I last wrote about the SPX and the SPX:VIX Ratio in my post of Jan. 17.

If Jeremy Grantham's call for the SPX to correct by nearly 50% from its top at 4800 to his major support level around 2500 comes to fruition, the last four and a half years of wealth accumulation will be wiped out, as shown on the following monthly chart of the SPX.

That level is well below S3 (2870) mentioned in my 2021 Market Wrap-Up and 2022 Forecast post.

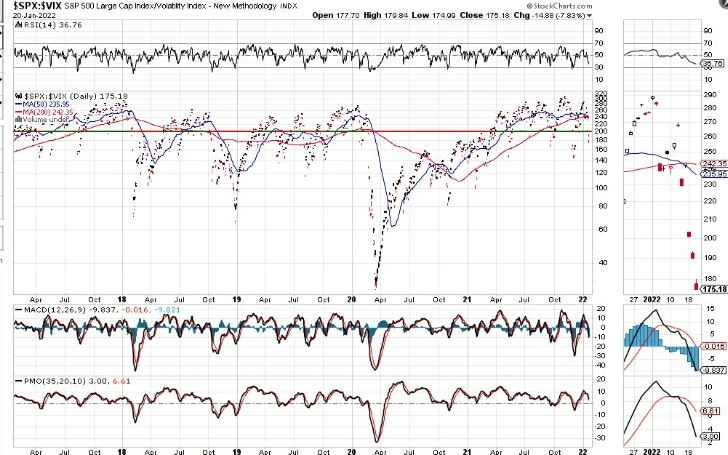

The SPX:VIX Ratio closed below the major support level of 200 in Thursday's trading, as shown on the following daily ratio chart.

This follows the formation of the moving average Death Cross discussed in my Jan. 17 post.

If price holds below 200, this does not bode well for the SPX, inasmuch as it seems that the 'sell the rip' traders have overtaken the 'buy the dippers' at this point.

This will continue, in my opinion, provided that the Fed does NOT interfere, but allows the equity market to self-correct and find its fair value.

I'd keep an eye on whether fair value and market stabilization occur around any of the following ratio levels, namely 150, 100, 80, or 60.

A drop and hold below 60 would be catastrophic for the SPX and could send it plunging to 2500, or lower.

President Biden's two-hour question and answer session with the press on Jan. 19 did absolutely nothing to stabilize the markets.

I won't bore you with the details. Many others have reported on his disastrous answers and performance...true to form, it wasn't pretty.