Our latest market moves might have you wondering: what's next for S&P 500 and gold? On September 13, 2024, we sold our SPX position at 5626.02, locking in a 2.23% gain after buying in on September 5. Just recently, we also cashed out at 5608.25 on August 19, securing an 8.14% profit from our August 5 position. This year alone, we've grown by more than 28%, outpacing the SPX's 20% rise.

Let's break down what we’re watching now. We have our eyes set on the Relative Strength Index (RSI) for the SPX/TLT ratio. Historically, an RSI near 30 has been a bullish indicator leading up to elections, just as it happened during the 2016 and 2020 election cycles when Trump was a candidate. We're watching this closely as a potential setup for the 2024 election.

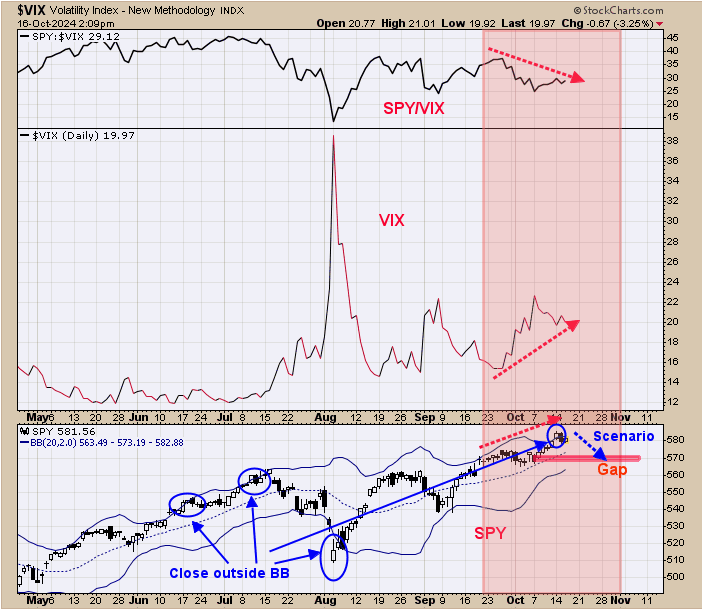

Another key metric is the SPX/VIX ratio, which shows some intriguing dynamics. We noticed a negative divergence, where SPX reaches new highs and the SPY/VIX ratio forms lower highs. This pattern often signals a potential market reversal, particularly when SPY closes outside its Bollinger band, as it did recently. An open gap near 565 on the SPY from October 8 could serve as a target zone.

Historically, we tend to see a corrective wave start around mid-October and extend into the election period, given the SPY/VIX divergence and an RSI above 70 on the SPX/TLT ratio. These signs suggest a possible pullback is on the cards.

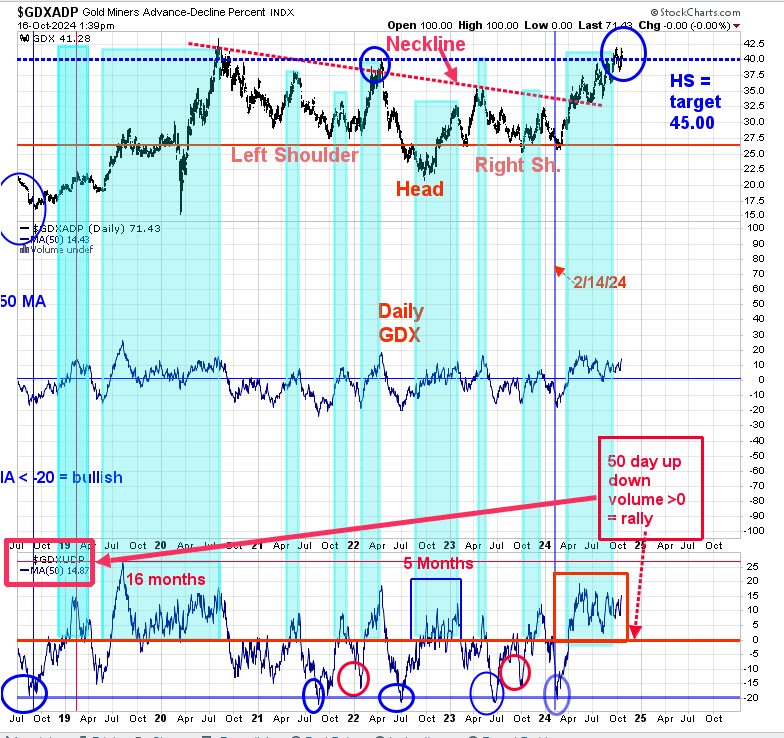

Turning our attention to gold, the internals for GDX (NYSE:GDX), a gold mining ETF, remain robust. The bottom window of our chart shows the 50-day moving average for GDX's up-down volume percent. As long as this average stays above zero, GDX is in an uptrend—currently, it's sitting at +14.87, after closing at +15.39 yesterday. We've highlighted periods in light green where the moving average stayed above zero, indicating continued bullish momentum. The first instance happened back in early April, and we've remained in positive territory since.