When we wrote about Match Group (NASDAQ:MTCH) over five months ago, the stock was trading below $150 a share. News about its due inclusion in the S&P 500 index sent the shares surging in early September. However, being part of a benchmark doesn’t change a company’s fundamentals.

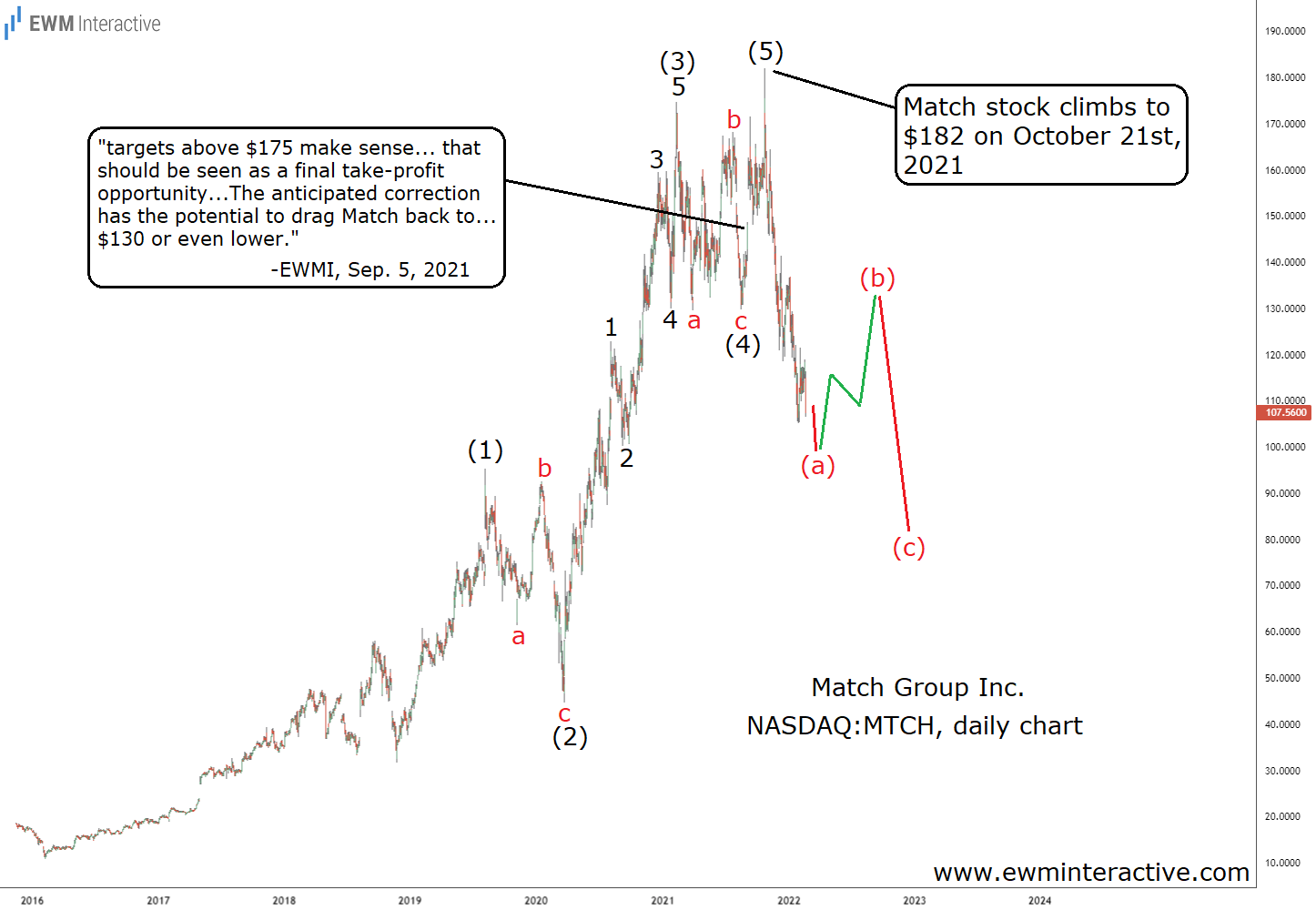

Fresh institutional buying was likely to lift the price in the short-term, but it couldn’t keep the uptrend going by itself. So, instead of buying Match right there and then, we decided to examine the bigger picture. On Sept. 5, 2021, the Elliott Wave chart below convinced us to stay aside.

Match ‘s daily chart revealed an almost complete five-wave impulse, labeled (1)-(2)-(3)-(4)-(5). The only missing piece was the fifth and final wave. Once it was in place, the Elliott Wave principle says to expect a correction in the other direction.

Match Group Stock Down 41% in Four Months

Wave (5) was supposed to exceed the top of wave (3), putting targets above $175 within the bulls’ reach. We thought that should be seen as a final take-profit opportunity because a decline to $130 or even lower was likely to follow. Less than six months later, here is an updated chart of Match Group stock.

Match climbed to a new all-time high of $182 a share on Oct. 21, 2021. That was when the enthusiasm from the S&P 500 inclusion ran out. The following four months brought nothing but sorrow to the company’s shareholders.

As of last week’s close at $107.56, the Tinder parent’s stock is down 41% from its record. Unfortunately, the current selloff looks like a single wave within the more significant retracement that is still in progress. Even if a temporary recovery in wave (b) does occur, we can still expect more weakness in wave (c) afterward.

Besides, despite the recent plunge, Match is far from cheap as it trades at a 2022 price to earnings ratio of 39. Hence, we remain on the sidelines.