YTD the S&P 500 (SPY) is down 7.54%, while the Barclays Aggregate is -8.46%, per Morningstar data.

Given Ukraine, inflation, sharply higher crude oil prices, worries about nuke usage in Ukraine, and higher interest rates I’m beginning to think the capital markets have held up pretty well this year, all things considering.

However, the May ’22 Fed / FOMC / Powell statement loom large.

JP Morgan (NYSE:JPM) and Citigroup (NYSE:C) had pretty poor earnings last week, and both face tough compares in Q2 ’22 as well. Technology and Financials both have another quarter of tough numbers to face down in Q2 ’22, from the Q2 ’21 results.

Tesla (NASDAQ:TSLA) reports this coming week, too.

S&P 500 earnings data:

- The forward 4-quarter estimate slid to $233.83 from $234.18 last week;

- The forward PE is 18.8x as “PE compression” continues to make the stock resemble an uphill bike ride;

- The S&P 500 earnings yield jumped to 5.32% from last week’s 5.22%;

- Per the IBES data Q1 ’22 revenue growth is still expected to be in the range of +10% – 11%;

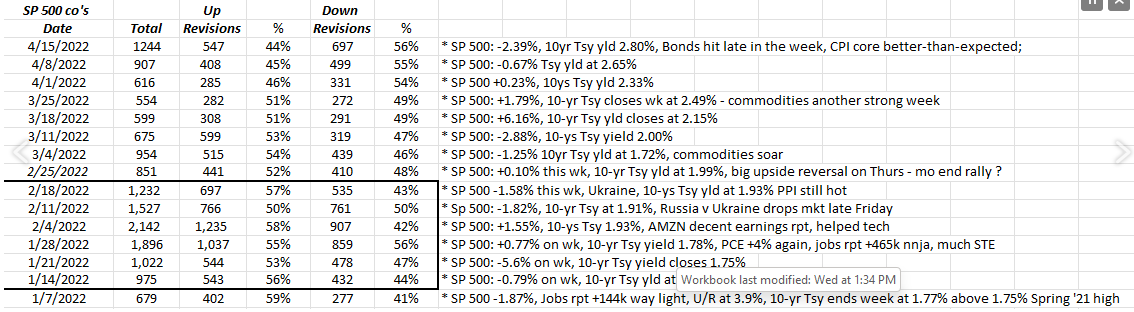

Revision data is weaker: a little worrisome

One thing that worried me after updating this table over the weekend is that the number of “positive revisions” hasn’t started to tick higher. Hopefully that will be the this coming week, 4/18/22 – 4/22/22. The off months in a quarter, like March, June, September and December tend to be quieter in terms of revision activity.

Readers can see how in this table that total revisions rise sharply during the bulk of earnings season, which this quarter is between April 11th and mid-May ’22. (Refinitiv provides this data on a rolling 4-week basis. The above spreadsheet is my own. Readers should remember that S&P 500 earnings in the first two quarters of 2021 were some of the strongest growth rates since 2009 hence (again) the S&P 500 is facing tough comparisons.)

The Crude Oil chart:

Chris Kimble, (@kimbleCharting) located in Cincinnati where I went to undergrad, and founder of Kimble Charting Solutions published this chart last week. I do think for the average American still, crude oil and gasoline are the face of inflation for the consumer and crude looks to be at a key technical juncture.

If crude drops back under $90 and depending on the severity of the decline, I would think it takes at least a little pressure off Powell at the May meeting and provides a psychological boost to the US consumer.

If crude moves back to the $120 area, that would continue to keep a wet blanket over everything but energy sector sentiment.

Top 10 Client Holdings as of 3/31/22:

- Blackrock (NYSE:BLK) Strategic Income Bond Fund (BSIIX): -2.92% YTD return;

- Microsoft (NASDAQ:MSFT): -8.14% YTD return;

- Invesco S&P 500® Equal Weight ETF (NYSE:RSP): -2.69%;

- Tesla (TSLA): +1.97% YTD return;

- JP Morgan Income Fund (JNBCX): -2.46% YTD return;

- Schwab (NYSE:SCHW) +0.49% YTD return;

- Amazon (NASDAQ:AMZN): -2.23% YTD return;

- Oakmark International (OAKIX): -8.69% YTD return;

- JP Morgan (JPM): -13.28% YTD return;

- Schwab Money Market (SWVXX):

- All return data as of 3/31/22 and courtesy of Morningstar

Summary / conclusion: The Energy sector faces much tougher comps for the rest of 2022, after Q1 ’22 is reported, which is part of the piano sitting on the backs of the Technology and Financial sector as we lap the first half of 2021. My own opinion is S&P 500 earnings should be fine “more normal” relative to the pandemic period from Q2 ’20 through Q2 ’21, and should look more realistic in the back half of 2022.

So how does this help readers invest or what does this mean for portfolio construction? Energy, Basic Materials, Real Estate and Utilities in total combine for roughly 12% – 13% of the S&P 500’s market capitalization versus the tech sector’s 27% by itself. Commodities rule right now but they tend to flame out quickly and the publicly-traded commodity companies tend to have poor returns-on-invested capital over long periods of time.

Value continues to outperform Growth with the SPDR® Portfolio S&P 500 Value ETF (NYSE:SPYV) -0.75% YTD, while the SPDR® Portfolio S&P 500 Growth ETF (NYSE:SPYG) down 3.5% this week and down 14% YTD.

I’m disappointed in the YTD returns of some financials since the financial sector is clients' largest value overweight.

The next three weeks are critical for earnings with the tech heavyweights staring to report the week of April 25th.

The most compelling stat circulating in the financial news media (for me anyway) is the 100% rise in the S&P 500 from the March ’20 lows to the anniversary in March ’22. That’s too far, too fast. A lot of technicians still cite the 3,800 as a 1/3rd retracement of that rally as a natural correction point. I’m not a technician, but I for sure don’t ignore the science and natural support levels.

A 50 basis point hike in May along with quantitative tightening and I don’t think the S&P 500 will handle that well.

Take this all with a grain of salt and substantial skepticism. Past performance is no guarantee of future results and capital market conditions can change very very quickly, for both better and worse.