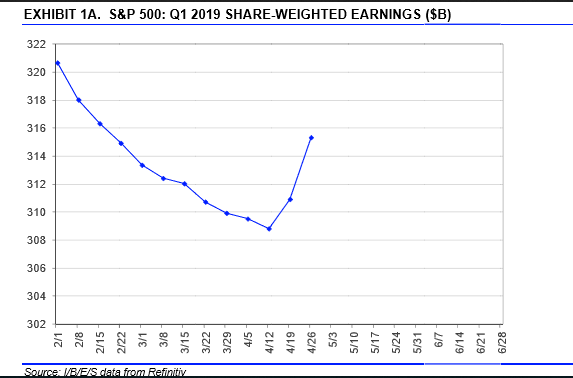

Love this graph IBES by Refinitiv puts at the bottom of the first page of “This Week in Earnings” every week.

That’s about all you need to know right now: Q1 ’19 earnings growth “expectations” for Q1 ’19 earnings were too low, and now that we are seeing actual earnings, the expected growth rate for Q1 ’19 is rising.

The all-time-high for the S&P 500 was 2,940.91 on 9/21/18. The S&P closed Friday, April 26, 2019 at 2,939.88. One more point was needed!

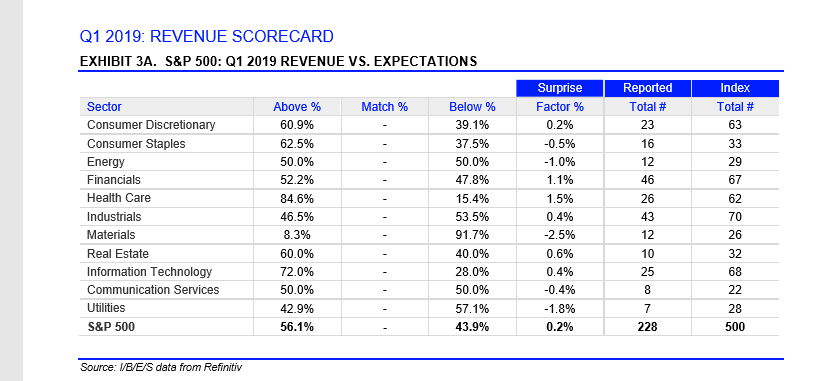

Revenue growth:

The “upside surprise” or beat rates for earnings are better than the revenue beat rates. Just over half the S&P 500 companies that have reported are beating on revenue, with Energy, Financials, and Industrials, Matrials, seeing the worst revenue performance relative to estimates.

Health Care and Technology are two of the best sectors in terms of actual revenue reported vs expectations.

Summary / conclusion: Q1 ’19 earnings for the S&P 500 should be fine since sentiment was so bad headed into the reporting season. The key aspects to watch are what happens to Q2, Q3 and Q4 ’19 estimated growth rates as we move through the next few weeks.

The dollar will be a factor – the DXY ended the week over 97.0, which is nearing breakout levels if it hasn’t already. For S&P 500 earnings and revenue, a stronger dollar is not necessarily a plus for the “international” businesses.