As of approximately 2:00 p.m. eastern, CME Group’s FedWatch Tool was reporting an 77.5% chance the Fed will not change the Fed Funds rate on Wednesday and a 22.5% chance that they will cut rates by 0.25%. Like these probabilities suggest, there will most likely not be any change this week. Instead next month may be a more appropriate time. Between now and the July 30-31 meeting there is a G20 meeting and another whole month of data. The second quarter will also be history and the first reading of Q2 GDP will be available as well.

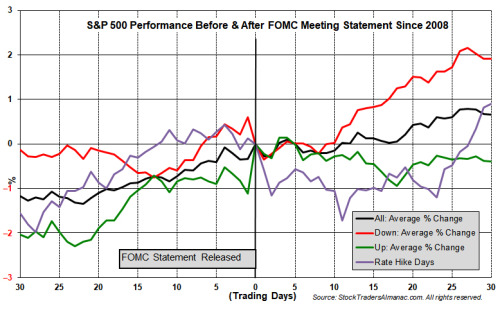

In the chart above the 30 trading days before and after the last 90 Fed meetings (back to March 2008) are graphed. There are four lines, “All,” “Up,” “Down” and “Rate Hike Days.” Up means the S&P 500 finished announcement day with a gain, down it finished with a loss or unchanged. Rate Hike Days are the nine times a hike was announced. Note how past down announcement days have, on average, enjoyed the best gains over the next 30 trading days.

Of the last 90 announcement days, the S&P 500 finished the day positive 49 times. Of these 49 positive days S&P 500 was down 28 times (57.1%) the next day. Of the 41 down announcement days, the following day was down 22 times (53.7%). All 90 announcement days have averaged 0.35% S&P 500 gains while the day after has been a net loser with S&P 500 declining 0.29% on average.