Investing.com’s stocks of the week

Wednesdays Trade

Wednesdays trade started with overall weakness in the Asian and European stock markets. The Stoxx Europe 600 was down 0.5% in early trading. In the U.S., the S&P 500 futures (ESH18:CME), which sold off late in the day on Tuesdays close, sold off down to 2737.25 around 5:00 AM, and then bounced up to 2744.75 just before the 8:30 CT futures open. Total volume on Globex was high, with roughly 275,000 ES traded.

The ESH first print on the 8:30 AM CT bell was 2744.50, followed by a dropped down to 2742.50, and then a move up to 2746.75, 10.25 handles off the Globex low. From there, the ES went screaming back down to a new low at 2736.50.

There were three MrTopStep 10 hande rules, the first was from the globex low at 2737.25 up to the early day high at 2746.75, the second was from the 2746.75 high to the new low at 2737.50, and the third was from the new day low at 2736.50 up to 2746.00 (give or take a few ticks). Volume was humming along, at 9;30 635,000 ES had traded.

After trading 2746.00, the ES sold off down to 1 tick above the vwap, rallied up to a new high at 2748.00, sold off under the vwap down to 2742.25, and then went up and made a new high at 2748.50. After a few more smallpull backs the ES made new highs at 2749.75, 2750.50, and then up to its final high for the day at 2751.75.

Yesterday’s trade was another good example of how the overnight Globex session creates some of the best trade setups. Some big selling showed up, and yes, there was a day session drop below the Globex low, but the early weakness led to a 15.5 handle rally. All the selling was used up before, and just after, the 8:30 open.

In the end the S&P 500 futures (ESH18:CME) settled at 2750.50, down -1.50 handles, or -0.05%; the Dow Jones futures (YMH18:CBT) settled at 25,351, down -22 points, or -0.08%; the Nasdaq 100 futures (NQH18:CME) settled at 6677.25, down -9.75 points, or -0.14%; and the Russell 2000 (RTYH18:CME) settled at 1561.90, up +1.20 points or +0.07% on the day.

The Close

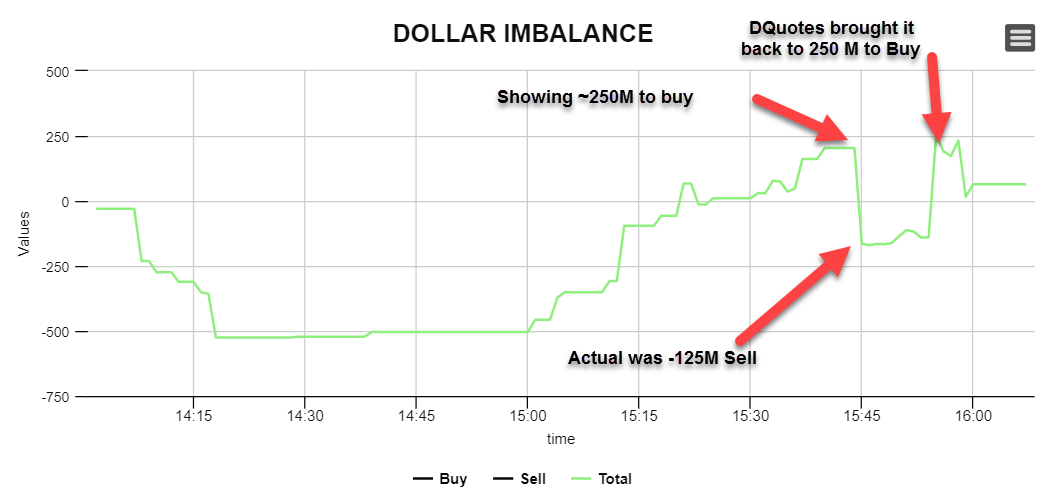

Our closing imbalance meter (MiM) showed a pending imbalance of about 250M to buy which was knocked back to about 125M to sell after the 3:45pm ET cut off. The discretionary late traders came in five minutes before the NYSE close and bought the market which swung the imbalance back up to 250M. All in all it was a small imbalance, much smaller than we have been seeing so far in 2018.