-

Important earnings season ahead as investors look for confirmation that the US economy is still heading for a soft landing

-

Q3 S&P 500 EPS growth is expected to come in at 4.2%, the fifth consecutive quarter of growth.

-

Banks on deck this week: JPM, WFC out on Friday

- Peak weeks for Q3 season run from October 28 - November 15

The wait is over for earnings watchers, as the latest quarterly read on US corporations kicks off with reports from JPMorgan Chase (NYSE:JPM) and Wells Fargo (NYSE:WFC) on Friday. Earnings will provide a gut check on the state of the US economy, and investors will be looking for these results to confirm the mostly improving economic data that’s been released in the last month or so.

While quarterly earnings are typically closely watched, corporations may have to fight for investor attention as this reporting season will be competing with a US presidential election on November 5, a highly anticipated Fed Rate cut on November 7, and a conflict in the Middle East which has led to volatile oil prices, among other things.

It’s Beginning to Look a Lot Like Earnings Season

For the Q3 season, S&P 500 EPS growth is expected to hit 4.2%, which would be the fifth consecutive quarter of bottom-line growth. Revenues are expected to come in even higher with 4.7% YoY growth. What’s interesting to note about this earnings season is that sell-side analysts have ratcheted down their estimates more than usual, which is even more notable considering last quarter they barely moved their estimates.

Since June 30, Q3 earnings estimates have come down by 3.6 percentage points, more than the 3.3 percentage points that we’ve seen on average over the last ten years. This compares to the mere 0.5 percentage points that analysts drew down Q2 2024 estimates at this point in the quarter.

Starting the Q3 season at a lower base increases the chances of larger positive surprises which investors should view favorably. Keep in mind that, during the Q2 season, while 79% of S&P 500 companies beat bottom-line estimates, they did so by very slim margins, causing investors to reward those companies less than usual, and punish those that missed estimates by more than usual.

Lower expectations are a good catalyst for more impressive top and bottom-line beats during the Q3 season. However, as quarterly results are backwards looking, it’s forward looking guidance that trumps all. Companies that can beat on the top and bottom-line, while increasing Q4 and/or CY 2025 guidance will likely receive the best reception.

Q3 Themes: A US Presidential Election, a Middle Eastern Conflict, and the Fed’s Next Move

There will be a lot to talk about Q3 on calls, and you better believe analysts will be asking a lot of questions. Depending on the sector, themes for Q3 calls will likely focus on the US presidential election and implications for companies and stocks depending on the results.

For energy companies, there will likely be discussion around the current Middle Eastern conflict between Israel and Iran, the risk of oil supply disruption, and how that may impact oil prices, with WTI crude rising 10% in the first week of October.

Given the latest jobs data, which showed an unexpectedly high number of jobs created in September, and an uptick in wage growth, there will likely be conversations around labor inflation. This could then cascade into what it all means for the upcoming FOMC meeting on November 7.

Since Friday’s Nonfarm Payroll report, expectations for a 50 basis point interest rate cut next month have dropped to zero. September wage growth hit 4%, the highest since 2022, and well above the Fed’s 3.2-3.7% target which is in line with their 2% inflation target.

However, wage inflation and a robust labor situation are good for the consumer, which both continue to show gradual signs of improvement just in time for the holiday shopping season, after a slump in consumer spending and sentiment were highlighted this summer. We’ll wait to hear from the retailers towards the end of the season about what this means for them.

Up This Week: Big Banks

In its usual fashion, Q3 earnings season will begin with the big banks, with JPMorgan Chase and Wells Fargo (WFC), reporting on Friday, followed by Citigroup and Bank of America on Tuesday, and the investment banks Goldman Sachs (NYSE:GS) and Morgan Stanley (NYSE:MS) on Tuesday and Wednesday.

Financials is one of one three sectors expected to show a YoY decline (-0.4%) in EPS (along with Materials and Energy). The Bank sub-sector is expected to lead that decline with a YoY decrease of 12%, while some of the other sub-sectors such as Capital Markets (11%), Insurance (9%) and Financial Services (4%) should pick up the slack.

Keep in mind that the investment banks, Goldman Sachs and Morgan Stanley, typically lumped in with the big bank reports, are part of the Capital Markets segment, and have been some of the big bank standouts in recent quarters.

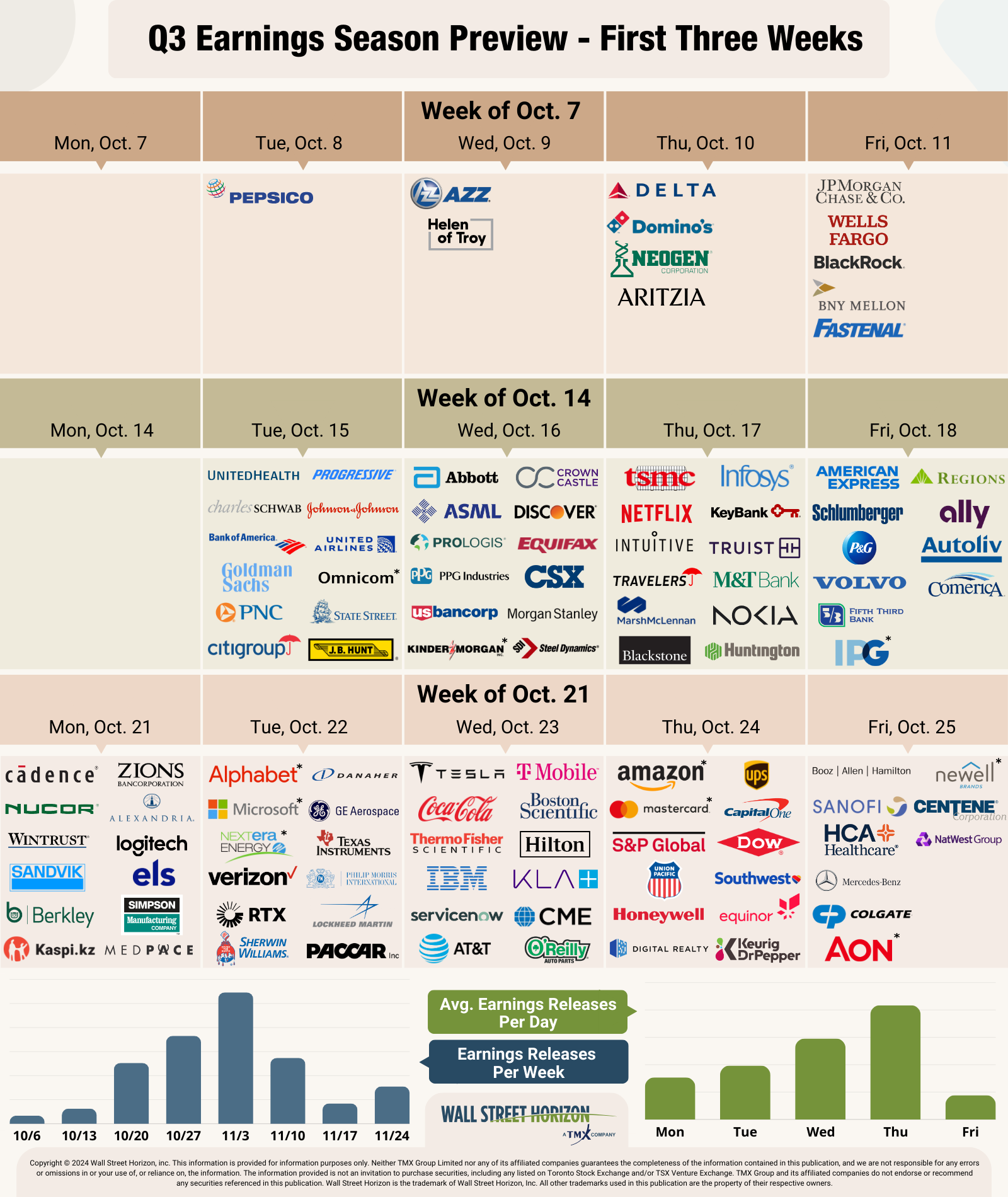

Source: Wall Street Horizon. All companies marked with an * were unconfirmed as of October 7, 2024.

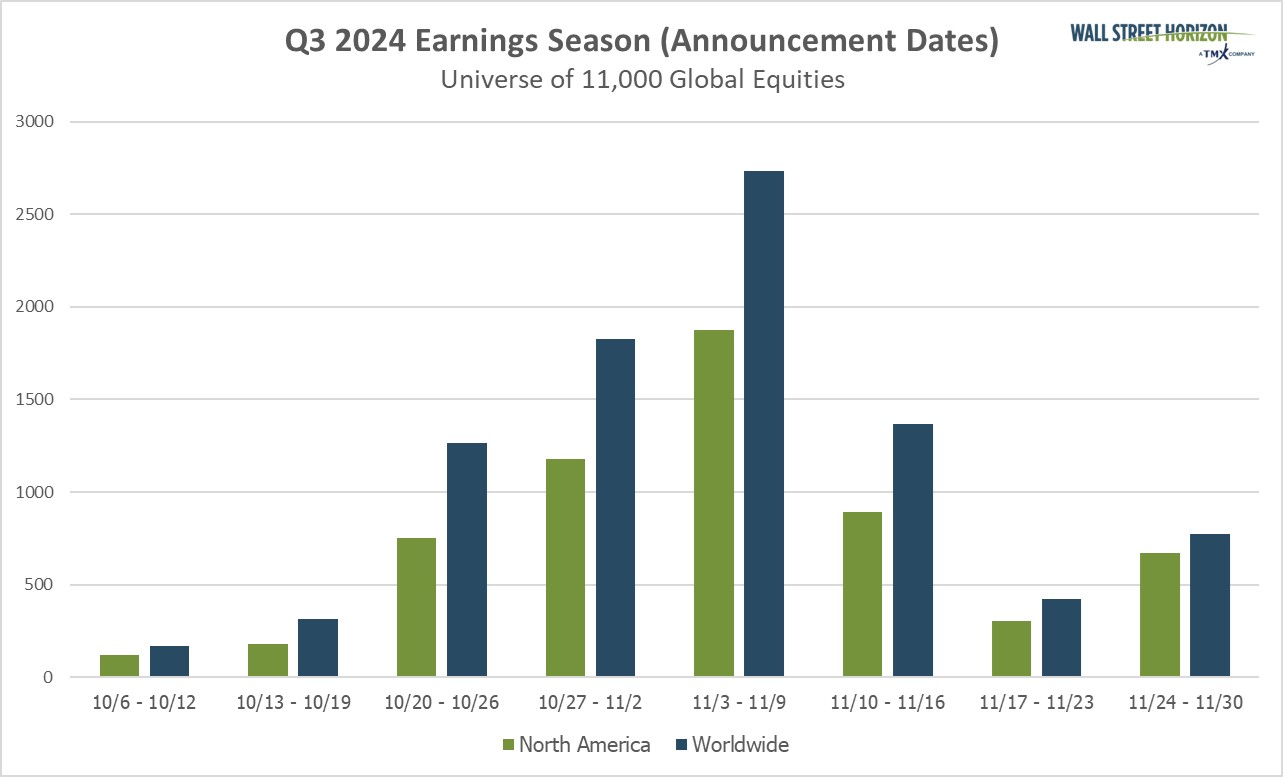

Q3 Earnings Wave

This earnings season, the peak weeks will fall between October 28 - November 15, with each week expected to see over 2,000 reports. Currently, November 7 is predicted to be the most active day with 1,475 companies anticipated to report. Thus far, only 43% of companies have confirmed their earnings date (out of our universe of 11,000+ global names), so this is subject to change. The remaining dates are estimated based on historical reporting data.

Source: Wall Street Horizon