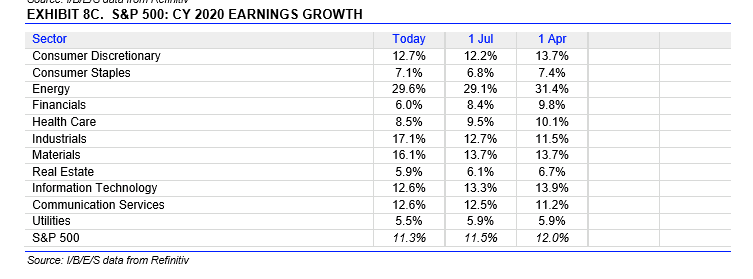

Last week, the 2020 expected growth rates by sector were noted.

This week, what has caught my eye again, is that during a period when there is typically a slow erosion of forward estimates downward, the three sectors that would indicate so, the kind of an acceleration in global economic growth are seeing upward revisions to 2020 growth estimates:

Note the positive revisions to Energy sector estimates, Basic Material sector estimates and maybe most importantly, Industrial sector estimates.

The other aspect to 2020 that caught my eye was that Financials, Health Care and Technology are seeing the more normal downward erosion to 2020 expected growth rates.

For calendar 2019, the following sector growth is expected:

On January 1 ’19, the following growth rates were expected:

Summary / Conclusion: It’s too early to get excited about these three sectors even with the positive revisions to forward estimates. These three sectors comprise about 17% of the S&P 500 today, and the last time the sectors really had long-lasting relative performance was in the mid-2000’s after Technology, Financial’s and large-cap growth hit the skids starting with March, 2000. If you go back and look at the decade from 2000 through 2009, the 15% annual GDP growth out of China drove a massive demand for commodities, and Energy and anything non-tech and non-Financial related, but unfortunately that ended starting in late 2007, early 2008. To give readers some sense or proportion of what I’m talking about, you could have bought U.S. Steel (X) for under $10 per share in late 2002, early 2003, and you would have seen it soar to $196 per share by June of 2008, at which point it promptly fell apart again, falling to $16 per share by March of 2009, as global growth collapsed around 2008.

It always amuses me to see value investors scoff at “momentum” investing, but Energy, Commodities, and Industrials were the momentum stocks for most of the decade from 2003 to early 2008, after Technology. Financials, large-cap Retail, and such were the momentum stocks of the 1990’s.

China was the catalyst during the 2000’s and with tariffs and the U.S. trade rancor today, I don’t think China will be growing at 15% or even 10% anytime soon, meaning their growth won’t be fast enough to drive the kind of commodity demand that would drive Commodity, Energy, or Basic Material earnings.

My advice for readers is to wait and see how 2020 earnings develop over the next 5 months. Commodities, Energy and Basic Materials are very often value traps in my opinion i.e. the valuations typically look compelling, but you need to be a “deep value” kind of investor and ignore relative performance and be VERY patient to invest in these sectors.

Here is what isn’t being said in the Financial media: if the trade and tariff dispute between China and the U.S. does get resolved and we get a Brexit deal in October, we could suddenly see an acceleration in global growth starting late ’19, early ’20. Why? Because everyone will now know the rules finally, rather than the uncertainty of what’s going to happen.

What are the odds on that happening? I wouldn’t know and haven’t read anything on the probability of a trade deal, but venturing a guess I’d say it’s still less than 20%.