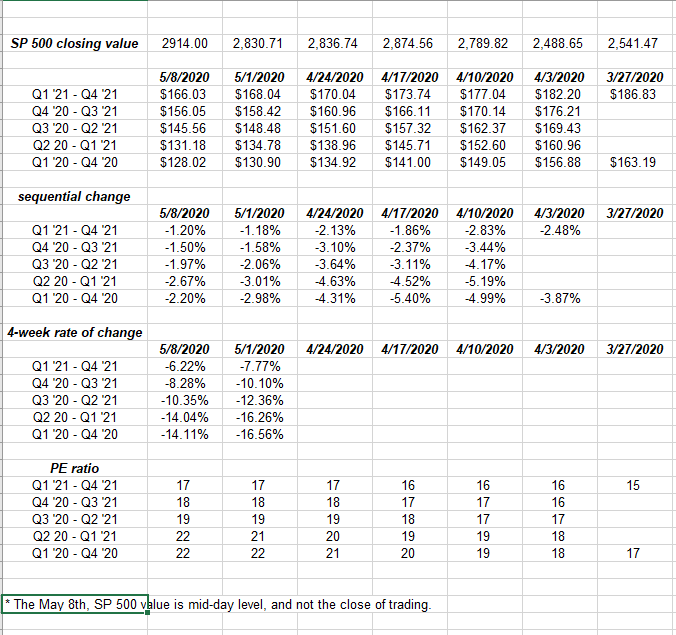

Using some interim IBES data by Refinitiv reports, here is the “forward earnings curve” for the S&P 500. This Week in Earnings comes out tonight.

As readers can see using the base case the 2020 S&P (NYSE:SPY) 500 estimate, the sequential improvements continue in the rate of decline of the forward estimates, which should give investors some comfort that S&P 500 earnings are not as bleak as the mainstream media might lead you to believe.

The worst year-over-year growth rates continue to indicate that Q2 2020 will be the nadir for S&P 500 EPS y/y growth.

There continues to be some skepticism that 2021 S&P 500 EPS will remain above the $162.39 2019 actual EPS.

Dr. David Kelly of JP Morgan thinks that the 2021 S&P 500 EPS will fall below the 2019 actual print, as does the DataTrek Reserach bloggers, Nick Colas and Jessica Rabe, who estimate 2021 EPS at:

“#1: Q1 US corporate earnings are down 14% in Q1. Q2 should be the trough at -37%, but 2H recovery is more U-shaped by the day. Best case for 2021: $147/share, 19x for the S&P 500.”

Stimulus, Stimulus, Stimulus (is helping):

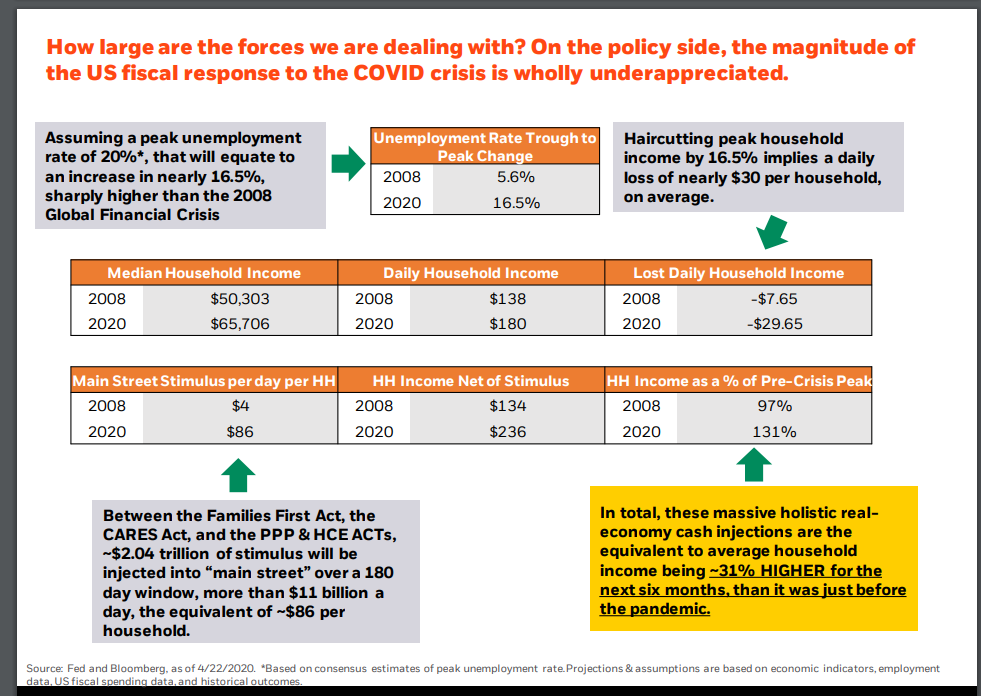

Possibly the best slide of BlackRock’s Rick Rieder presentation to clients on Thursday, May 7, 2020.

What this slide details is the amount of income lost in both the 2008 Financial Crisis and the 2020 pandemic (today).

The yellow box in the far right-hand corner shows that – with the fiscal stimulus – the average household income could be 31% higher for the next six months versus prior to the pandemic.

From an anecdotal standpoint, I have two friends – one a pilates trainer at a well-known health club in the Chicago suburbs, and the other a waitress (both women) who are out of work with the sheltering-in-place and lockdown in Illinois, and both of whom aren’t really in any hurry to get back to work. While we don’t get into specifics, neither seems financially stressed in the least bit, and can continue on unemployment for a while longer.

The goal of the stimulus is to replace the drop in household income with government support so “consumption” doesn’t drop precipitously, and that seems to be working.

The stimulus is different from the Fed liquidity, which can be discussed at another time.

Conclusion: CNBC’s Joe Kernan interviewed Dr. Jeremy Seigal, the famed Wharton B-school professor, this morning after the release of the April ’20 nonfarm payroll report, and during the discussion, Dr. Siegal said something I had never heard before: most market participants think of the “stock market” as a leading economic indicator, looking 6-9 months out into the future and discounting that future into current prices. Dr. Siegal said that the stock market looks at 18 months forward earnings and discounts that future earnings stream today, although Dr. Siegal didn’t reference any study or academic finding as to where he derived that conclusion.

That was the first time I had ever heard of the “18-month horizon.”

That would mean that today’s market is looking at 2022 S&P 500 EPS, which today is being forecast at $187.46 and is currently expecting 13% y/y growth relative to the 2021 S&P 500 estimate.

Here is a table of the forward, expected growth rates, for 2020, 2021, 2022:

The “average” S&P 500 EPS growth rate today for 2020 and 2021 is currently at 4%, as was shown last week here.

This is the third week in a row the “average” for 2020 and 2021 expected S&P 500 EPS has averaged 4%, another indication that forward earnings might be in the early stages of stabilizing.

All the base data that this blog uses is from IBES data by Refinitiv, from David Aurelio and his staff. They do good work, but this blog takes the data and has tried to find other working patterns that might aid in spotlighting turns in S&P 500 EPS.

To be honest, in late 2018, I was caught completely off-guard by the rapid drop in S&P 500 earnings that occurred throughout 2019 (2019’s expected S&P 500 earnings growth fell from an expected 7% in January ’19 down to 1% by December ’19), which was highlighted by the Q4 ’18 23% drop in the S&P 500. That wasn’t good (in terms of the analysis).

In that case, unlike Jeremy Seigal’s 18-month forecast horizon, the S&P 500 EPS estimate actually began to decline in growth in January ’19 from 7% to 3% by the end of March ’19.

In this practical case, the S&P 500 was looking 3-6 months out, but the blow was cushioned when Fed Chair Jerome Powell started to loosen monetary policy.

Examining the rate-of-change for the forward estimates is a big help. Bob Doll of Nuveen and LizAnn Sonders of Schwab were early in late September, 2018, turning more bearish, and noting a change in the rate of decline in S&P 500 estimates.