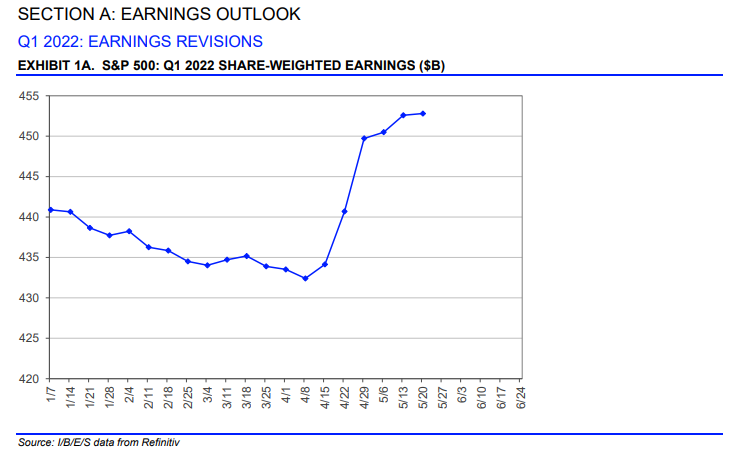

This graph gets tossed out to readers occasionally just to show the crowd the “net income” gains as recorded by Refinitiv. It’s always been puzzling why Refinitiv calls this “share-weighted” earnings, which—as far as I can tell—it really isn’t since it excludes share count.

Refinitiv publishes this every quarter during earnings season, as you can see from the X-axis.

From what I can tell eyeballing the graph, Q1 ’22 net income estimates bottomed around April 10th at $423 billion and have risen to roughly $453 billion since that April 10th date.

This graph is always on the front page of the “This Week in Earnings” report published by Refinitiv on Friday morning of each week.

S&P 500 data: (all data sourced from IBES data by Refinitiv)

- The forward 4-quarter estimate this week slid $0.03 to $235.22 from last week’s $235.25;

- The PE ratio is 16.5x down from last week’s 17x and the start of the 2022’s 19x – 20x;

- The S&P 500 earnings yield is 6.03% vs last week’s 5.85% and the start of the 2022’s 4.5% – 4.8%;

- The Q1 ’22 bottom-up estimate dropped $0.05 this week from $54.84 from $54.89;

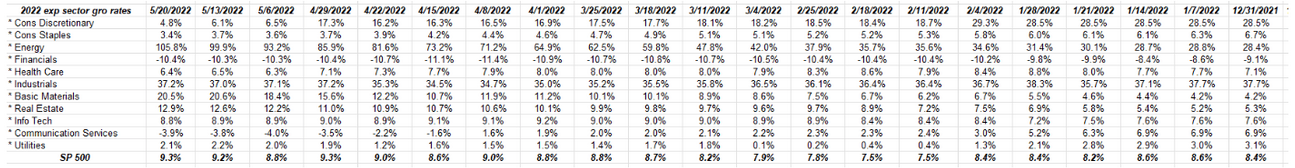

How have full-year ’22 sector growth rates changed?

What was fascinating about this week’s update is how Consumer Discretionary (i.e Walmart (NYSE:WMT), Target (NYSE:TGT), homebuilders, etc.) held its value quite well and didn’t see the decay in expected EPS growth for full-year 2022. Cisco (NASDAQ:CSCO) too didn’t drag down Communications Services much, either.

What readers need to be aware of is the difference between market cap weights and “earnings” weights in an index. Walmart’s earnings weight is likely a lot larger than its market cap weight. The opposite is the case with Tesla (NASDAQ:TSLA). Tesla is one of the top names by market cap in the consumer discretionary sector, but its earnings weight is minimal. If Tesla caves, it will impact the performance of consumer discretionary dramatically, but not so much the expected growth rate of the sector (depending on the severity of the EPS reduction, and again that’s if it happens.

What’s more interesting is that the Industrial sector is expecting 37% EPS growth in 2022, pretty much unchanged since January 1. But industrials market cap weight is just 8% in the S&P 500. Also I can’t find any industrial names in the top 25 of the S&P 500. Maybe the last major industrial name in the S&P 500 was GE. The point is the sector is expecting good growth, but it’s way under the radar. This was a post on industrials in late ’21. However since this last update, the Energy sector has outpaced the industrial sector in terms of expected growth for ’22 (by a longshot—check the spreadsheet).

Summary / conclusion: Quite a reversal on Friday, May 20th, by the S&P 500 as the SPDR® S&P 500 (NYSE:SPY) touched 3,818 briefly. Lots of folks watching that 3,800 Fibonacci level since it represents a 1/3rd retrace of the March ’20 lows to the early January ’22 highs for the key benchmark.

Would love to see a big down open Monday, May 23rd, 2022 and then a substantial rally for the rest of the week. That would be a good sign of a near-term bottom.

The long-end of the Treasury curve and the iShares Core U.S. Aggregate Bond ETF (NYSE:AGG) are acting well. The early May ’22 high for the 10-year Treasury of 3.16% could be the peak. That’s not a prediction though. 50 bps is almost a given for the June 15th, ’22 Fed meeting.

The US dollar needs to depreciate and it would be great to see crude oil and gasoline pullback sharply.

The S&P 500 closed with an earnings yield above 6% since the 6.25% hit March 31, 2020 (a week after the COVID bottom). The S&P 500 earnings yield landed just above 7% Christmas week of 2018, the last time Jay Powell was tightening.

It’s just a metric. Take everything with substantial skepticism. Past performance is no guarantee of future nor is any of this a recommendation. Do your own homework and understand your own risk profile.