The S&P 500 Futures Index is the world’s most traded stock index.

In this article we make a S&P 500 forecast and also a long-term price prediction. We would like to give an assessment of the future price development of the S&P 500 index futures using the daily, weekly and monthly charts. We also look at the long-term charts for the S&P 500, which are the quarterly chart and yearly chart with a logarithmic scale. The basis of our analysis is the Price Action and Technical Chart Analysis.

The charts used are from TradingView and the prices are from the CME.

S&P 500 Forecast Daily Chart: All-Time High Within Reach

Last update: March 15, 2021

S&P 500 E-Mini futures is trading at 3947 points after recovering above the January high. Strong support was shown at the high of 2020.

S&P 500 forecast: Index futures is quoted near the all-time high. (Chart: TradingView)

Resistance Levels: 3959.25 (All time high)

Support: Levels 3862 | 3753 | 3668

S&P 500 Forecast: Beginning from the October low at 3225, the S&P 500 futures index is moving in an established uptrend. With the all-time high within reach, we expect the uptrend to continue as long as the nearby supports can be defended. On the flip side, prices below the 2020 high would change the chart to a neutral expectation with possible sideways movement.

S&P 500 Outlook Weekly Chart: Market Trading Near All-Time High

Last update: March 15, 2021

S&P 500 is trading near 3950 points. The uptrend on the weekly chart is intact and the market shows a recovery above the January high.

S&P 500 forecast: Market is trading close to the all-time high. (Chart: TradingView)

S&P 500 Outlook: The weekly chart looks positive. More upside potential with a continuation of the long-term uptrend has a high probability. Only a drop below the September high at 3587 could turn the positive weekly chart picture to neutral. Prices below the February 2020 high could turn the positive outlook of the weekly chart to negative.

Resistance Levels: 3959.25 (All time high)

Support Levels: 3862 | 3753 | 3652

S&P 500 Forecast Monthly Chart: Market Trading Close To All-Time High

Last update: March 2, 2021

S&P 500 has reached a new all-time high in February, and is trading above the January high. We are looking at an established uptrend.

S&P 500 forecast: Market has reached a new all-time high. (Chart: TradingView)

S&P 500 Forecast: A continuation of the uptrend in the monthly chart has the highest probability and in the longer perspective more price advance is possible. Only a drop below the February 2020 high at 3397.50 could turn the positive monthly chart picture to neutral.

Resistance Levels: 3959.25 (all-time high)

Support Levels: 3862 | 3652 | 3587

S&P 500 Prediction – The Bigger Picture (Quarterly Chart)

Last update: March 2, 2021

The bigger picture: In the quarterly chart, which shows price action from 2012 until the end of 2020, we can see the long-term uptrend. S&P 500 has reached a new all-time high in February. The market is trading above the major support of the February 2020 high, which is located at 3397.50 points and also above the September high.

Resistance Levels: 3959.25 (All time high)

Support Levels: 3587 | 3397.5

S&P 500 Outlook: We expect S&P 500 to continue the long term uptrend. The quarterly chart is looking positive.

Very important is the February high at 3397.50, which is key support. As long as the market is trading above this level, the outlook and bigger picture remains positive. Prices below 3397.5 would worsen the chart picture and turn the bullish outlook to neutral or negative.

S&P 500 Historical Chart And Long-Term Outlook

Last update: March 02, 2021

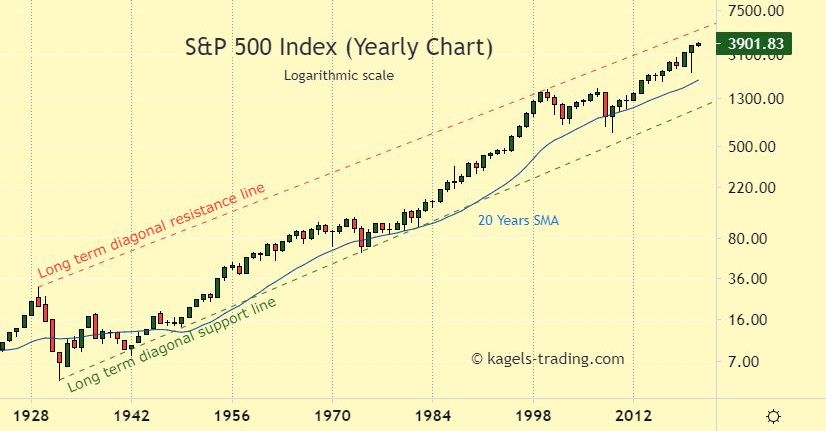

In the yearly chart of the S&P 500 Index, which shows price history from 1910 until 2021, we can see the long-term uptrend.

The price bar of 2020 is a so-called outside bar. In this historical chart, the 20-year simple moving average (20 SMA) is also moving upwards. In the past, the yearly 20 SMA was last tested in the financial crisis of the years 2008/2009.

Potential Resistance is the all-time high at 3 950.43

Support Levels: 3247.93 | 2490.91

SMA20: 1877.88

S&P 500 Forecast: We expect to see the S&P 500 resume the long-term uptrend. Only a drop below the 2020 low at 2191.86 would turn the positive long-term chart to neutral or negative. But this outlook has a probability of only 30 %.