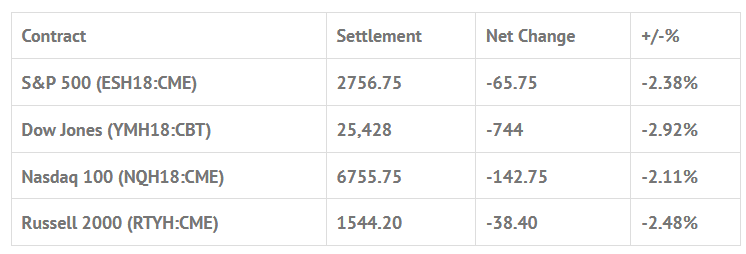

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 10 out of 11 markets closed lower: Shanghai Comp +0.73%, Hang Seng -1.09%, Nikkei -2.55%

- In Europe 12 out of 12 markets are trading lower: CAC -1.47%, DAX -1.08%, FTSE -1.35%

- Fair Value: S&P +0.08, NASDAQ +5.96, Dow -32.64

- Total Volume: 2.5mil ESH & 989 SPH traded in the pit

Today’s Economic and Earnings Calendar:

PMI Services Index, 9:45 a.m. Eastern; ISM Non-Mfg Index, 10 a.m.

S&P 500 Futures: ‘Crash And Burn’ Down 2.35% After Favorable Jobs Report

Friday, Japan and South Korean stocks were down off of weak earnings, and the European Stoxx 600 was down 1%. Bitcoin plunged 13%, falling to $7,913, down 60% from its highs back in December. In the U.S., the Yields on 10-year U.S. Treasuries rose to 2.791%. Despite The U.S. economy adding more jobs than forecasted in January, the S&P 500 futures were down almost 1% before the 8:30 bell.

Thursday night, the the ES sold off quickly down to 2811.75, then bounced up to 2821.50, but by 4:15 am, it had sold off all the way down to 2797.00. There was a move up to 2807.25 just as the jobs number was released, followed by a selloff down to 2799.50, and then a bounce up to 2810.00 before the open.

After the open, the ES traded up to 2808.00, and then in came the ‘all day’ sell program. We are not going to do a blow by blow of the selloff, but at 1:30 CT the ES traded all the way down to 2770.25, down 53.25 handles, or -1.83%.

Yes, there were some pops, but every small short covering rally failed. After another small pop the ES sold off dwn to 2761.50, then had another small pop up to 2773,75 before trading back down to 2765.00 on the release of the 2:45 imbalance. The MOC came out sell $2.2 billion, and the ES sold off down to new lows at 2757.25. On the 3:00 cash close the ES traded 2762.75 and made another new low at 2755.25 before settling at 2757.25 on the 3:15 futures close, down 66.25 handles, or -2.35%.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Any decision to purchase or sell as a result of the opinions expressed in the forum will be the full responsibility of the person(s) authorizing such transaction(s). BE ADVISED TO ALWAYS USE PROTECTIVE STOP LOSSES AND ALLOW FOR SLIPPAGE TO MANAGE YOUR TRADE(S) AS AN INVESTOR COULD LOSE ALL OR MORE THAN THEIR INITIAL INVESTMENT. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.