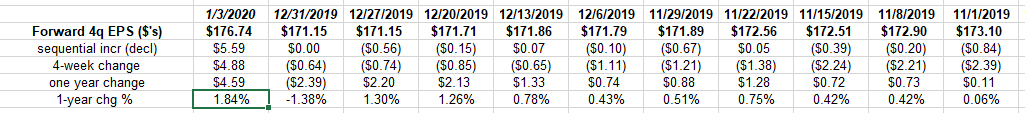

The new “forward 4-quarter” estimate as we roll into the new January ’20 quarter is $176.74 versus last week’s $171.15.

This happens every quarter and now for the next twelve weeks the $176.74 will gradually erode into the last week of March ’20 and then we’ll get another jump in early April ’20.

This is what most retail investors miss about S&P 500 earnings as a forward quarter is added and the back quarter falls off, the trend is inexorably higher.

In early October ’19, the quarterly bump in the first week of October was from $170.58 to $175.49.

To be even geekier about it, look at Q4 ’19 earnings which will start to get reported and then Q1 ’20, which is flat with Q4 ’19.

Q4 ’19 will end up about $42 per share by the end of March, ’20, but after Q1 ’20 note the sudden ramp in the last three quarters of 2020.

We’ll see how the 2020 quarterly and year-end S&P 500 EPS and growth rates change with official guidance in the Q4 ’19 conference calls.

1-year % change still growing – that’s a big plus

We told readers we’d keep you posted on the bottoming of the “1-year Change %” for the forward estimate.

Ignore the 12/31/19 data point. There is not a matching data point for 12/31/18.

Note how the 1-year rate of change continues to grow. That supports the bottom-up quarterly estimates in the first table.

Could the 31% gain in the S&P 500 in 2019 discount the expected improvement ? Absolutely, it’s still a positive from the last 12 months action in that forward estimate.

Summary / conclusion: Most are skeptical of the 2020 “estimated” S&P 500 EPS growth of 10% being forecast by IBES data. My take is estimates are conservative given the last year. and the very little y/y growth we saw in 2019 SP 500 EPS.

Particularly if we get a bump in the Energy sector and sector estimates turn positive, that and commodities / basic materials could help the S&P 500 even though the sectors are less than 10% of the market cap.

- 2020 – S&P 500 return matches S&P 500 earnings growth ? That would be Ok.

- 2019 – year of PE expansion

- 2018 – year of PE contraction

- 2017 – year of PE expansion

Too much navel-gazing on the numbers.