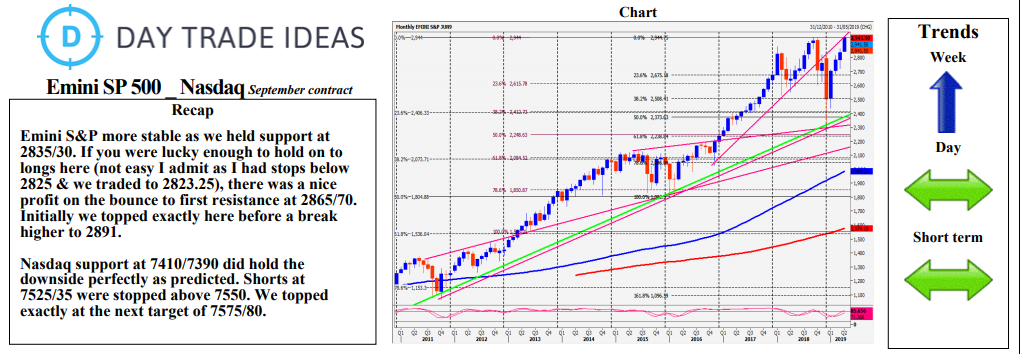

Emini S&P holding first support at 2865/70 re-targets 2882/84 and 2891/95 before strong resistance at 2905/15. Try shorts with stops above 2925. A break higher is a buy signal targeting 2935 and 2946/48. Back below 2960 signals weakness to 2850/45 before support at 2833/30. Longs need stops below 2825. Further losses meet support at 2800/2795 before a retest of 2775. A break lower certainly possible for strong support at 2755/45. The brave can try longs with stops below 2730. A break lower is an important sell signal targeting 2700/2695 and 2680/70.

Nasdaq now holding above first support at 7535/25 targeting 7575/80 before resistance at 7615/20. Above 7630 meets strong resistance at 7650/60.

First support at 7535/25 but below 7515 targets 7480/75 then 7440/35. Support at 7410/7390 could hold the downside again. A break below 7380, however, targets 7350/40 with minor support at 7310/05 and 7275 before the low at 7225. From here down to 7200 is the most important support of the week. Longs need stops below 7170. A break lower is an important sell signal and we could quickly drop another 100 points or more.