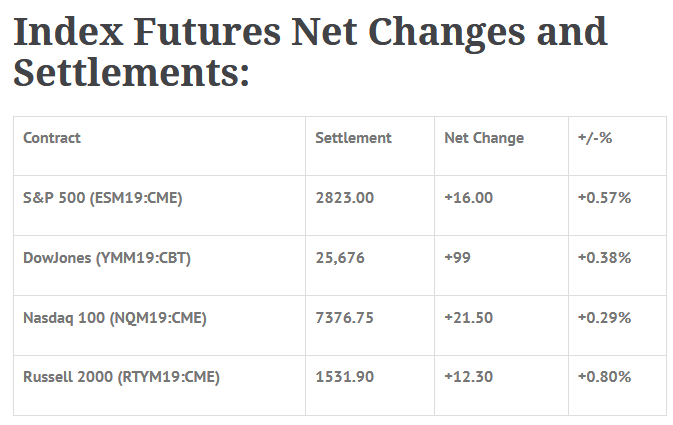

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 6 out of 11 markets closed lower: Shanghai Comp +0.85%, Hang Seng +0.56%, Nikkei -0.23%

- In Europe 12 out of 13 markets are trading lower: CAC -0.10%, DAX -0.12%, FTSE -0.29%

- Fair Value: S&P +4.94, NASDAQ +27.51, Dow +19.49

- Total Volume: 1.45mil ESM & 199 SPM traded in the pit

Today’s Economic Calendar:

Today’s economic calendar includes MBA Mortgage Applications 7:00 AM ET, International Trade 8:30 AM ET, Current Account 8:30 AM ET, State Street (NYSE:STT) Investor Confidence Index 10:00 AM ET, EIA Petroleum Status Report 10:30 AM ET, and Esther George Speaks 7:00 PM ET.

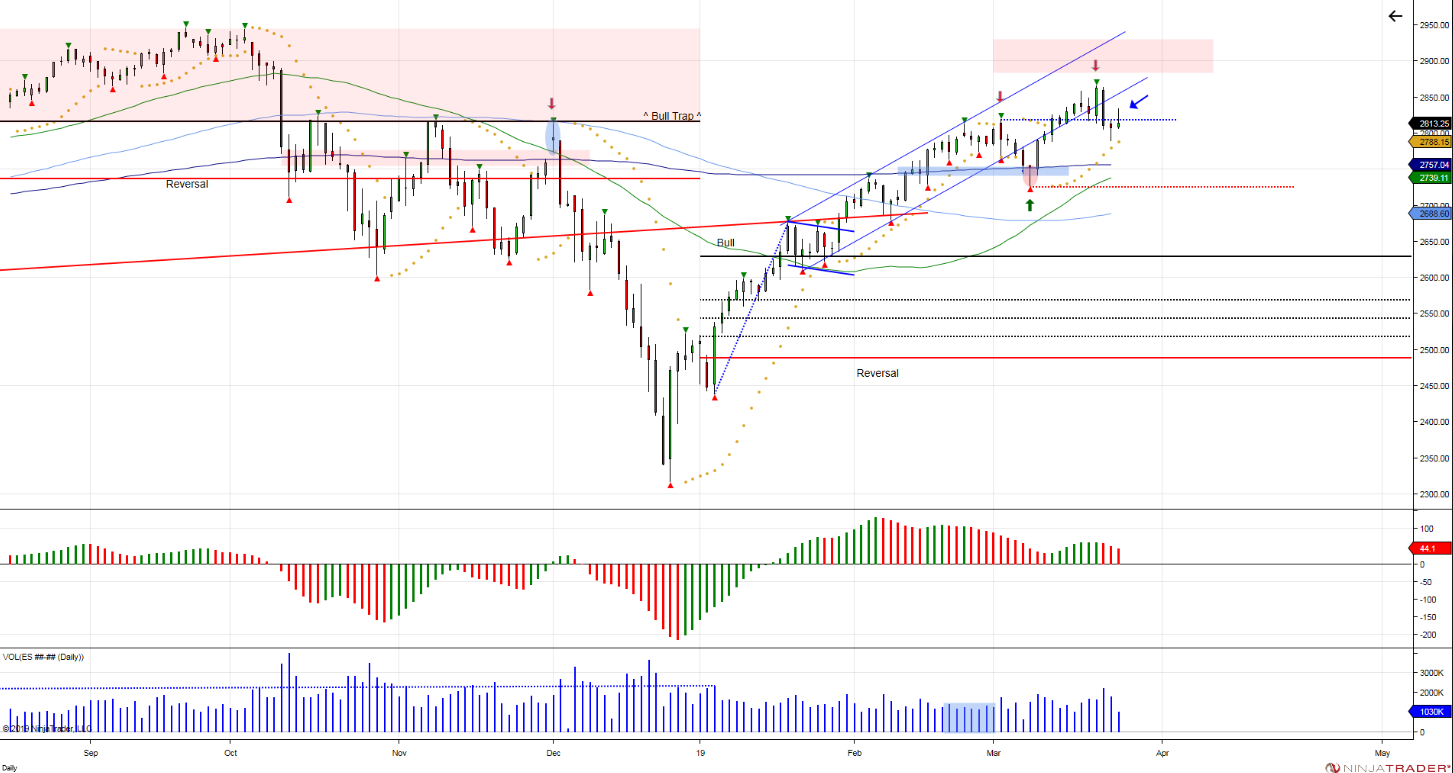

S&P 500 Futures: Pop, Chop & Drop

Chart courtesy of Stewart Solaka @Chicagostock – $ES_F Having trouble holding above the early March high of 2820. Bulls need to overcome that to prevent last week’s squeeze from trapping buyers above. Failure to overcome, give way to retest 2760-40 off month low.

During Monday nights Globex session, the S&P 500 futures (ESM19:CME) printed a high of 2823.75, a low of 2806.00, and opened Tuesday’s regular trading hours at 2822.75.

The first move after the 8:30 CT bell was up to a new high at 2833.50, followed by some consolidation back down to 2825.50, and then a rally up to another new high at 2835, where it double topped. From there ES turned lower for the rest of the day, eventually bottoming out at 2808.50just after 1:30.

The futures made somewhat of a comeback going into the last hour, rallying up to 2819.25 at 2:00, then trading 2814.50 when the cash imbalance reveal showed $534M to buy. The ES then went on to print 2818.50 on the 3:00 cash close, and 2823.25 on the 3:15 futures close, up x handles or +% on the day.

In the end, the overall tone of the ES was firm early in the day, and weak late in the day. In terms of the days overall trade, total volume was lower, but picked up when the ES sold off. At the end of the day, total volume was 1.4 million futures contracts traded.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Any decision to purchase or sell as a result of the opinions expressed in the forum will be the full responsibility of the person(s) authorizing such transaction(s). BE ADVISED TO ALWAYS USE PROTECTIVE STOP LOSSES AND ALLOW FOR SLIPPAGE TO MANAGE YOUR TRADE(S) AS AN INVESTOR COULD LOSE ALL OR MORE THAN THEIR INITIAL INVESTMENT. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.