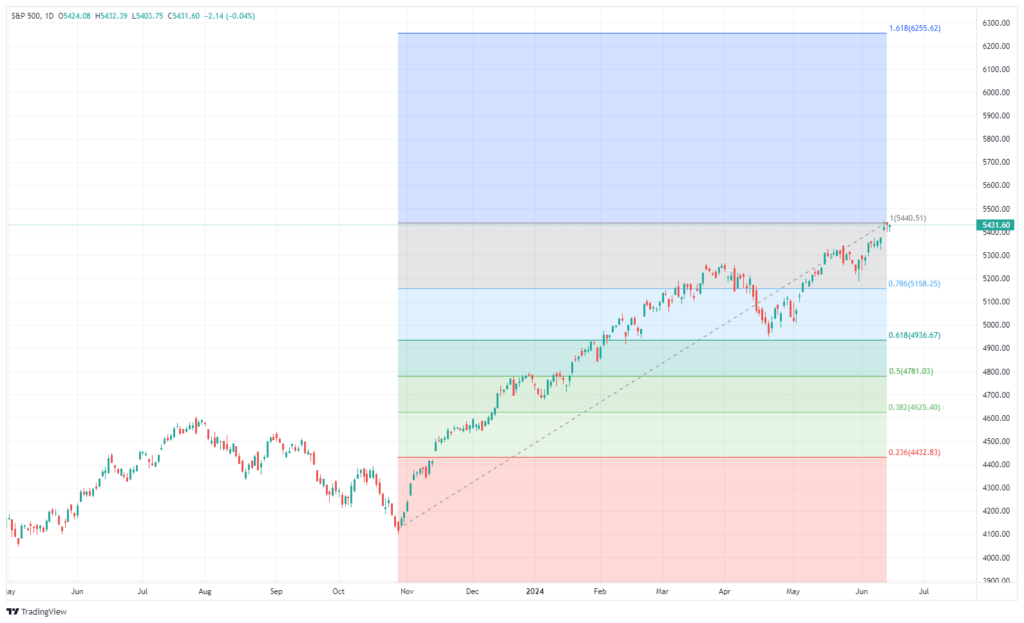

How did we pick S&P 6300? We used a standard Fibonacci sequence to identify the logical, numerical sequence from the November 2023 lows. From those lows, an extension of 1.62% would take the market to roughly 6300 (6255, to be exact). However, for the market to make that advance, the underlying earnings will need to support the continued rise.

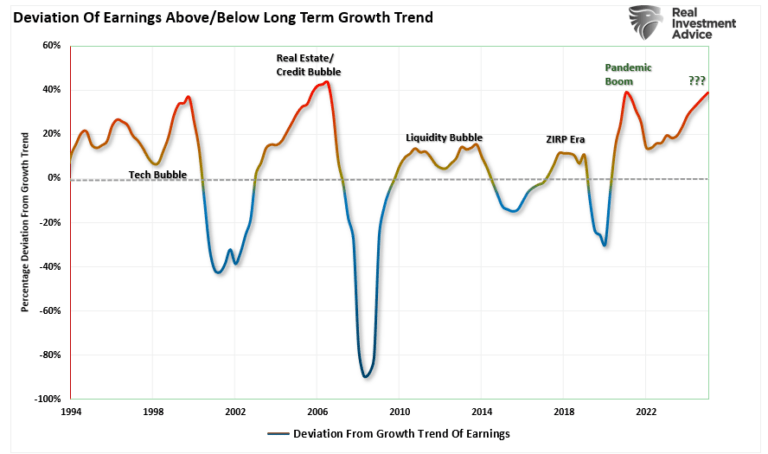

As noted in the previous article, valuation contractions happen during recessionary and bear market periods. During such a phase, the exuberance of the market realigns the price of the market with the underlying fundamentals. However, multiple expansions are underway before the beginning of the reversion process. During this bullish phase, Wall Street analysts continue to ratchet earnings estimates higher to justify rising prices. Currently, we are in the multiple expansion phase, where analysts are dramatically increasing earnings estimates to more extreme levels. As shown, the earnings estimates for 2025 are at a record deviation from the long-term exponential growth trend.

So, how can the S&P 500 get to 6300? We can use current Wall Street estimates to work backward through the valuation process. As we did previously, we usually look at the market’s price and determine the “fair value” of the market based on expected earnings. In this case, we will take the denominator (earnings) of the valuation equation to find the “fair price” of the market.

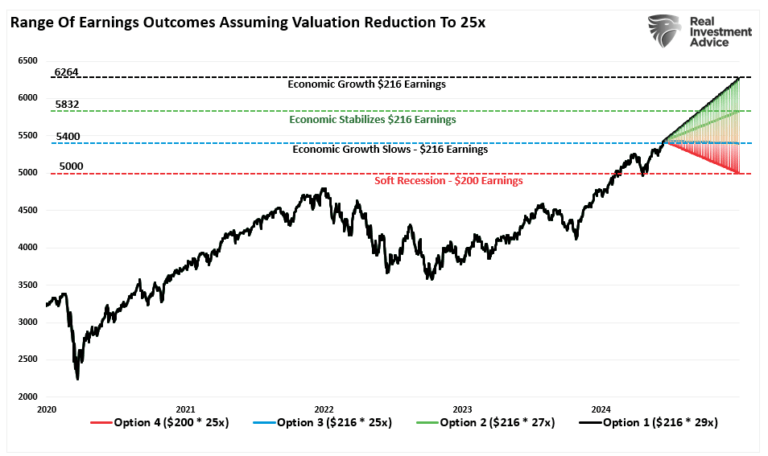

While Goldman is looking at 6300 for the end of this year, for this thought experiment, we will use S&P Global’s current estimates of $216/share for the end of 2024. For Goldman’s estimate of 6300, trailing one-year valuations will rise to 29x earnings. However, we will also assume some lower valuation of 27x and 25x earnings by year-end if economic growth continues to slow. Furthermore, we will consider a drop in earnings to $200/share if the economy starts heading into a soft recession. However, given that Wall Street estimates are always overly optimistic, a deeper discount in earnings is possible. However, those parameters give us the following results.

- $216/share * 29x Trailing Earnings = 6264 (Assumes continued economic growth)

- $216/share * 27x Trailing Earnings = 5832 (Assumes economic growth stabilizes.)

- $216/share * 25x Trailing Earnings = 5400 (Assumes economic growth slows further)

- $200/share * 25x Trailing Earnings = 5000 (Assumes a mild economic recession)

As we did previously, we can use these forecasts to build a chart showing the range of potential outcomes over the next 6 months.

Those outcomes are just one set of assumptions. By adjusting valuation and earnings expectations, we could create infinite possibilities. The purpose of the exercise, however, is to establish a reasonable range of possibilities for the market at the end of the year. As shown, the range of potential outcomes is broad from market levels at the time of this writing. The bullish argument of “no recession” suggests a possible upside from 7.4% to 15%. However, if the economy slows or slips into a soft recession, the potential downside ranges from a -1% loss to -8%.

Challenges Remain

Let me state that I have no idea what the next 6 to 18 months hold in store. As noted, there are an infinite number of possibilities. What happens in the November election, Fed policy, and the potential for a recession will all affect one of those outcomes.

Here is our concern with the bullish scenario. It entirely depends on a “no recession” outcome, and the Fed must reverse its monetary tightening. The issue with that view is that IF the economy does indeed have a soft landing, there is no reason for the Federal Reserve to reverse its balance sheet reduction or cut interest rates drastically.

More importantly, the rise in asset prices continues to ease financial conditions, keeping inflation “sticky,” thereby eroding consumer purchasing power. The bull case also suggests that employment remains strong, along with wage growth, but there is clear evidence of erosion on both.

While the bullish scenario of S&P 6300 is possible, that outcome faces many challenges heading into 2025, given the market already trades at fairly lofty valuations. Even in a “soft landing” environment, earnings should weaken, making current valuations more challenging to sustain.

Our best guess is that reality lies somewhere in the middle. Yes, there is a bullish scenario in which earnings decline, and a monetary policy reversal leads investors to pay more for lower earnings. However, that outcome has a limited lifespan as valuations matter to long-term returns.

As investors, we should hope for lower valuations and prices, which gives us the best potential for long-term returns. Unfortunately, we don’t want the pain of getting there.

Regardless of which scenario plays out in real-time, there is a substantial risk of poor returns over the next 6-18 months. As investors, we must manage the risk of an unexpected turn of events undermining Wall Street’s continued optimistic views.

After all, the math is just the math.