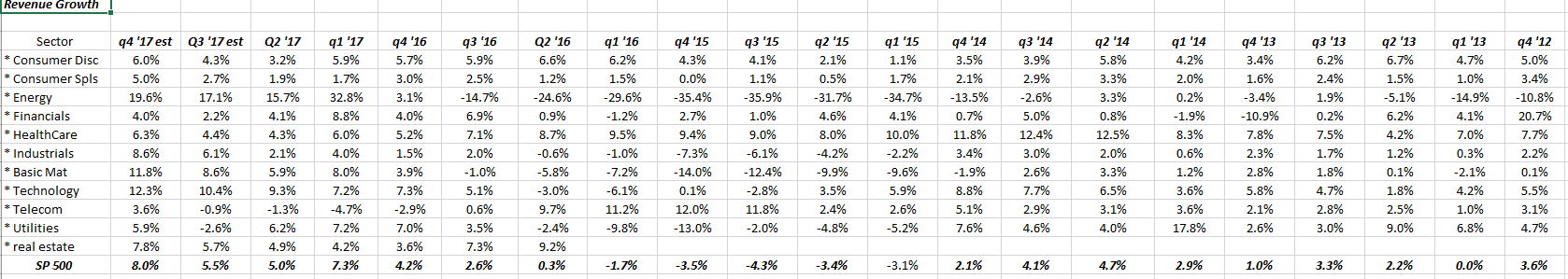

The table shows S&P 500 revenue growth – by sector – from the 4th quarter of 2012.

As readers can see, S&P 500 revenue growth started to accelerate in Q4 ’16, and while some readers might think that is my attempt to link the results of the Presidential election to the stock market, it isn’t, although to be fair with readers, I do think the joint Republican Presidency and Congress probably allowed the S&P 500 corporations to fear regulation a little less.

S&P 500 revenue growth started to improve between the 2nd and 3rd quarters of 2016.

The tax reform bill was signed on December 22nd, 2017 thus it is just starting to work its way into the S&P 500, as was written about on the blog this weekend.

While it requires another blog post, the fact is i think this could be a tougher year for S&P 500 returns than 2017, not because of anything earnings related, but because of interest rates and the bond market.

The bond market is what readers should worry about today.

This blog was never written to espouse any particular political view. While i do have an opinion on what economic, monetary and fiscal policies are in the long-run best interests of capital formation and wealth creation in America, it is not my place to advocate for political parties.

The current economic and fiscal policies today, are – in my opinion – good for the US stock market, but could cause a problem for the US Treasury market, interest rates and the bond markets, and in a convoluted way, that could come back on US stocks.

Too much stimulus, and too much growth, too quickly, wont be good for the US Treasury market.

Looking at the above spreadsheet, three sectors are expected to grow “double-digits” in Q4 ’17: Energy, Basic Materials and Technology.

Current expectations are that Q1 ’18 will see the same three sectors generate double-digit revenue growth, sourcing Factset’s data from February 9 ’18.

Keep your eye on revenue growth – it matters.

Earnings growth can be a function of a number of different levers on the income statement, but revenue growth is usually is a result of demand for whatever good or service you are selling.