Refinitiv published their weekly update Friday, January 12th, 2024.

S&P 500 Data:

- The forward 4-quarter estimate ended the week at $243.52, down from last week’s $243.98;

- The quarterly bump that happened the first week of January ’24, saw the FFQE jump from $234.60 to $243.98;

- The PE on the forward estimate is now 19.6x

- The S&P 500 earnings yield (EY) fell to 5.09% this week, from last week’s 5.19%;

- The bank earnings releases of January 12, ’24 are NOT in the current Refinitiv estimates since Refinitiv cuts off the data as of every Thursday night:

- Q4 ’23’s “upside surprise” for S&P 500 is just 2.7%, down from 7% last quarter, but only 29 companies have reported their actual Q4 ’23 earnings so far, with another 20 companies expected to be reported this week;

- A request has been put in to Refinitiv to confirm their final Q3 ’23 bottom-up, actual, EPS figure of some number close to $58.40. Here’s how the 2023 “actual” S&P 500 EPS have progressed in 2023:

- Q4 ’23: $54.28

- Q3 ’23: $58.40 (waiting for confirmation)

- Q2 ’23: $54.29

- Q1 ’23: $53.08

- JP Morgan (JPM), Citi (C) and Bank of America (BAC) all missed on revenue consensus for Q4 ’23, i.e. actual net revenue reported was lower than the estimate for all three.

- According to @garysmorrow, this blog’s favorite technician, Citi (C) traded the best after Friday’s earnings, while JP Morgan traded poorly into the close.

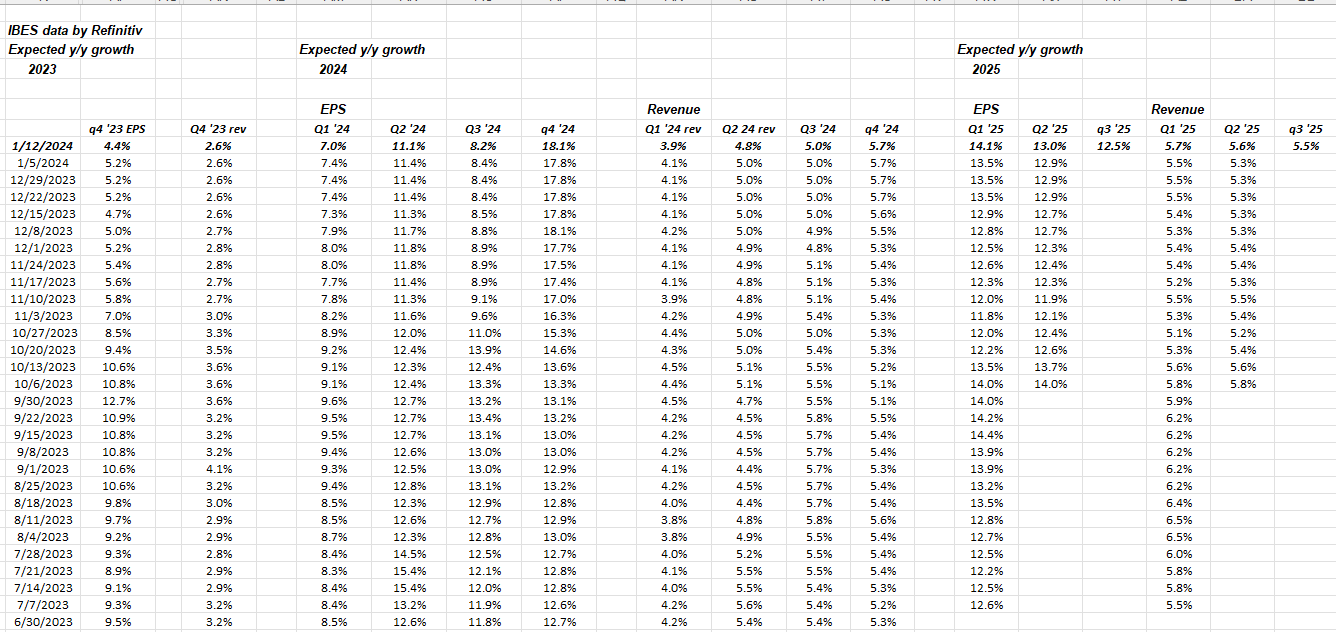

Here’s a spreadsheet kept updated from Refinitiv earnings data each week. (see above)

Q4 ’23 EPS growth (estimate) has come down sharply since Sept 30 ’23. Estimated GDP growth is expected to slow from the 3rd quarter ’23’s torrid pace of +5%, to Q4 ’23’s 2.5% pace, which might have resulted in some of the sharply lower estimate revision to Q4 ’23 expectations, but we also saw weaker quarters and guidance from global brands like Nike (NYSE:NKE) and FedEx (NYSE:FDX) at the end of December ’23.

It’s an educated guess but expect Q4 ’23 S&P 500 EPS to have grown in the 6.5% – 7% range when all is said and done. There is always a 1% or 2% increase in the expected S&P 500 EPS growth rate each quarter since, revisions are typically negative into each quarter and are the sharpest typically before the quarter starts to get reported, and analysts are typically cautious anyway. It’s better to lower the estimate and get an “upside surprise” than be aggressive with your estimate and see the company miss the consensus badly.

Goldman (GS) and Morgan Stanley (MS) reports their Q4 ’23 results Tuesday morning, January 16th, before the opening bell, while Schwab (SCHW) reports their Q4 ’23 financial results before the open on Wednesday morning, January 17th. It’s another week of “whole lotta” bank and financial institutions reporting: according to the Briefing.com calendar, of their 41 companies reporting, 26 are financials.

It’s interesting that Briefing.com shows 42 companies reporting earnings next week, while the Refinitiv reports say 20. Neither company states for which quarter these companies are specifically reporting earnings, but you have to assume that it is for their Q4 ’23 quarter, particularly if the reporting period ends on 12/31/23.

Remember Q4 ’22 Is a Very Easy Comp:

This blog post from late November ’23 detailed the very easy compares the S&P 500 faces in Q4 ’23.

This construct is actually a negative since what might be weaker earnings in Q4 ’23, might actually look stronger given the weaker compare, again the Q4 ’22 results.

Conclusion:

It’s actually another lighter week of earnings and no one will wake up and pay attention until the Mega-Cap or Magnificent 7 start to report their results, since those companies (with the exception of Tesla (NASDAQ:TSLA), and not because of it’s market-cap but because of it’s earnings weight) comprise – with the tech sector – about 20% of the S&P 500’s earnings weight.

The S&P 500 needs to firmly breakout above the January ’22 high of 4,818 to bring the bulls back out of the closet.

Microsoft (NASDAQ:MSFT) closed at an all-time-high of $388 on Friday, January 12th, 2023. The previous all-time-high high was $384 on 11/29/23.

With Microsoft’s all-time-high close, the Magnificent 7 is at it again. Microsoft’s market cap weight in the S&P 500 was 7.10% as of Friday, January 12th, 2024’s close, and now has a larger market capitalization than Apple (NASDAQ:AAPL).

What’s more interesting is that Microsoft and Apple, with market cap weights close to 7%, are twice the size of Amazon’s 3.5% market cap weight, which is ranked third in size in the S&P 500.

While Q4 ’23 S&P 500 EPS estimates have come down sharply in the last 90 days (see above), when S&P 500 companies report their Q4 ’23 results, they are also giving calendar year 2024 EPS and revenue guidance. The latter is far more important than the former, but readers should expect it to be subdued given the uncertainty over monetary policy, and the rapid tapering of GDP growth. (We get the first look at Q4 ’23 GDP growth in late January ’24.)

None of this is advice or a recommendation. Past performance is no guarantee or even suggestion of future results. All S&P 500 EPS and revenue data is sourced from IBES data by Refinitiv, unless otherwise stated. None of the information above may be updated and if updated, may not be done in a timely fashion. Readers should gauge their own comfort level with market and portfolio volatility and adjust their portfolio’s accordingly. Capital markets can change quickly for both the good and the bad.

Thanks for reading.