In the world of trading, patterns matter, and the main one is that the S&P never goes down after a big down day. Why? I am not exactly sure, but I think it has something to do with the shorts. If you asked 100 traders on Thursday’s close if they thought the S&P was going to sell off again, I bet 99 would have said yes, but it just doesn’t work that way. After all the margin calls, selling, hedging and option rolling, it left most of the crowd short at lower prices. Many traders were forced into selling to protect positions, and by the time the 8:30 futures open came around, all the selling had been used up.

Thursday night’s globex trading range was 2434.00 to 2424.25, with 380,000 ES traded. On the 8:30 open the ES traded 2426.00, and made five early lows until it got down to 2419.50 at 9:00 CT. After a few attempts to trade above the vwap at 2426.50, the ES sold back off down to 2420.50, and then in came the buy programs, which initially pushed the future back up to 2431.25 at 10:30. After a little ‘back and fill’ at the 2428.50 to 2431.25 area, the ES popped up to 2435.50, pulled back a few handles, and then rallied all the way up to 2439.50. The next move was a ‘stutter step’ back down to the vwap 2428.50, as the early MiM started to show $180 million for sale.

We have a trading rule that says the S&P never does what most people want it to do when they want it, and Friday was a good example of that. After trading down to 2427.50 the ES traded up to 2430.75 as the MiM went to $357 million for sale. On the 2:45 cash close, the MiM flipped, and ended up showing $100 million to buy.

Stock Market Crashes

Yes, the Russell 2000 briefly turned negative for 2017 last Thursday, after falling below its 200-day moving average. If you look, there are hundreds of stories on the internet about a stock market crash. The VIX moved above its 200 day moving average, gold jumped above $ 1,300 for the first time since Trump was elected, the Dow Jones Transportation (DJT) had broken down, and last but not least, Trump’s agenda is on the line. There is no doubt the stock market has a funny feel to it, and investors are nervous. With the S&P up nearly 250% since its March 2009 lows there is no doubt that the Trump rally, at the very least, is on the line.

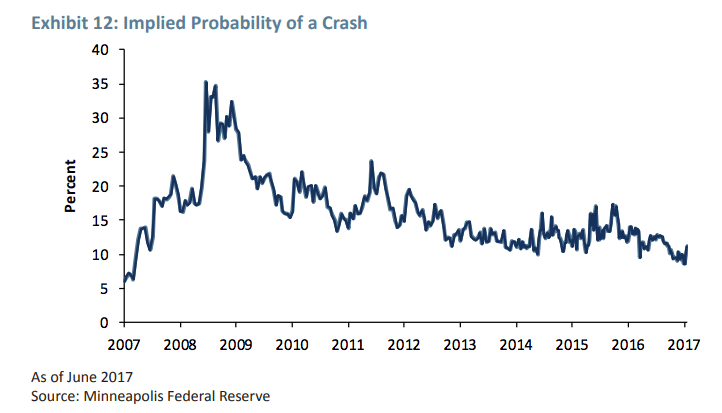

When I typed in ‘stock market’ crash on Google (NASDAQ:GOOGL), there were a lot of stories to read, but according to the Minneapolis Federal Reserve, the probability of a 25% or greater decline in U.S. equity prices occurring over the next 12 months implied in the options market is only around 10%. But that’s not how the news reads. Most of the news stories are telling investors to be careful, that something bad could happen at any moment. I personally think it’s about time for the markets to pull back / correct, but i also know that the ‘market timers’ have been calling for a crash for so long, it’s hard to believe most of them still have jobs.

What I do know is that the markets do not have the same feel to them. Does that mean the markets are going to crash? I do not think so, but if the S&P takes out the 2438-2430 level, I think 2500.00 and then 2385.00 are possible downside targets.

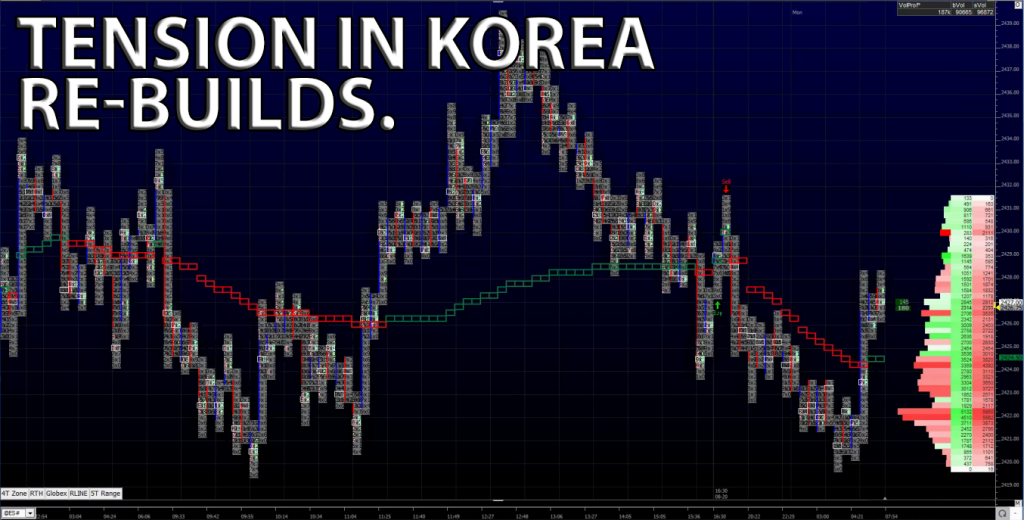

The next big thing facing the markets starts today. On Sunday, the U.S. and South Korea warned North Korea that we will be “pouring gasoline on fire.” China and Russia have been urging the United States to consider a “freeze for freeze” agreement to reduce tensions. In such a deal, Pyongyang would agree to suspend its tests of missiles and nuclear weapons, and Washington and Seoul would agree to suspend large-scale military exercises, but that’s not going to happen. South Korea’s top military officer said Sunday that the current security situation on the peninsula was “more serious than at any other time.”

The markets had an uneasy feel to them last week, and I suspect that with the 2017 Freedom Guardian exercises starting this week, things could get even more tense.

While You Were Sleeping

Overnight, equity markets in Asia and Europe traded mixed, as uncertainty on the Korean peninsula continues to grow.

In the U.S., the S&P 500 futures opened last night’s globex session at 2428.75, and printed the overnight high at 2431.50 in the first hour of trading. From there, the ES started a slow grind lower through the Asian session, printing a low of 2419.75, and extending the overnight range to 11.75 handles. As of 6:50am CT, the last print in the ES is 2427.50, up +0.75 handles, with 186k contracts traded.

In Asia, 7 out of 11 markets closed lower (Shanghai +0.57%), and in Europe 8 out of 12 markets are trading lower this morning (FTSE +0.03%).

Today’s economic calendar includes the Chicago Fed National Activity Index, a 4-Week Bill Announcement, a 3-Month Bill Auction, and a 6-Month Bill Auction.

Pyongyang Warns Of ‘Actual Fighting’

Our View: The markets have an uneasy feel to them. There are long term sell stops that start under 2410.00 and go straight down to 2385.00. I am not saying that will happen, but if North Korea shoots off some ballistic missiles, it will be game on in the Korean Peninsula.

Our view is that we want to get a look at the price action. Like we said above, if the ES breaks 2418 we could see 2410, and a break through 2410 would not be good.

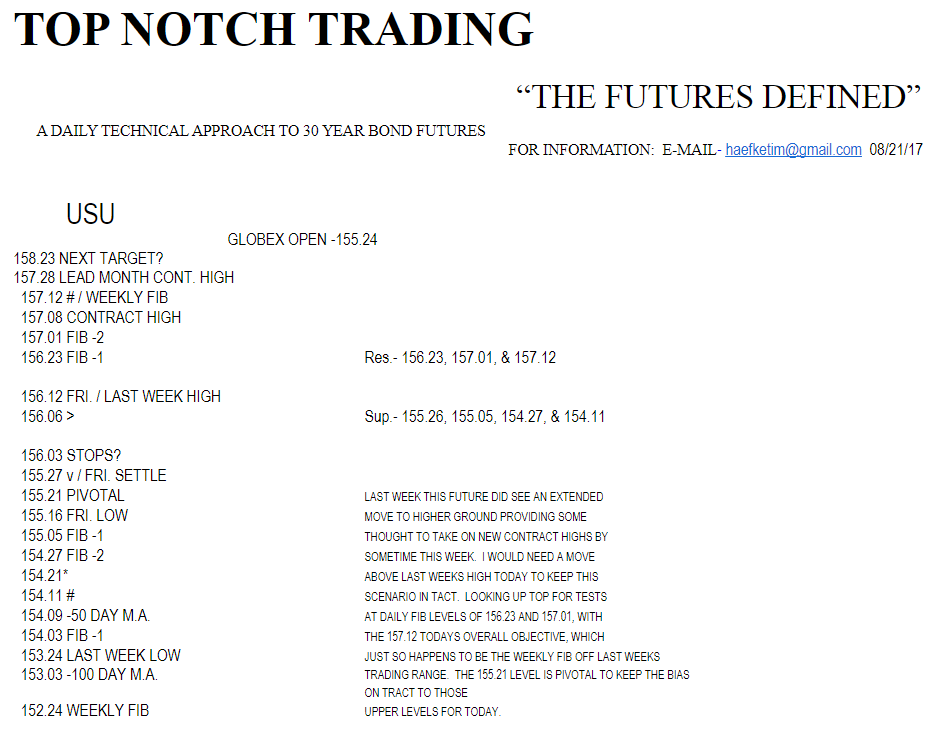

PitBull: CLV osc -17/2 turns down on a close below 45.60; ESU osc -17/-5 turns up on a close above 2466.69; VIX osc 10/14 turns down on a close below 12.14.