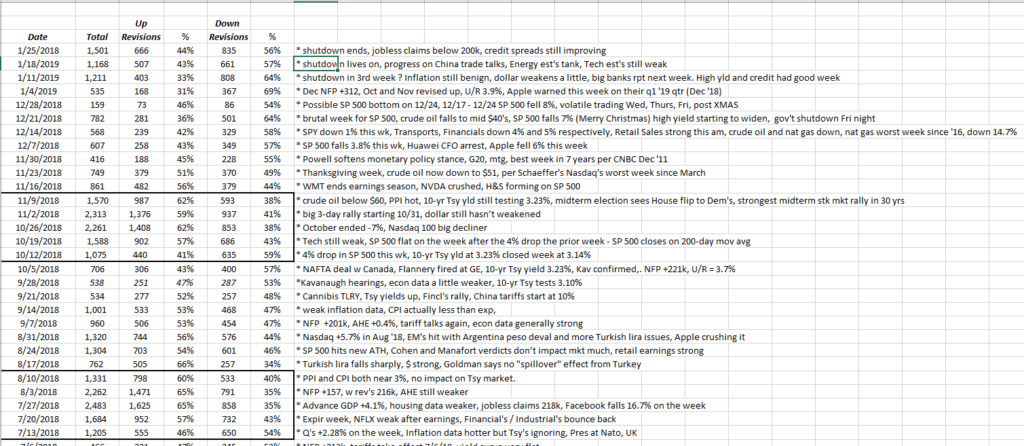

The above table is S&P 500 estimate revisions which are tracked every week and published on Friday. It is from the I/B/E/S by the Refinitiv report, “This Week in Earnings.” What is really interesting in the revision pattern is that every Q1 of every year, the positive revisions contract to below 50% range, only to see a rebound above 50% for quarters 2, 3 and 4. I don’t know what it is about the first quarter revisions and the actual 4th quarter earnings every year that turns the Street negative for this one quarter, only to see the revisions bounce back above 50% for the April – May reporting period.

The only blind spot in the data is that I don’t know if the revisions are to forward numbers or just to current EPS, or what would be Q4 earnings results. Presumably, if the actual Q4 results are revised lower, then Street consensus would probably trim forward estimates as well. Also, we don’t know the magnitude of the change in the forward revisions, but that does show up to some degree in the “forward 4Q estimate” that is provided to readers every week. This week’s S&P 500 earnings update was published yesterday here.

Summary

S&P 500 earnings estimates revisions have fallen back below 50% after 7 consecutive quarters above 50% for the main weeks of the S&P 500 reporting period. The fact that this has happened in the first quarter isn’t unusual. The pattern is that – for whatever reason that I have yet to see a good explanation for – the Q4 earnings season tends to cause analysts to be less aggressive in raising estimates. The shutdown, trade talks and Brexit will likely only make analysts more reluctant to boost forward numbers for 2019. Geeky stuff, but the data has been tracked since the fall of 2009. The pattern (so far) is consistent.